Inflation report could get a lot attention, PCE price index released today!

Video section is only available for

PREMIUM MEMBERS

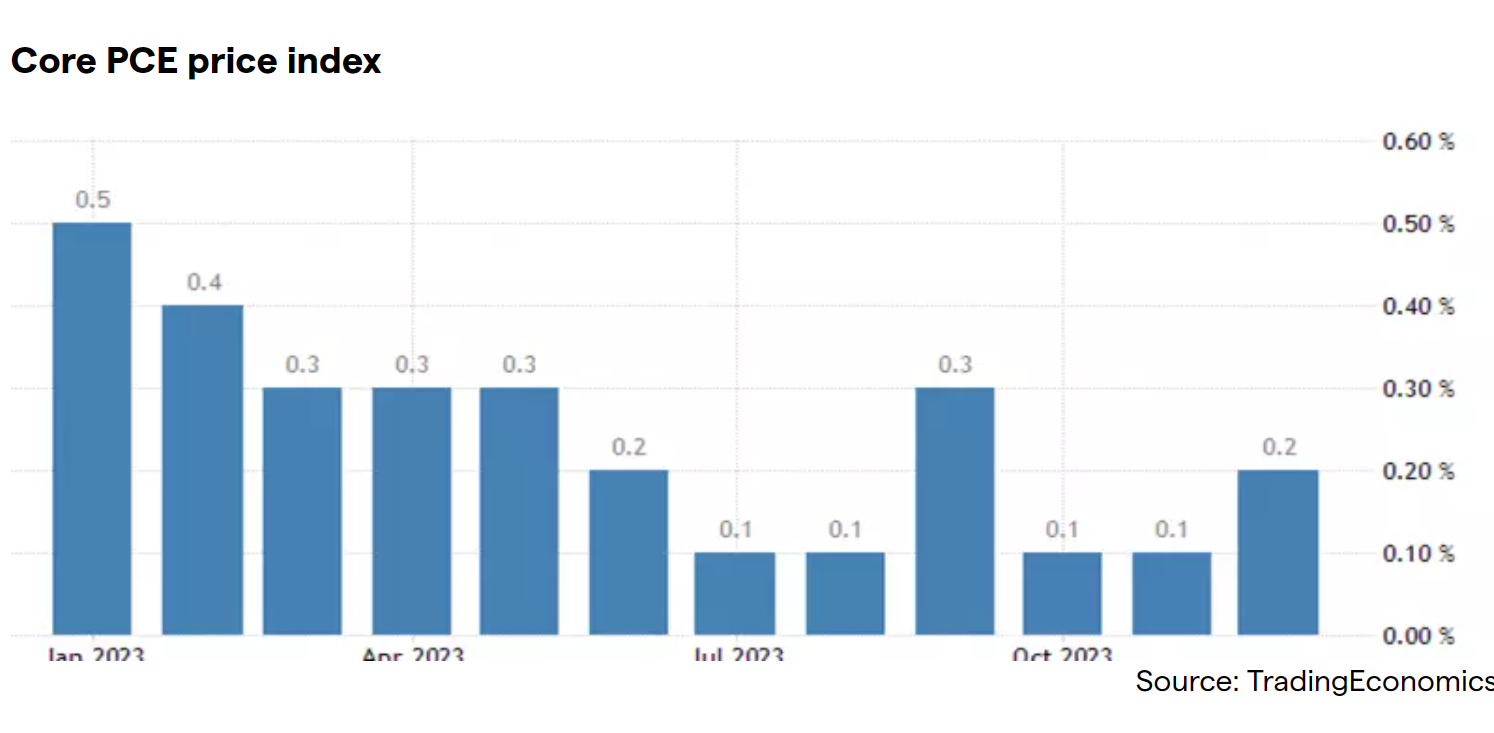

There were three primary takeaways from today’s PCE price index report.

- The Commerce Department released the data from the January inflation numbers vis-à-vis the personal consumption expenditures price index, the preferred inflation gauge of the Federal Reserve revealed inflation growth was much hotter than expected.

- Some economists including Mark Zendi believe that if the Fed maintains its restrictive stance and tight economic policy it would result in increasing the danger to economic expansion.

- Today’s report revealed that the forecast of a 0.3% monthly gain and a 2.4% year-over-year move in line with a survey of economists from Dow Jones.

Today’s release of the inflationary data provided by the PCE price index for January contained a heightened concern when compared to previous reports. This was due to the fact that many economic predictions indicated that inflation would come in much hotter than originally expected. The primary concern was that the report would reveal that inflation in January would show that the cost-of-living is still well above the Fed’s target of 2%, an increase from the previous month which could be interpreted as a lack of progress despite the Fed’s restrictive monetary policy for the last two years.

The core PCE price index is the preferred method of inflationary data by the Federal Reserve because it strips out the more volatile costs of both food and energy. Multiple economists had dire warnings including Zandi, chief economist at Moody’s analytics who said, “Inflation doesn’t move in a straight line. It zigs and it zags, and it zagged in January.” Zandi and other economists expected that the PCE price index would reveal a 0.4% in both the headline and core numbers month over month.

The expectations were that the core PCE data would reveal that inflation had doubled the growth from December which if true would present a dynamic challenge for the Fed to begin rate cuts later this year. However, many economists have underscored the need to put too much emphasis on a single months data because regardless of the numbers that were revealed today unquestionably inflation has been decelerating, and the Fed is moving closer to its 2% target.

Susan Collins, the Boston Fed president agreed with that assumption saying that, “Expecting all data to speak uniformly is too high a bar.” That being said she added that, “Still, it will be important to see sustained, broadening signs of progress toward the Fed’s dual mandate goals – while recognizing that progress may be uneven.”

Collins is still under the assumption that there are high expectations that the Fed will cut rates this year however the process and timeline will be based on a “methodical, forward-looking” manner and to happen “gradually,” and not use an aggressive pace of cuts which was the protocol previously.

The net result of today’s numbers increased the yields on the 10-year treasury by nearly ¼ percentage, while the 10-year tips rate increased by more than ¼ point.

Although there are two primary inflation reports the CPI and the PCE the latter tends to acquire a significant focus under the assumption that the PCA is considered a much broader measure that also takes into account differentials in consumer behavior which is different than the CPI which is laser-focused on a rather than just focusing on a static set of goods and services.

In addition to higher numbers than expected in the PCE, both the producer price index and CPI rose to a greater extent than expected in January which was a component factored into the computations of the PCE price index.

The result was that the major stock indices showed gains across the board, concurrently gold had a significant gain with oil, 10-year debt instruments, the euro dollar compared to the US dollar, and the Vix moving lower immediately after the release of today’s report.

As of 5:46 PM ET gold futures basis the most active April contract rose significantly gaining $12 or 0.59% fixing April gold at $2054.70. Gains in gold were not stifled by dollar strength which gained 0.19% fixing the dollar index at 104.10. Lastly, silver futures which had been steadily declining over the last seven trading days had a moderate recovery of 1.1% taking the most active March contract to $22 88 ½ cents.

For those who wish to learn more about our service, please go to the links below,

Pricing, Track Record, Trading system ,Endorsements of Confidence, FAQ

Wishing you as always good trading,

Gary S. Wagner - Executive Producer