FOMC minutes rattle investors about the timing of first rate cut

Video section is only available for

PREMIUM MEMBERS

Today gold prices fell significantly down just over $30, the largest percentage decline in over three weeks. As of 5:30 PM EST gold futures basis the most active February contract is fixed at $2042.80 after factoring in today’s decline of -1.48%, or $30.60. Although dollar strength today was a component of gold’s decline, it was certainly not the predominant factor taking the precious yellow metal lower.

The dollar gained 0.23% now for the fourth consecutive daily rise. Currently, the dollar index is fixed at 102.474. Silver’s decline was much more dramatic with a loss of 3.32% or $0.795 taking the most active March contract to $23.155.

The primary component taking both gold and silver lower was today’s release of last month’s FOMC minutes. At issue was a lack of clarity concerning the timing of rate cuts, specifically when the Federal Reserve will implement its first rate cut of the year.

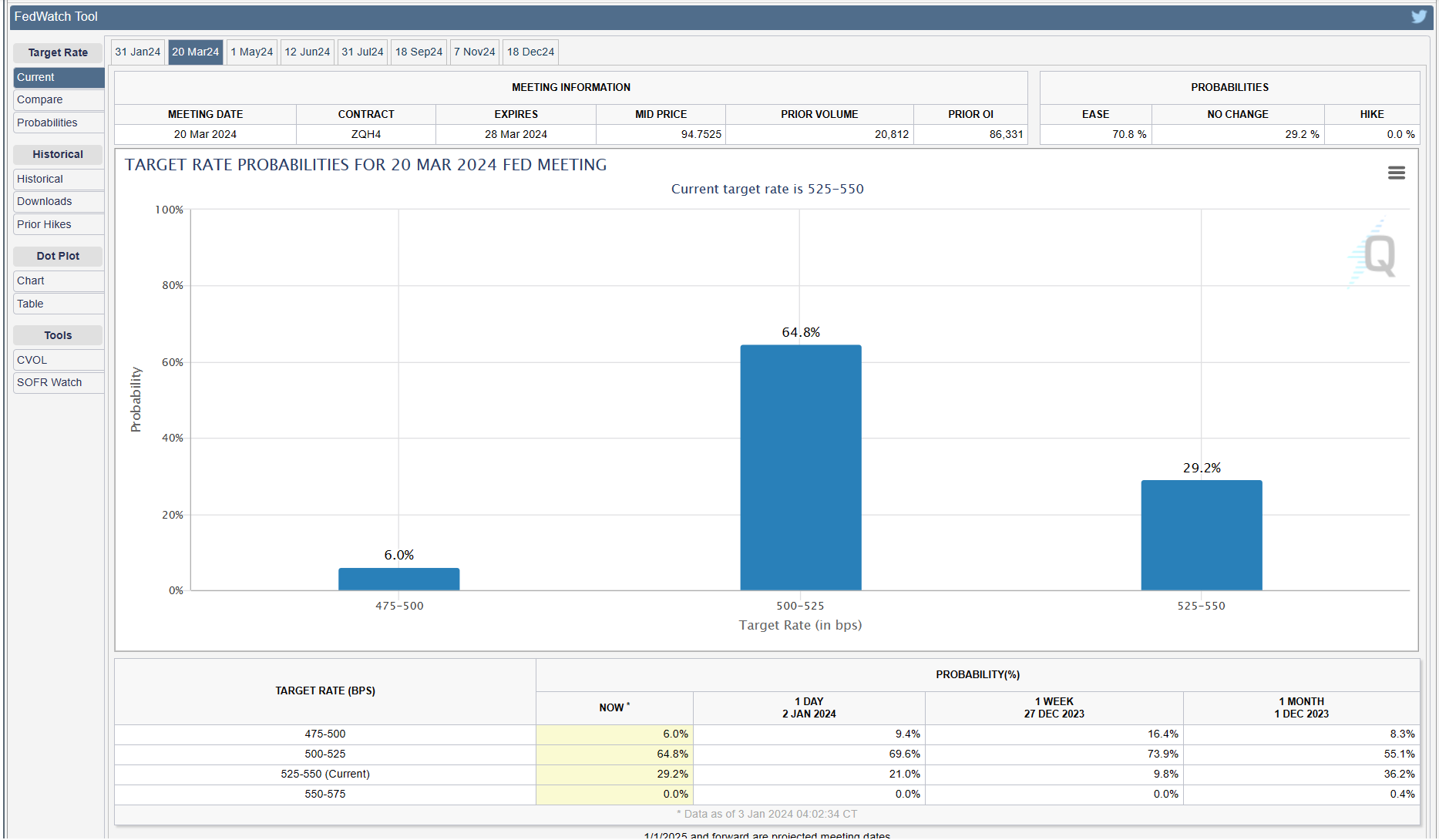

Clearly, market participants and investors have been unrealistically optimistic. The consensus amongst many analysts and economists believe that the Fed will implement its first rate cut as early as the second quarter of the year, and possibly as late as mid-year. This differs greatly from traders who according to the CME’s FedWatch tool believed that there is a 64.8% probability that the Federal Reserve will initiate its first quarter percent rate cut at the March FOMC meeting.

The minutes released contained no insights as to the timing of upcoming rate cuts this year and tempered optimism with "an unusually elevated degree of uncertainty" as it pertains to the monetary policy path. The minutes also left the door open for further interest rate hikes if the data necessitates it.

That being said, they continue to underscore their confidence that inflation is coming under control and “upside risks” have diminished. The minutes also addressed concern that “overly restrictive” monetary policy might damage the economy. Recent data confirms that assumption, as the December ISM figures revealed an additional month in which US manufacturing activity has contracted.

Currently, on the radar is additional economic data, with the exceedingly important nonfarm payrolls report to be released on Friday.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer