Dollar Surges Moving Gold Lower After Robust Jobs Report: A Week of Economic Shifts

Video section is only available for

PREMIUM MEMBERS

The U.S. dollar demonstrated remarkable strength this week, culminating in its most robust performance since September 2002. Over five consecutive days, the dollar index climbed from 100.468 to 102.573, marking a substantial 2.07% increase. This surge was fueled by a combination of factors, including positive economic indicators, hawkish statements from Federal Reserve Chairman Jerome Powell, and a surprisingly strong jobs report.

The September jobs report exceeded all expectations, revealing the addition of 254,000 new jobs, far surpassing economists' projections of 140,000 to 150,000. This unexpected growth was accompanied by a decline in the unemployment rate to 4.051%, beating the anticipated 4.2%. These figures paint a picture of a resilient and growing U.S. economy, bolstering confidence in the dollar.

Chairman Powell's recent comments at the National Association for Business Economics conference played a crucial role in shaping market expectations. He emphasized that future interest rate cuts would be data-dependent, tempering expectations of a more aggressive rate cut in November. This stance, coupled with the strong economic data, has significantly altered the outlook for the Federal Reserve's November meeting.

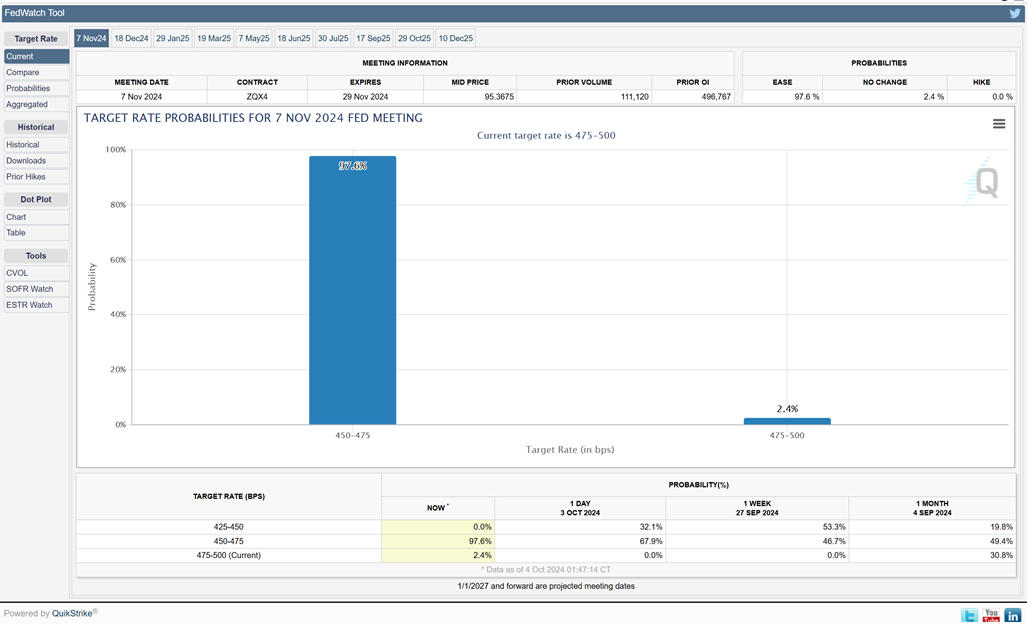

The CME's FedWatch tool reflects this shift in sentiment. The probability of a 25-basis point rate cut in November has skyrocketed from 46.7% at the beginning of the week to an almost certain 97.6% following the jobs report. Concurrently, the likelihood of a more substantial 50-basis point cut has diminished to near zero (2,4%), marking a significant change in monetary policy expectations.

Gold prices, typically inversely correlated with dollar strength, faced considerable headwinds throughout the week. Despite a brief rally on Tuesday driven by geopolitical tensions following Iran's missile strike on Israel, gold ultimately ended the week lower. As of Friday afternoon, December gold futures were trading at $2,669, down $6.80 for the day and $12 for the week.

The precious metal's performance underscores its dual nature as both a safe-haven asset during times of geopolitical uncertainty and its sensitivity to dollar movements and interest rate expectations. Tuesday's spike near record highs demonstrated gold's enduring appeal during global crises, while the subsequent decline reflected the overwhelming influence of dollar strength and shifting monetary policy expectations.

The dollar's surge, driven by robust economic data and evolving Fed expectations, has reshaped the near-term outlook for both currency and precious metals markets. As investors digest these developments, all eyes will be on the Federal Reserve's November meeting and future economic reports for

Wishing you as always good trading,

Gary S. Wagner - Executive Producer