Fitch Ratings lower the U.S. Government rating from AAA to AA+

Video section is only available for

PREMIUM MEMBERS

In an article penned by Benjamin Purvis, and Simon Login in Bloomberg News written on August 1 and updated today where they reported a shocking revelation in the financial rating of the United States government.

“Fitch Ratings downgrade of US government debt sparked criticism from Washington and Wall Street even amid unease that swollen fiscal deficits risk eventual turbulence in markets, the economy, and next year’s presidential election.”

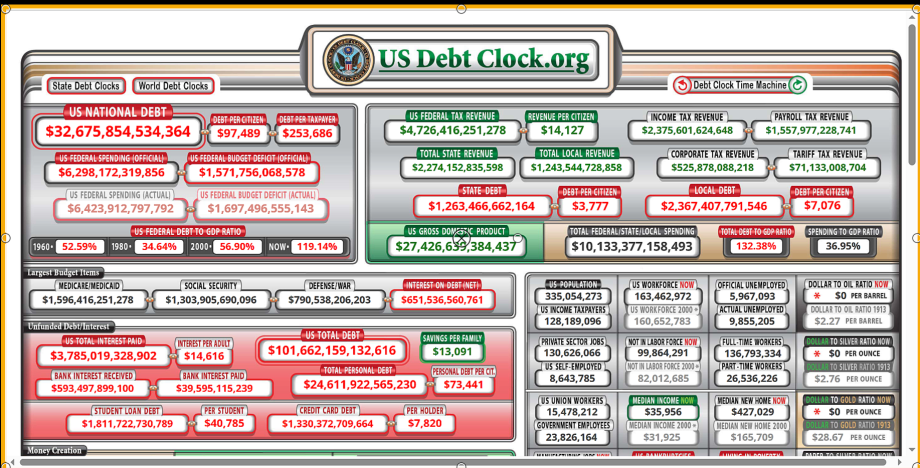

The article stated that Fitch cut the U.S.’s sovereign credit grade one level from AAA to AA+. This announcement occurred just two months after the credit rating company warned that the fiscal and financial rating of the U.S. government was under threat as “lawmakers flirted with default by battling over raising the nation’s debt limit.”

Fitch said it was justified in its rating downgrade by citing that the finances in the United States will likely “erode over the next three years given tax cuts, new spending initiatives, economic shocks, and repeated political gridlock”.

Just hours before the Treasury Departments’ decision to ramp up its borrowing to plug a ballooning budget deficit Secretary Janet Yellen called the downgrade “arbitrary and outdated”. Citing that the economy has recently shown signs of resilience and the debt limit was ultimately lifted.

The news sent major ripples through the financial markets taking U.S. equities, gold, and silver lower while being highly supportive of the dollar taking it higher along with yields on U.S. Treasuries. As of 7:40 PM EDT, gold futures basis the most active December contract is currently fixed at $1971.30. The December contract opened trading in New York at approximately $1989. The dollar gained 0.34% and is currently fixed at 102.43. Silver had only a fractional decline of 0.18% taking the most active September contract to $23.83.

This story is not only fluid but still ongoing. The fallout at the end of the tunnel contains many unknowns and uncertainties but the initial shockwave has been released and the outcome will not be known for quite some time.

The actual Chinese expression "Hearing something a hundred times isn't better than seeing it once" ( 百 闻 不 如 一 见, p bǎi wén bù rú yī jiàn) is sometimes introduced as an equivalent, as Watts 's "One showing is worth a hundred sayings."

百 闻 不 如 一 见, p bǎi wén bù rú yī jiàn

Wishing you as always good trading,

Gary S. Wagner - Executive Producer