'Just because gold is at a new record high does not mean it can't go a lot higher’ - Michael Armbruster

Video section is only available for

PREMIUM MEMBERS

Speaking to MarketWatch Michael Armbruster made this profound and I believe decisively accurate statement. His quote was his sentiment based on the tremendous upside spike in gold prices today.

On a remarkable trading day, gold futures for the most active December contract opened at $2540.60 and closed at an unprecedented $2586.40, marking a net gain of $45.80 or 1.81%. The intraday high of $2587.70 set a new historical benchmark for both price and closing value. This surge represents the most substantial single-day increase since August 16, when gold climbed by $51.70, effectively transforming the previous resistance level of $2500-$2520 into a new support zone.

The global nature of gold trading adds another layer of intrigue to this rally. With trading continuing for another 24 hours this week, there remains potential for further gains before the market closes Friday in New York. This 24-hour trading cycle, spanning from Australia to Hong Kong, London, and back to New York, ensures that gold's momentum can build across time zones and continents.

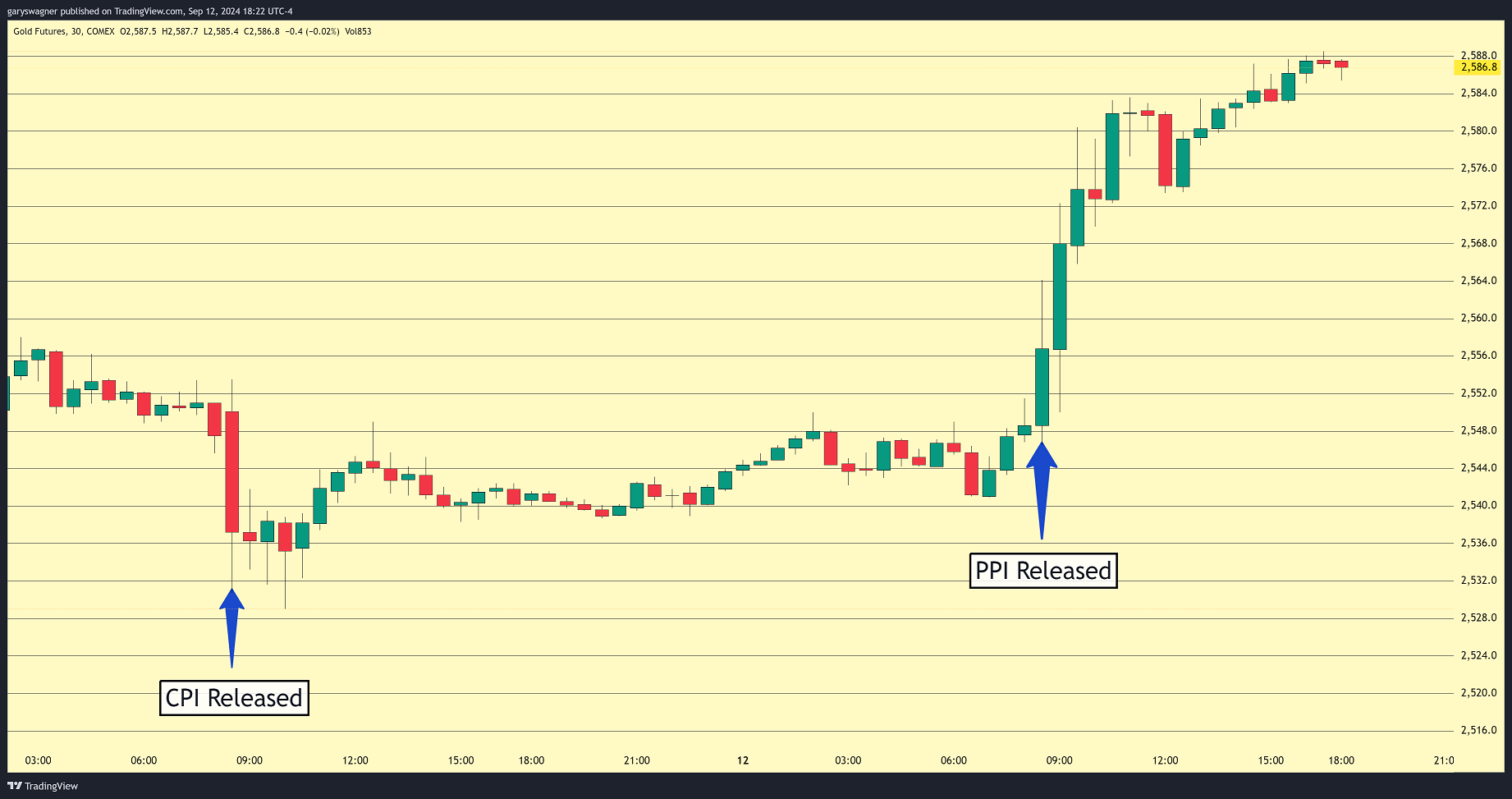

The catalyst for today’s impressive gains can be traced to the release of two critical economic reports. The Consumer Price Index (CPI) for August and the Producer Price Index (PPI), both issued by the U.S. Bureau of Labor Statistics because they provided the market with crucial insights. While neither report deviated significantly from consensus estimates, their combined impact bolstered trader confidence in the CME's FedWatch tool predictions.

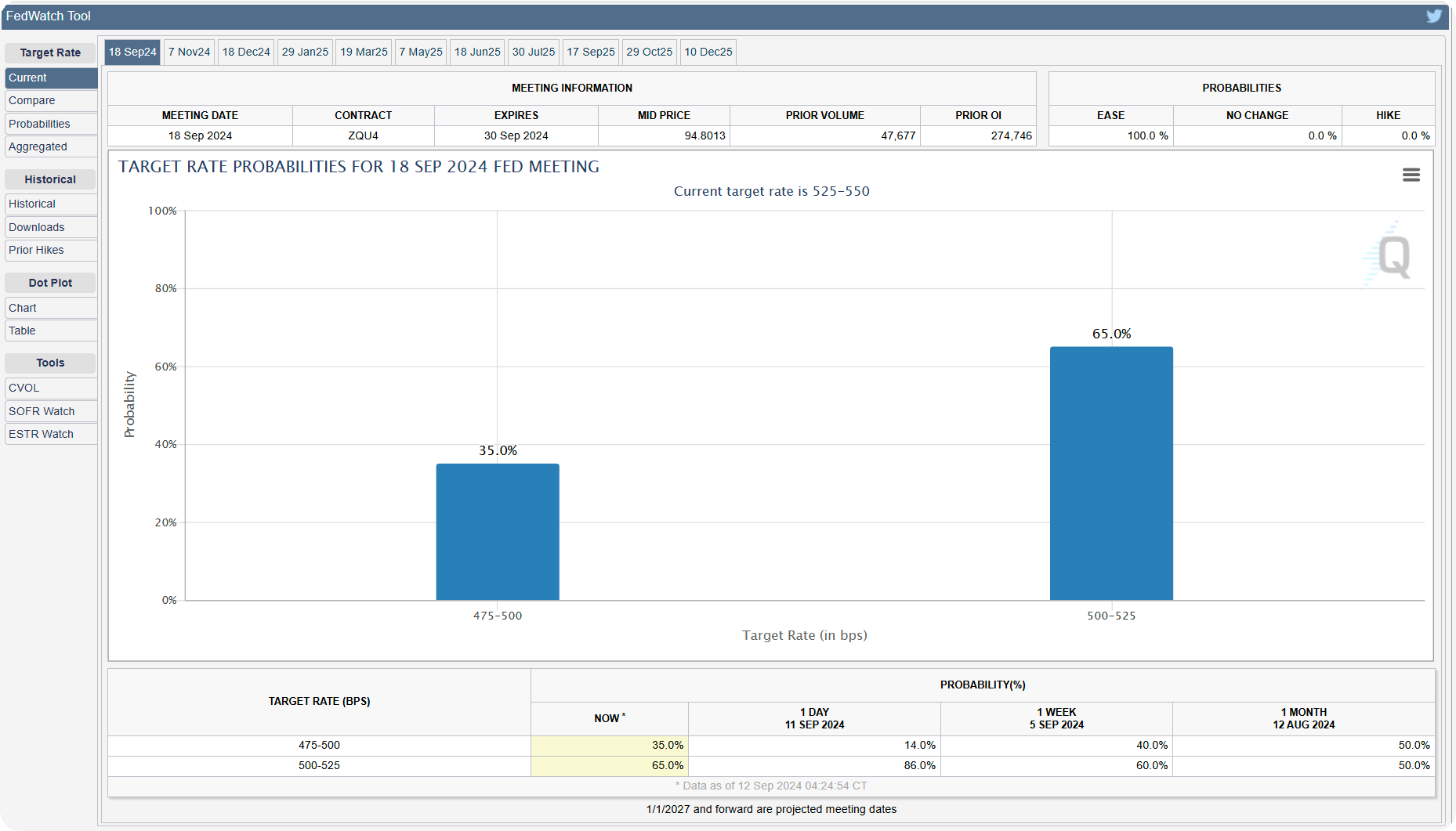

Currently, the FedWatch tool indicates a 100% probability of the Federal Reserve initiating its first rate cut since the commencement of rate hikes in March 2022. This shift in monetary policy expectations has fueled gold's ascent, as lower interest rates typically boost the appeal of non-yielding assets like gold.

Interestingly, market sentiment has seen a notable shift regarding the magnitude of the potential rate cut. The probability of a 50-basis point rate cut next week has surged from 14% to 35%, while expectations for a 25-basis point cut have correspondingly decreased from 86% to 65%. This evolving outlook reflects the market's growing confidence in a more aggressive monetary easing stance.

The chart above is a 30-minute Japanese candlestick chart of December gold futures. What is most interesting is that today’s $45 gain occurred throughout the morning session. It began 90 minutes prior to the release of today’s PPI report and gained approximately $10 each half hour from 8:30 AM to 10:30 AM when it reached $2581.60.

As the gold market continues to demonstrate its strength and appeal, investors and analysts alike are closely watching for signs of sustained momentum. The combination of global economic uncertainties, shifting monetary policies, and gold's traditional role as a safe-haven asset suggests that this rally may have further room to run.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer