Inflation Eases in April, Raising Hopes for Fed Policy Shift

Video section is only available for

PREMIUM MEMBERS

The latest US inflation data provided a glimmer of hope that price pressures may be starting to cool, fueling expectations that the Federal Reserve could begin easing its aggressive monetary tightening campaign later this year.

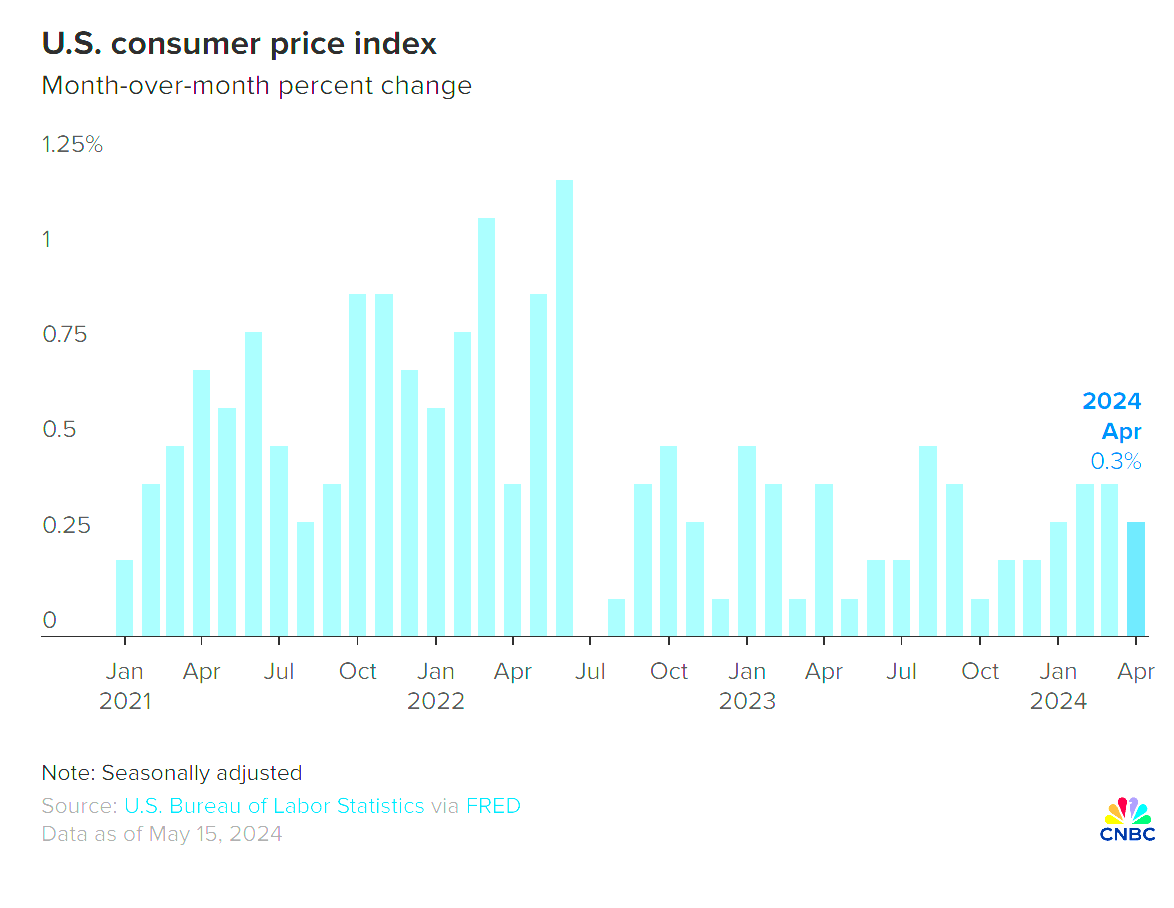

The Consumer Price Index (CPI) report released today showed that headline inflation rose 0.3% in April, slightly below the 0.4% increase forecast by economists. On an annual basis, the pace of consumer price growth decelerated to 3.4% from 3.5% in March.

Perhaps more encouragingly, core CPI, which strips out volatile food and energy costs, also rose 0.3% last month, marking the first moderation after three consecutive months of 0.4% gains. The annual increase in core prices eased to 3.6% from 3.8% in March, the lowest level since April 2021.

"I would characterize it as a small step in the right direction," said Stephen Stanley, chief U.S. economist at Santander. "Both overall and core prices rose 0.3 percent from the previous month, down from 0.4 percent in February and March."

While the data provided some relief to Federal Reserve officials concerned that recent rate hikes have not been sufficient to tame inflation, economists cautioned that it was too early to declare victory. "I think there will be something of a sigh of relief from the Fed, but at the same time there's still work to be done," said Sarah House, senior economist at Wells Fargo, noting that services prices, particularly, continued to rise rapidly in April.

One area where inflationary pressures remained stubborn was housing costs, which have continued to rise more quickly than before the pandemic, defying expectations of a slowdown.

Nevertheless, the report raised optimism among market participants that the Fed could begin easing its monetary policy stance later this year. Currently, traders are pricing in a 25-basis-point rate cut at the September Federal Open Market Committee (FOMC) meeting, followed by another 25-basis-point reduction in November.

The prospect of a potential Fed pivot toward easier policy weighed heavily on the US dollar, which plunged 0.724% to 104.303 against a basket of major currencies, breaching a key support level at 105. Should the greenback's weakness persist, analysts see scope for a further decline toward 103.

Conversely, gold prices surged in response to the softer inflation data and the accompanying dollar sell-off. As of 5:40 PM EDT, the most active June 2024 futures contract was trading 1.48% higher at $2,394 per troy ounce. With the precious metal benefiting from both inflation-hedge demand and dollar weakness, the next resistance level is seen at $2,400, followed by the record high of $2,448.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer