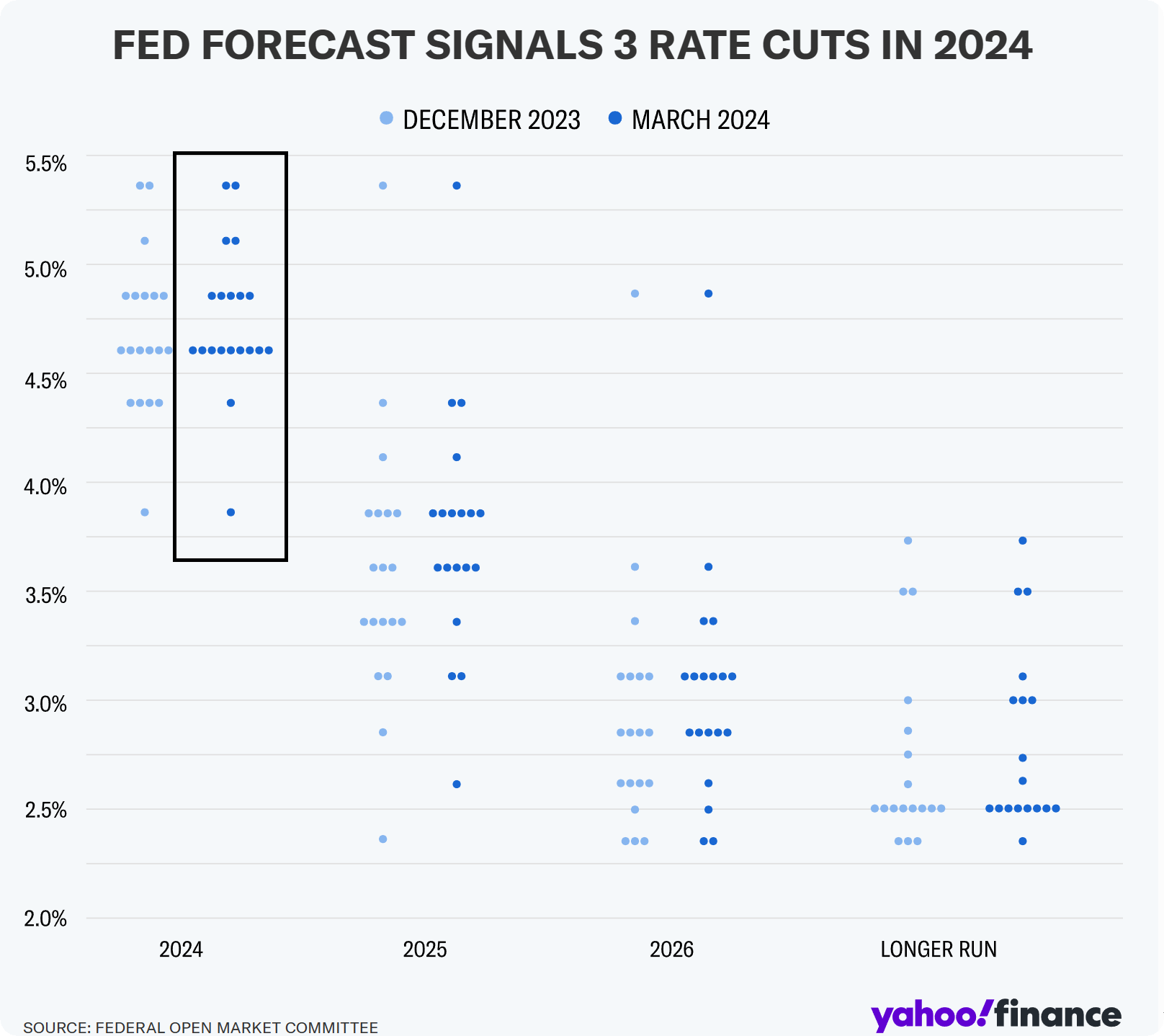

Federal Reserve’s “dot plot” continues to be three ¼% rate cuts this year

Video section is only available for

PREMIUM MEMBERS

Investor’s long-awaited update regarding the Federal Reserve’s plan to cut its benchmark interest rate (Fed funds) is finally over, and financial markets overwhelmingly welcomed what the Fed revealed today.

First, as expected the United States Central Bank left its benchmark interest rate unchanged, and is still between 5 ¼% and 5 ½%. However, today’s FOMC meeting differs in that this month the Fed released its Summary of Economic Projections (SEP) which reveals expectations by Federal Reserve officials as to where interest rates should be in 2024, 2025, and 2026.

The last dot plot which was released in December 2023 anticipated a total of three 1/4% rate cuts, reducing the Fed’s benchmark rate by three-quarters of a percent this year. The concern by market participants was that recent reports on inflation revealed an uptick. Recent data came in even above the high projections by economists polled by both Reuters and the Wall Street Journal. This raised the question of whether Federal Reserve officials would maintain their projections from December and carry them over to today.

Overwhelmingly, market participants felt a sigh of relief when the SEP revealed that the Fed had not changed its outlook. The Feds rate cut projections still anticipate taking the benchmark rate to 4.6% by the end of 2024.

The graph above is the most current “dot plot” which was released after today’s FOMC meeting. It compares today’s projections side-by-side with the projections from December. The most current projections are in darker blue to the right of the projections revealed in 2023.

That being said, it also reveals that the Federal Reserve anticipates that core inflation will peak at 2.6% this year, slightly above December’s projection of 2.4%. The expectation is that inflation will cool to 2.2% in 2025, and reach their 2% target in 2026.

Gold investors and traders immediately bid the precious yellow metal higher taking gold futures within striking distance of its new record high of $2203 per ounce. As of 5:50 PM EDT, gold futures basis the most active April contract is currently fixed at $2189.60 after factoring in today’s gain of $29.20, a 1.35% increase. Dollar weakness certainly played a role in today’s double-digit climb in gold. The dollar declined by 0.42% taking the dollar index to 103.045.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer