Inflation eases below economists’ forecast prompting dollar weakness and a rally in gold

Video section is only available for

PREMIUM MEMBERS

Today the U.S. Bureau of Labor Statistics released the CPI index report for November. The report showed that inflation remains elevated above 7%, but has declined substantially, coming in at 7.1% year-over-year in November.

“The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in November on a seasonally adjusted basis, after increasing 0.4 percent in October, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.1 percent before seasonal adjustment.

The index for shelter was by far the largest contributor to the monthly all items increase, more than offsetting decreases in energy indexes. The food index increased 0.5 percent over the month with the food at home index also rising 0.5 percent. The energy index decreased 1.6 percent over the month as the gasoline index, the natural gas index, and the electricity index all declined.”

Tomorrow the Federal Reserve will conclude its last FOMC meeting this year which will be followed by the release of a Fed statement and a press conference led by Chairman Powell. Today’s CPI report is the data that the Fed needed to slow the pace of rate hikes.

According to the CME’s FedWatch tool, there is still an exceedingly high probability (79.4%) that the Federal Reserve will raise rates by 50 bps tomorrow. Looking ahead, the probability of a smaller rate hike at the Fed's first FOMC meeting next year has had a dramatic revision in a single day. Yesterday it indicated a 35.1% probability of a 25-bps rate hike in February which was revised today to 52.3%. The probability that the Fed will raise rates by 50 bps in February dropped from 51% yesterday to 40.5% and a 7% probability of a 75-bps hike.

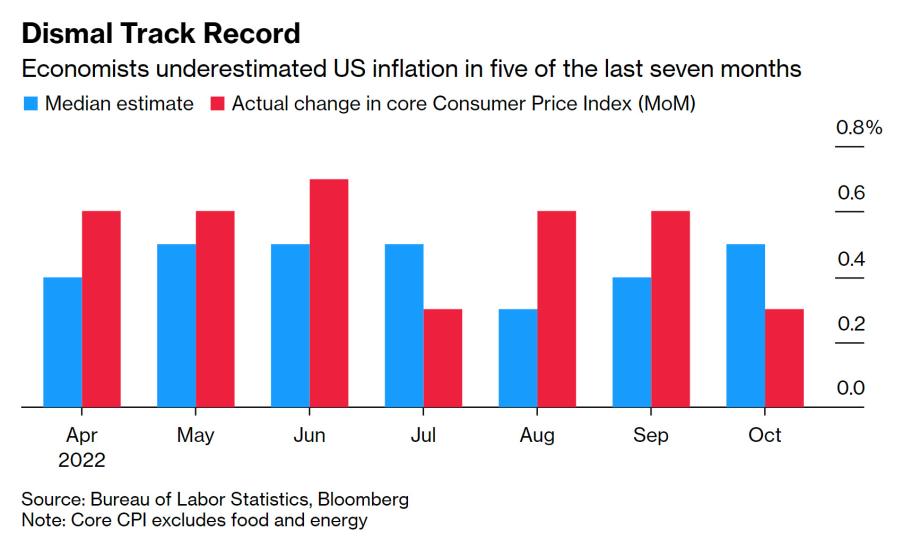

The fact that inflation declined to 7.1% year-over-year below the economist’s forecasts of 7.3% could be the needed data for the Federal reserves to slow the pace of rate hikes with a 25-bps rate hike in February rather than a 50-bps hike as formerly anticipated. In fact, the experts have had a “dismal track record” in estimating U.S. inflation. As the graph above released yesterday by Bloomberg News shows, the experts have incorrectly underestimated inflation in the United States only twice in the last seven months.

Gold had a strong upside move breaking above $1800 after opening at $1792.30 this morning in New York. As of 4:30 PM EST gold futures basis, the most active February 2023 Comex contract is fixed at $1822.20, after factoring in today’s large gain of $29.80 or 1.66%.

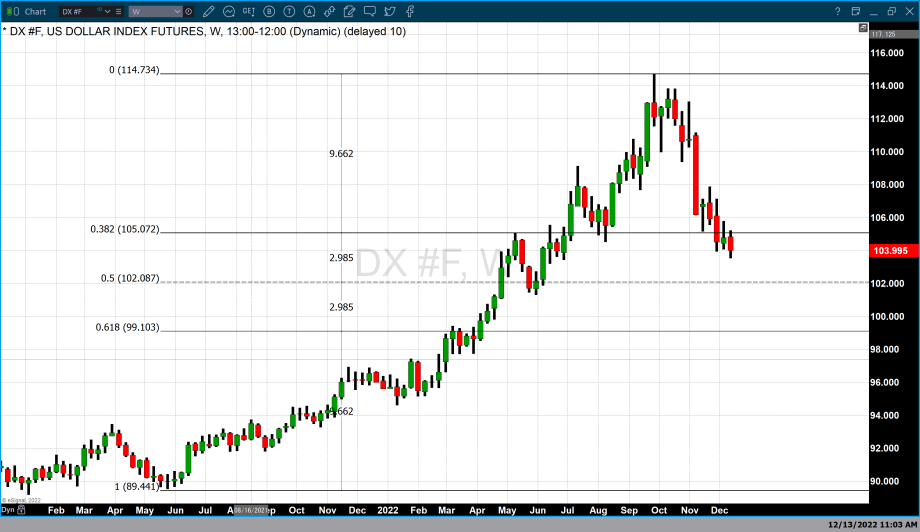

Today’s rally was aided by dollar weakness. The U.S. dollar lost -1.06% with the dollar index currently fixed at 103.985. This means that gold gains today are the result of both dollar weakness and bullish sentiment by gold traders and investors.

For those who would like more information simply use this link.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer