Gold Retreats Creating a Bearish Japanese Candlestick Pattern

Video section is only available for

PREMIUM MEMBERS

Gold futures are currently in the midst of a price correction after hitting a double top near $2,750. On Wednesday, December 11th, gold opened at $2,721 and reached an intraday high of $2,760, the highest level since the $2,654 low on December 6th.

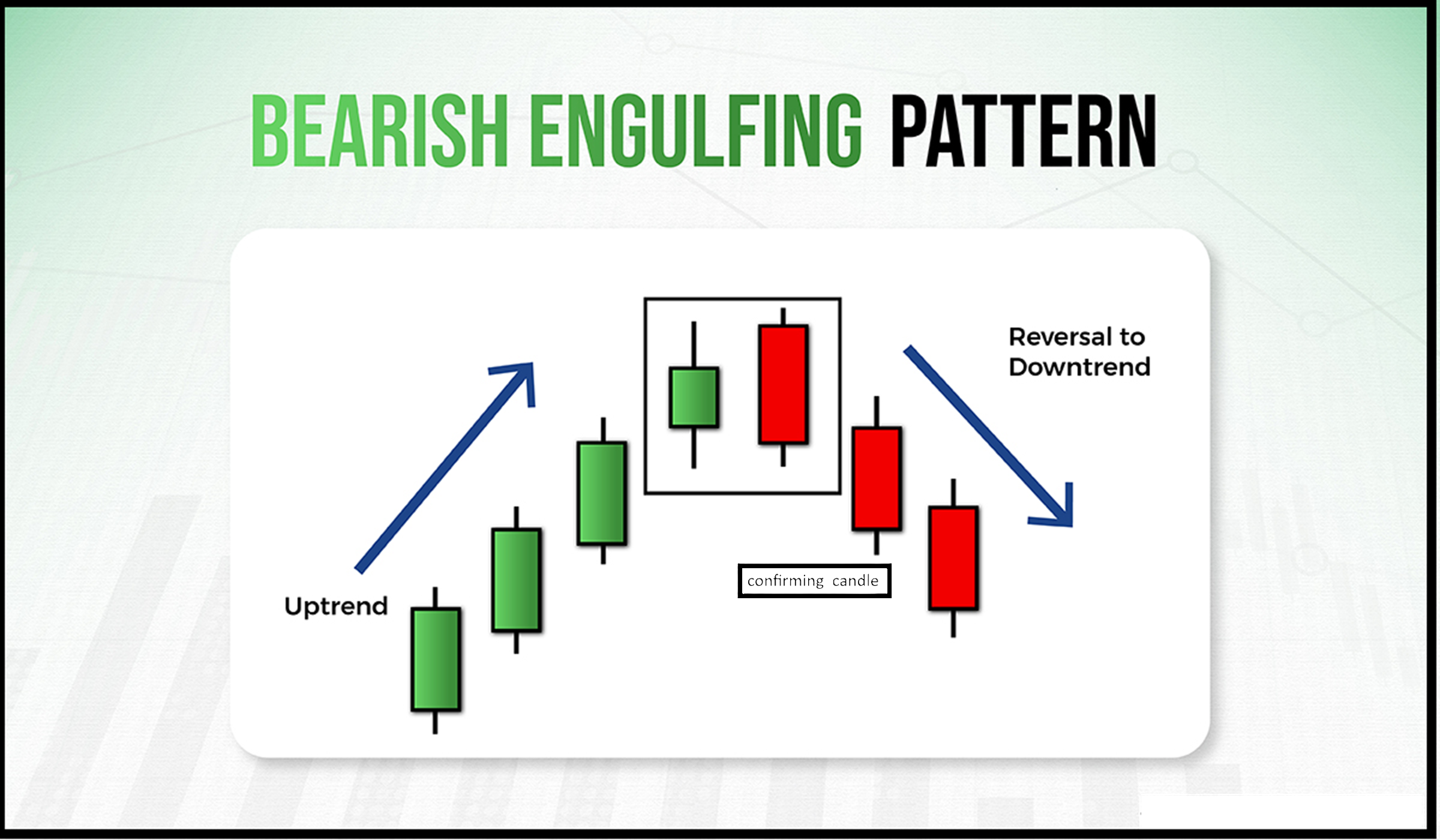

However, Thursday's trading session saw a bearish turn of events. Gold opened near the previous day's closing price but then sold off, resulting in a loss of $48.60. This created a Japanese candlestick pattern known as a "Bearish Engulfing Pattern."

The Bearish Engulfing Pattern is a technical chart pattern that can indicate a potential reversal after a strong uptrend. It consists of two consecutive candlesticks - a large green candle followed by a higher-opening red candle that closes below the previous green candle's open, essentially "engulfing" the prior bullish candle.

This pattern is considered a reliable bearish reversal signal, with corrections occurring around 60% of the time when all criteria are met. The pattern emerges after a defined uptrend, and a confirming third red candle with a lower low, lower high, and lower close provides confirmation.

The Bearish Engulfing Pattern seen in gold this week is likely the result of profit-taking after the commodity reached new record highs near $2,800 per ounce. Additionally, some mixed and less positive economic data for the upcoming year may have contributed to the pullback.

However, many analysts believe this correction will be short-lived, and gold is expected to set new record highs in 2025. RBC Capital Markets' commodities strategist Christopher Louney noted that with markets pricing in a December rate cut and China's central bank resuming gold purchases, some of the headwinds facing gold may start to abate as the new year approaches.

As of 4:40 PM ET, the most active February gold contract is trading $37.30 lower, a decline of 1.38%, with the troy ounce price at $2,667.90. Minor support is seen at $2,640, while major technical support lies around $2,580.

Wishing you, as always good trading,

Gary S. Wagner - Executive Producer