CPI report reveals a 0.6% rise in inflation taking yields and the dollar higher

Video section is only available for

PREMIUM MEMBERS

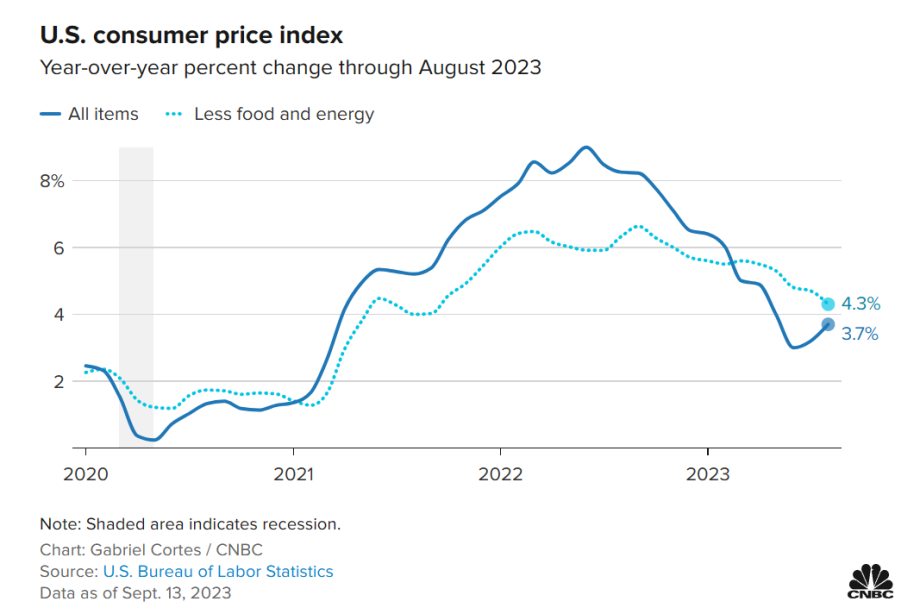

The CPI (Consumer Price Index) was released this morning, and predictions that headline inflation had risen by 0.6% last month forecasted by economists polled at the Wall Street Journal were spot on. Last month inflation had its largest month-over-month gain this year. However, economists polled by the WSJ slightly underestimated the rise in the core CPI which was predicted to increase by 0.2% and came in hotter with a rise of 0.3%.

According to the BLS (Bureau of Labor Statistics), “The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.6 percent in August on a seasonally adjusted basis, after increasing 0.2 percent in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 3.7 percent before seasonal adjustment”.

Inflation rose annually from 3.2% in July to 3.7% in August. This means that the Federal Reserve’s 2% target will unlikely be reached this year. But, according to the CME’s Fedwatch tool, traders’ expectations that the Fed will maintain its current terminal rate intact at the FOMC meeting next week increased from 92% yesterday to 97% today, and the probability of a continuation of the pause at the November FOMC meeting strengthening from 55.8% yesterday to a 58.4% probability today.

As reported by CNBC, Lisa Sturtevant, chief economist at Bright MLS said, “Housing continues to contribute an outsized share to the inflation measures,” Sturtevant said. “Rent growth has slowed considerably and median rents nationally fell year-over-year in August. ... However, it takes months for those aggregate rent trends to show up in the CPI measures, which the Fed must take into account when it takes its ‘data driven’ approach to deciding on interest rate policy at their meeting ... later this month.”

Nonetheless, gold prices continued their decline as market participants focused on the fact that the Fed funds rate will remain elevated for a longer period of time rather than the increased probability that the Fed will not raise rates this year. After dropping approximately $12 yesterday gold lost an additional $4.50 today taking the most active December futures contract to $1930.60. However, unlike yesterday’s double-digit drop which was primarily a result of technical selling today’s decline was primarily due to dollar strength. The dollar gained 0.21% taking the index to 104.765.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer