Gold Gains Momentum as Economic Slowdown Signals Emerge

Video section is only available for

PREMIUM MEMBERS

Gold continues to gain value after yesterday's report on weekly unemployment claims surged for the week ending May 4. The US Labor Department's report revealed that applications rose by 22,000 for a total of 231,000 new applications filed for unemployment claims, well above economists' forecast of an additional 214,000 claims.

As of 5:20 PM ET, gold futures basis the most active June contract is fixed at $2375, after factoring in a gain of 1.48%. Gold futures opened at $2353.50, traded to an intraday high of $2385.30, and a low of $2352.

These latest reports, coupled with the recent tepid jobs report showing only 175,000 new positions added last month, could be revealing strong indications that the US is amid an economic slowdown.

Federal Reserve's Monetary Policy Outlook

Federal Reserve officials will consider these economic reports when deciding the forward direction of their monetary policy at the next FOMC meeting in June. Currently, the probability that the Federal Reserve will maintain its current benchmark interest rate (Fed funds rate) between 5 ¼% and 5 ½% is almost a certainty, with a 96.5% probability, according to the CME's FedWatch tool.

There is an overwhelming consensus that the Federal Reserve will initiate its first rate cut at the September FOMC meeting. The CME's FedWatch tool predicts that there is only a 38.8% probability that the Federal Reserve will maintain its current benchmark interest rate after the September FOMC meeting.

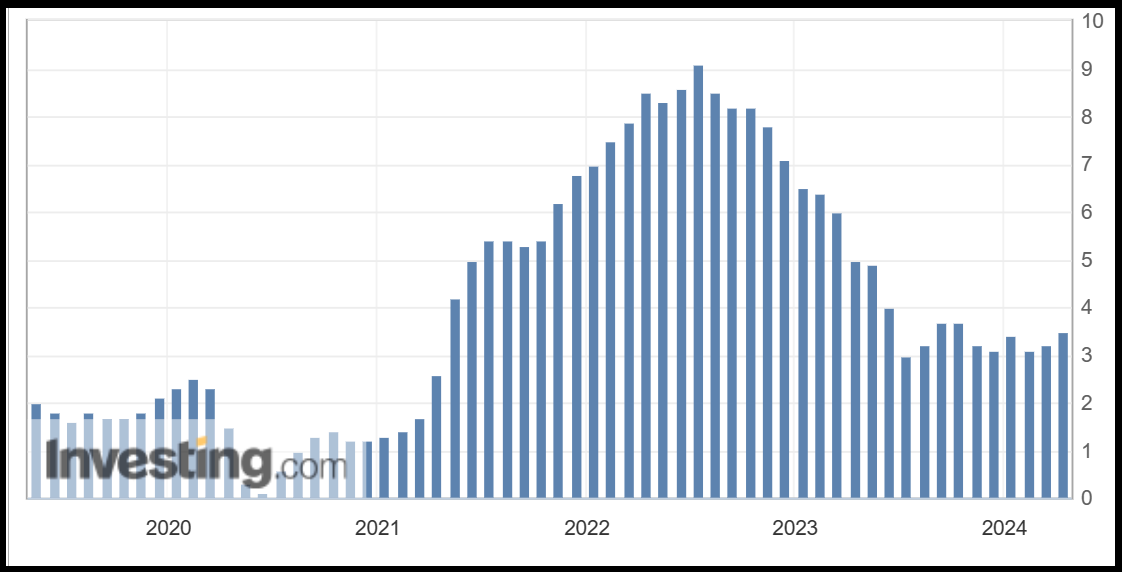

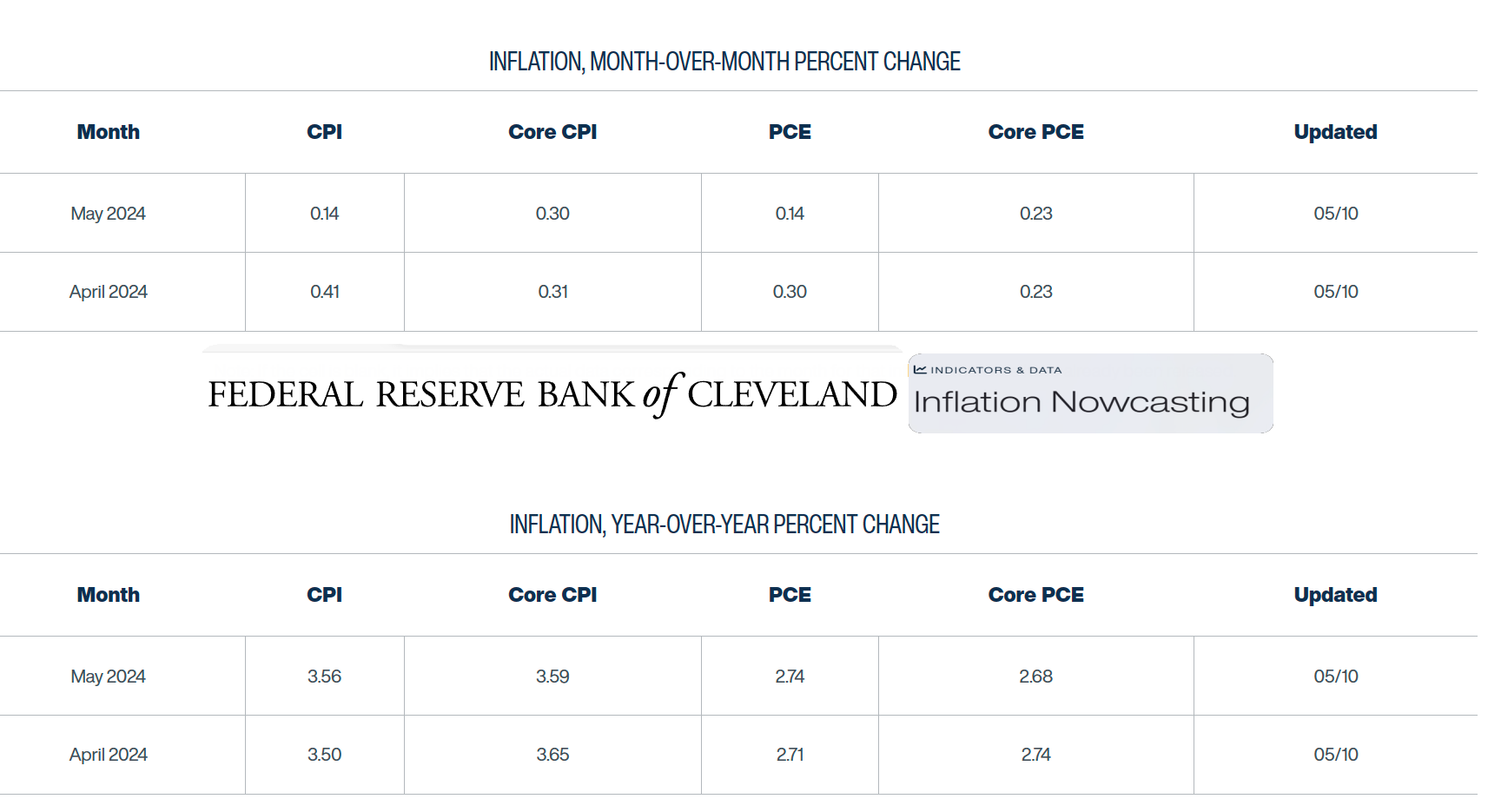

Inflation Data: A Crucial Factor

The Federal Reserve's monetary policy is fluid and based on the most current data, so the timing of rate cuts could change if inflation begins to cool, or warm faster than expected. This is why next week's CPI (consumer price index) report will be closely watched and have the potential to move gold prices.

Early forecasts by the Federal Reserve Bank of Cleveland's "Inflation Nowcasting" indicator anticipate that next week's report will reveal an increase in headline inflation of 0.41% month over month and an increase in core inflation (which strips out volatile food and energy pricing) of 0.31%.

According to Jim Wyckoff, Senior Market Analyst at Kitco News, "If we get hot inflation or even warm inflation data next week, that's going to throw cold water on any notions that the Fed might be able to cut interest rates as soon as September."

Next week's CPI report will provide crucial insights into current inflationary pressures in the US, potentially influencing the timing and magnitude of rate cuts by the Federal Reserve this year. The timing and magnitude of upcoming rate cuts will certainly have a strong influence on gold pricing.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer