Gold moves lower temporally halting rally on Fed clarifications of inflation concerns

Video section is only available for

PREMIUM MEMBERS

Breaking four consecutive days of gains, gold prices declined today by $20 as market participants reacted to data revealing that the U.S. labor market is tighter than previously perceived. A tight labor market raises the expectations that the Federal Reserve will maintain the elevated interest rates for a longer period. The expectations that the Fed will continue its extremely hawkish monetary policy throughout the entire calendar year have diminished the hope of easing by the Federal Reserve.

The vast majority of gold’s price decline today was directly attributable to dollar strength. The U.S. dollar index is currently up 0.85% and fixed at 104.91. Considering that gold is trading 1.11% lower indicates mild selling pressure combined with dollar strength led to gold’s first daily price decline this year.

Minutes released by the Fed earlier this week cemented sentiment by Federal Reserve officials who unanimously agreed that the central bank should slow the pace of rate hikes while maintaining the current elevated level. While there is very little hope that the Federal Reserve will reduce rates according to the minute's released rate hikes should be limited to their upper target of approximately 5.1% vis-à-vis its benchmark Fed funds rate.

As of 4:15 PM EST gold futures basis the most active February contract is currently fixed at $1838.50 after factoring in today’s decline of 1.10.%. Silver futures sustained a deeper decline giving up 2.48% with the most active March contract currently fixed at $23.37.

Price levels for gold

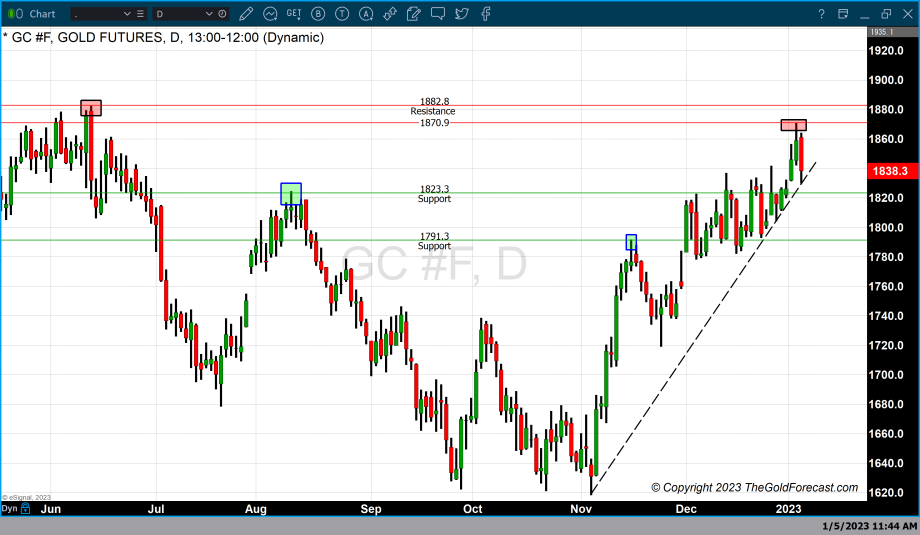

The two most recent tops occur at $1823 (August 2022) and $1791 (November 2022) which continue to be technical levels of support. Noteworthy is the fact that the support trendline covering recent lows from November to current pricing remains intact.

Major resistance still occurs at $1881.50 which is based on two tops that occurred in mid-November and mid-June 2022. However, yesterday’s intraday high of $1870 now becomes the next level of resistance for gold to take out.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer