Hot Retail Sales and Lower CPI Pave the Way for September Rate Cut

Video section is only available for

PREMIUM MEMBERS

Recent economic data has set the stage for a potential interest rate cut by the Federal Reserve in September, as retail sales surged and inflation continued to cool. These developments have sparked optimism among investors and economists alike, signaling a possible shift in monetary policy.

On August 15, 2024, the U.S. Census Bureau reported a robust 1% monthly increase in retail sales for July, surpassing expectations of 0.4% and marking the most significant rise in 18 months. This strong consumer spending data, coupled with the previous day's Consumer Price Index (CPI) report showing inflation at a three-year low, has strengthened the case for a rate cut.

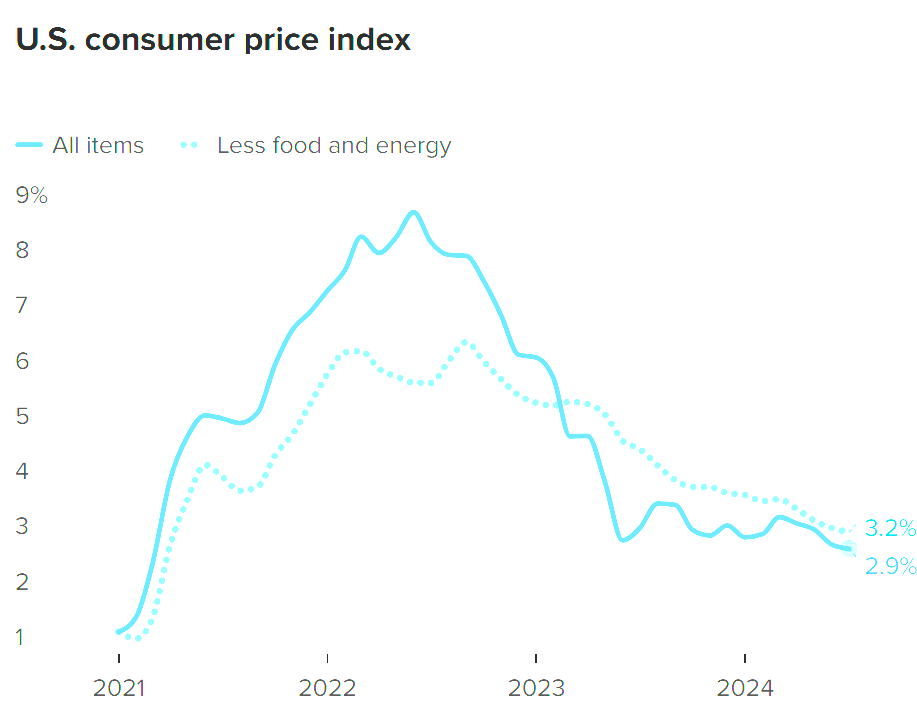

The Labor Department's CPI report for July revealed that inflation has continued to decline, reaching its lowest level since 2021. The core CPI, which excludes volatile food and energy prices, rose 0.2% month-over-month and 3.2% annually, aligning with economists' projections and representing the lowest core inflation rate since April 2021. The headline CPI increased by 0.2% month-over-month, bringing the 12-month inflation rate to 2.9%, the lowest since March 2021.

Seema Shah, chief global strategist at Principal Asset Management, commented on the CPI data, stating, "Today's CPI print removes any lingering inflation obstacles that may have been preventing the Fed from starting the rate-cutting cycle in September. Yet, the number also suggests limited urgency for a 50-basis point cut."

Adding to the dovish sentiment, Atlanta Fed President Bostic expressed openness to a rate cut in September, emphasizing that the Fed cannot "afford to be late" in easing monetary policy amid signs of cooling in the labor market. These comments have bolstered gold prices and raised expectations for a policy shift.

The Federal Reserve has previously indicated that it requires multiple months of data to establish a trend before pivoting to a more accommodative stance. With these recent reports, the central bank may be inclined to adjust its policy statement to signal a possible rate cut at the September meeting.

As of 6:00 PM EDT, gold futures for December delivery is currently fixed at $2,493.60, registering a modest gain today despite a strengthening dollar. The U.S. Dollar Index rose by 0.44% to 103.036, highlighting the complex interplay between economic indicators and market sentiment.

As investors and policymakers digest these latest economic signals, all eyes will be on the Federal Reserve's next moves. The combination of strong retail sales, easing inflation, and dovish comments from Fed officials has created a favorable environment for a potential rate cut, marking a significant turning point in the post-pandemic economic landscape.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer