Investors wait for Fed minutes as gold rises for fourth consecutive day

Video section is only available for

PREMIUM MEMBERS

According to a poll of economists conducted by Reuters, the Federal Reserve will initiate its first interest rate cut in June. This aligns loosely with the CME’s FedWatch tool which predicts only an 8.5% probability of the first rate cut in March, a 34.9% in May, and a 77.25% probability of lower rates in place by June.

This is why the release of the minutes tomorrow is so critical to market participants. Currently, there is no solid consensus on the exact month that the Fed will pivot and cut rates for the first time since March 2022.

The Federal Open Market Committee (FOMC) Meeting Minutes are a detailed record of the committee's last policy-setting meeting. The minutes offer detailed insights regarding the FOMC's stance on monetary policy. Investors are hoping that it will also include insights regarding the timing of the first rate cut.

Last week’s CPI report revealed that inflation in January came in fractionally hotter than anticipated. Before the CPI’s release exactly one week ago gold trading range could be best characterized as a compression triangle. This pattern type is characterized by a series of lower highs and higher lows which is exactly how gold traded from the record high achieved at the end of December to last week.

The chart above is a daily Japanese candlestick chart of spot gold with support and resistance trendlines created from the higher lows (support trendline) to the lower highs (resistance trendline). It clearly illustrates the hard selloff that occurred immediately after the January CPI report was released. The bearish momentum was short-lived but took gold prices to $1984 before reversing indirection. As of today, gold has had four consecutive trading days of higher highs, higher lows, and higher closes.

As of 5:40 PM ET spot gold is currently fixed at $2024.19 after factoring in today’s net gain of $6.24. Gold futures basis the most active April contract gained $15.70 or 0.78% today resulting in April gold currently fixed at $2039.80.

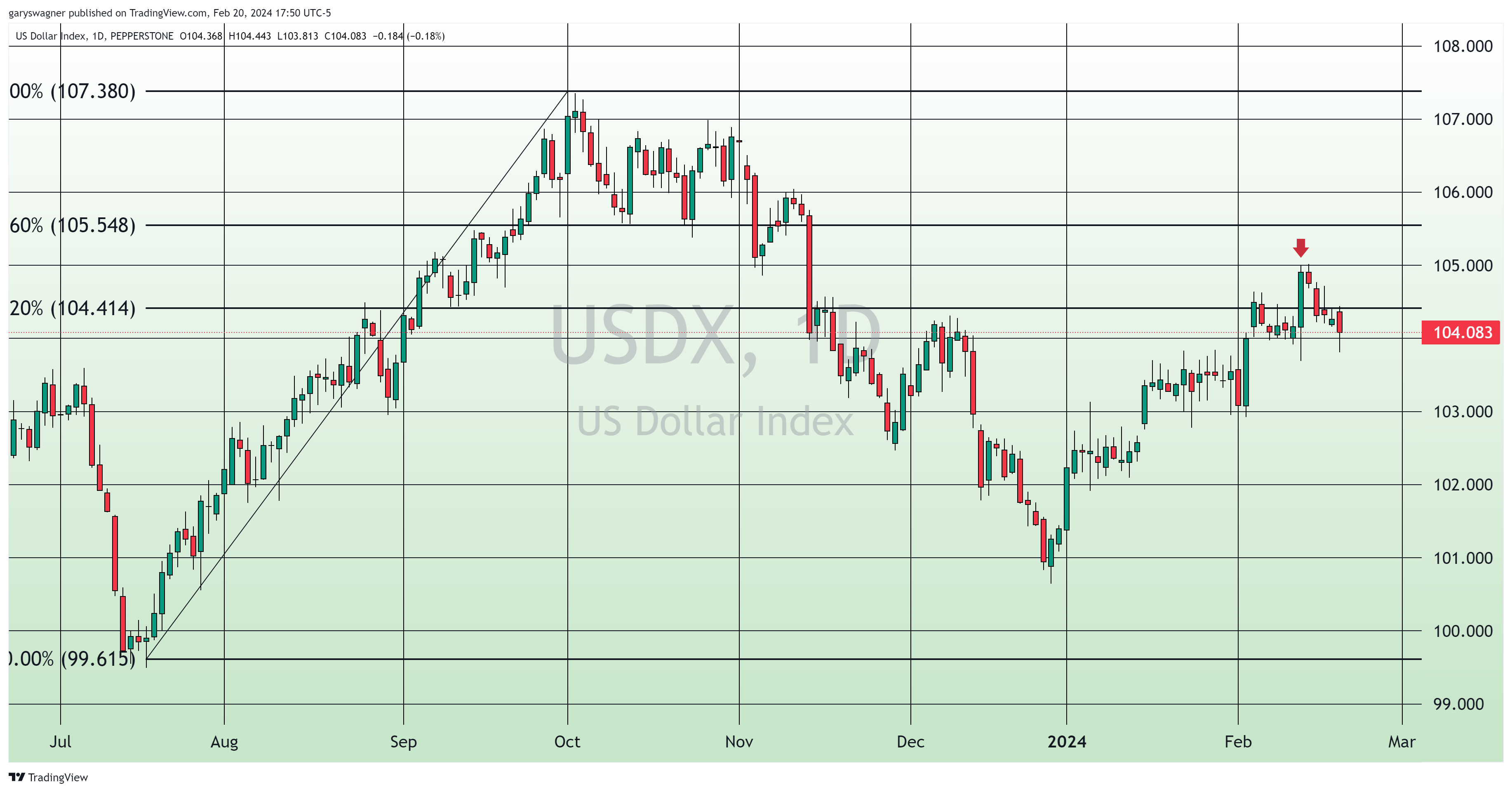

Dollar weakness has been providing solid tailwinds. The dollar index has declined for five consecutive days from recent highs just below 105 to its current fixed at 104.083. This is a 1% decline in the dollar when compared to the basket of currencies it is traded against.

Tomorrow’s release of the minutes will be an important report that hopefully provides more insight into the internal thinking of Federal Reserve members. The recent gains in gold were the result of both dollar weakness and solid market sentiment anticipating the first interest rate cut by the Federal Reserve. The combination of dollar weakness and interest rate cuts by the Fed could easily take gold prices higher from current values.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer