Gold Futures Soar to New Heights Amid Anticipation of Federal Reserve Rate Cut

Video section is only available for

PREMIUM MEMBERS

In a historic week for the precious metals market, gold futures have shattered records, breaching the $2600 per troy ounce threshold for the first time. As of 5 PM EDT, the most active December contract settled at $2606.20, marking a net gain of $19 or 0.73% for the day. This surge represents the second consecutive day of record-breaking highs, with the intraday peak reaching an unprecedented $2614.60.

The remarkable ascent of gold prices comes on the heels of yesterday's robust $47 gain, the most substantial single-day increase since August 16. This week's dramatic rise will undoubtedly be etched in financial history as the moment gold futures crossed the $2600 milestone.

As the dust settles on this landmark event, market participants are now pivoting their attention to next week's Federal Open Market Committee (FOMC) meeting. This gathering is poised to be one of the year's most consequential, with widespread anticipation of the first interest rate cut since 2020. The consensus among analysts, economists, and market observers is that a rate reduction is all but certain.

The stage for this pivotal decision was set on August 20, when Federal Reserve Chairman Jerome Powell signaled the central bank's readiness to cut rates during a speech in Jackson Hole, Wyoming. Powell's stance has been echoed by other Fed officials, underscoring the growing sentiment that monetary easing is imminent.

Chicago Fed President Austan Goolsbee recently emphasized that long-term trends in both the labor market and inflation data justify a swift transition to a more accommodative monetary policy. Goolsbee cautioned against prolonged tightening, citing potential risks to employment levels.

While the likelihood of a rate cut is high, the magnitude remains a subject of debate. Economists at Fitch project a conservative approach, forecasting two 25 basis point cuts—one next week and another in December. However, some voices, like Krishna Guha of Evercore ISI, advocate for a bolder 50 basis point reduction to safeguard economic stability.

Former Fed Vice-Chair Donald Kohn highlighted the central bank's flexibility, noting its ability to swiftly adjust policy if inflation resurges, reminiscent of its aggressive stance in 2022. Current Fed Governor Christopher Waller and New York Fed President John Williams have both indicated openness to various cut scenarios, depending on incoming economic data.

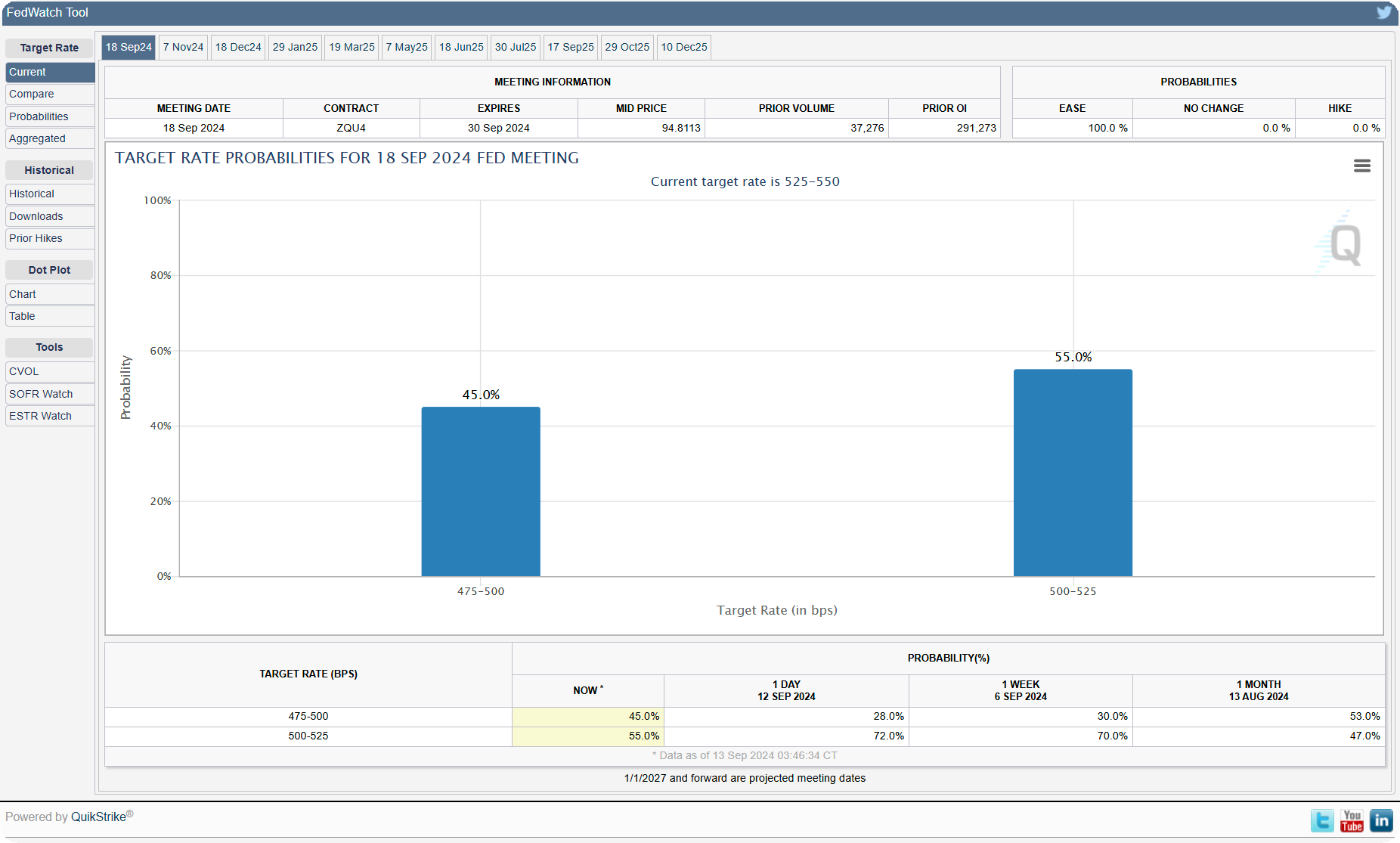

The CME's FedWatch tool reflects growing market expectations of a more substantial rate cut. The probability of a 50-basis point reduction next week has surged from 28% to 45% in just one day, with a 55% likelihood of a 25-basis point cut.

As the financial world holds its breath for the FOMC's decision, the gold market's recent performance serves as a barometer of economic uncertainty and anticipation. Market participants will be watching closely as these historic events unfold, potentially reshaping the financial landscape in the weeks and months to come.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer