The dollar continues to be the primary driver for pricing in precious metals

Video section is only available for

PREMIUM MEMBERS

Market participants continue to be laser-focused on upcoming changes to the monetary policy of the Federal Reserve. It is the monetary policy of the Federal Reserve and its challenge of bringing inflation down that has been one of the primary drivers of price changes in the financial markets across the board. However, investors and traders of gold and silver also need to factor in dollar strength or weakness, because precious metals are priced globally in U.S. dollars.

Today is no exception, dollar strength is entirely responsible for declines in gold and silver. As of 5:55 PM EST gold futures basis the most active April contract is down $3.30 or 0.18% and fixed at $1842.10. Silver futures basis the most active March contract had a decline of 0.52% or $0.11 and is fixed at $20.98 ½ cents.

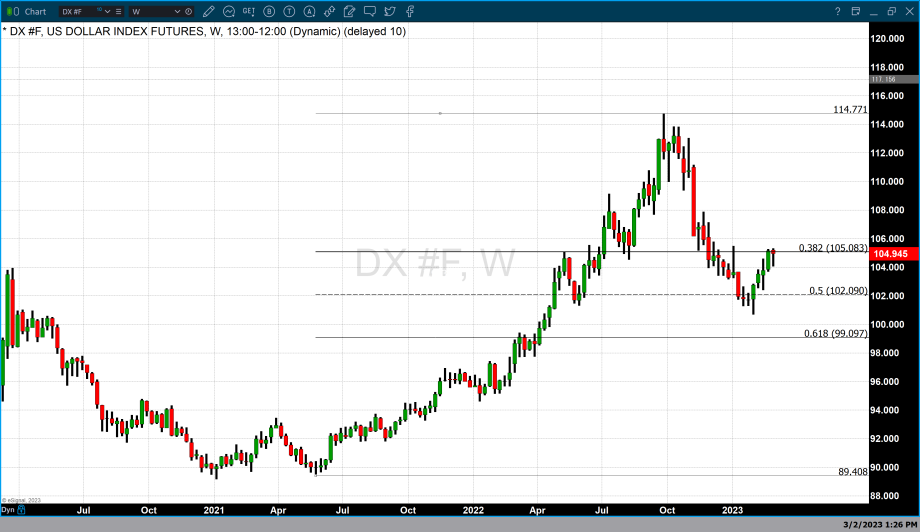

Dollar strength was the primary driver of the net price change in gold and silver today. The dollar gained 0.49% or 0.513 points resulting in the dollar index moving to 104.945

Investors who participate in the gold and silver markets bid both precious metals fractionally higher today, but dollar strength turned positive gains into price declines in both precious metals.

One of the best ways to illustrate that point is to look at the spot pricing of gold and silver through the eyes of the Kitco Gold Index (KGX). The screen-print of the KGX was taken at approximately 6 PM EST and shows that the price of spot gold is $1835.90 and $20.90 for spot silver.

Spot gold lost $0.90 of value per ounce and spot silver lost seven cents in value today. However, dollar strength resulted in gold declining by $9.90 and silver declining by $0.11. Even though gold gained nine dollars and silver gained four cents through normal trading gains were erased when dollar strength was factored into current pricing.

Market participants are concerned that the latest forecast for the upcoming jobs report (March 10) will reveal a tight labor market. A tight labor market will pressure employers to raise wages to attract needed employees which will put pressure on inflation to move higher. This could certainly accelerate the upcoming rate hikes by the Federal Reserve. Lastly, the CPI inflation index will be released on March 14 and these two reports collectively will be the most current data that the Federal Reserve will use to make its final decision.

Editor’s note: We again apologize for the delay in getting today’s video report and updated member pages to our subscribers. We were interviewed by Ivan Bayoukhi. founder of WallStreet Silver today which will be released either Friday or Saturday so that silver traders can get the most current forecast from our technical studies.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer