Why would the Fed scale back rate hikes as core inflation continues to rise?

Video section is only available for

PREMIUM MEMBERS

With the November FOMC meeting concluding tomorrow many analysts and news sources are reporting the possibility that the Federal Reserve will announce or at least give subtle hints that they might begin to scale down their aggressive stance on interest rate hikes.

PCE Still High Despite Rate Hikes

If the Fed announces or suggests that they will begin to slow down the magnitude and pace at which they implement further rate hikes they are doing so when the latest data suggests that the core PCE inflation index continues to rise.

The most recent inflation report revealed that the core PCE index jumped 5.1% in September year-over-year which is the fourth-highest reading in this cycle behind January, February, and March. The Federal Reserve is still quite a way away from reaching its benchmark level of inflation at 2%. To put it bluntly, inflation shows no signs of slowing down as measured by their preferred index; the core PCE.

Over the last five FOMC meetings, the Fed has implemented five consecutive rate hikes beginning with a ¼% rate hike in March, and a ½% rate hike in May which was followed by three consecutive ¾% rate hikes in June, July, and September. It is widely anticipated that the Fed will raise rates by ¾% for a fourth consecutive time at the conclusion of tomorrow’s FOMC meeting.

The net outcome of all these hikes is the benchmark rate going from between 0 and ¼% in March to between 3% and 3 ¼% in September.

Rate Hikes Were Toxic for Gold

The net result of the Federal Reserve’s aggressive monetary policy has brought about an extremely strong demise in the price of gold. Since the first rate hike by the Federal Reserve in March gold has fallen from its yearly high of $2078 to a double bottom that occurred at the end of September and last month in which gold futures traded to an intraday low of $1621. Gold has declined in value by approximately 22% from the yearly high to the yearly low.

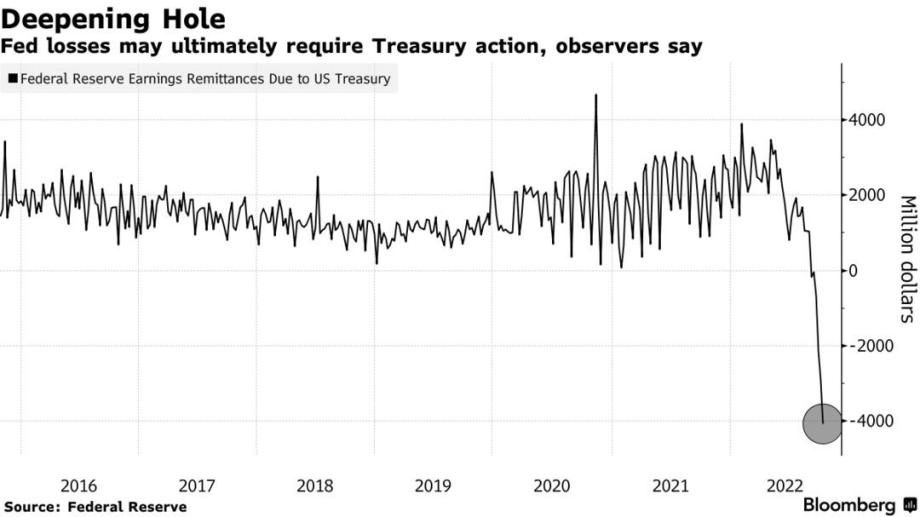

One possibility as to why the Federal Reserve is choosing to pivot its pace of rate hikes is the fact that the Federal Reserve is now losing billions of dollars based on the current benchmark interest rate of 3% to 3 ¼%. On October 25 Bloomberg news published an article titled, “Fed Is Losing Billions, Wiping Out Profits That Funded Spending”. In this article penned by Enda Curran, Jana Randow, and Jonnelle Marte they distinctly discuss the implications of the hawkish monetary policy by the Federal Reserve saying, “The bond market is enduring its worst selloff in a generation, triggered by high inflation and the aggressive interest-rate hikes that central banks are implementing. Falling bond prices, in turn, mean paper losses on the massive holdings that the Fed and others accumulated during their rescue efforts in recent years.”

The article says that the recent rate hikes also involve central banks paying out more interest on the reserves that commercial banks park with them. The net result according to this article is higher rates “tipped the Fed into operating losses, creating a hole that may ultimately require the Treasury Department to fill via debt sales. The UK Treasury is already preparing to make up a loss at the Bank of England.”

The outcome of their actions has led to huge operating losses or mark-to-market balance sheet losses which are now materializing. “Fed remittances owed to the US Treasury reached a negative $5.3 billion as of Oct. 19 -- a sharp contrast with the positive figures seen as recently as the end of August. A negative number amounts to an IOU that would be repaid via any future income.”

It seems quite plausible that the Federal Reserve does not wish to incur larger losses which would be a perfect explanation for their monetary policy pivot at a time in which they have come nowhere near reaching their inflation target of 2%.

Gold Today

As of 5:55 PM EST gold futures basis, the most active December contract is fixed at $1651 and is exhibiting the first gains in the last four trading days after factoring in today’s increase of $10.30.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer