Powell crushes investor optimism regarding March interest rate cut

Video section is only available for

PREMIUM MEMBERS

Today the Federal Reserve concluded its first open market committee meeting of the year. Three important takeaways were revealed in both the written Fed statement and comments made by Chairman Powell at the following press conference.

First, as anticipated the Federal Reserve decided to maintain its target range for the federal funds rate between 5 ¼% and 5 ½%.

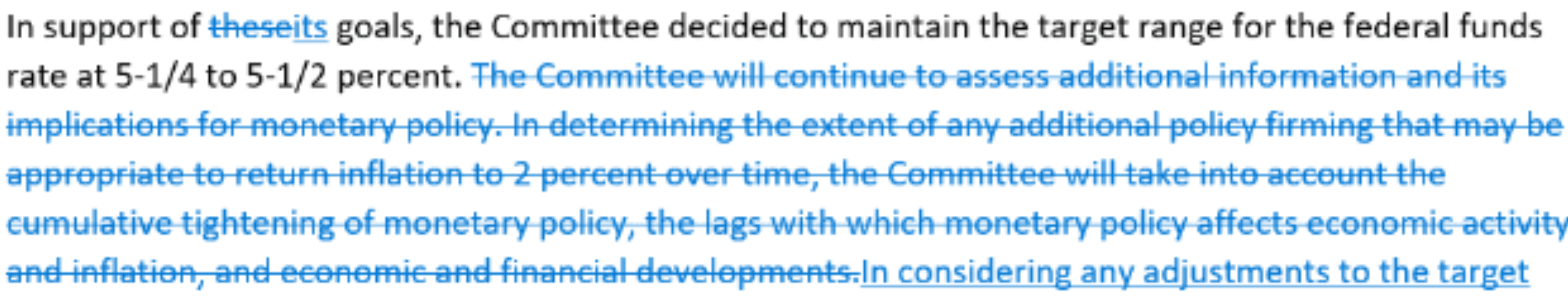

Secondly, the written statement removed comments that address additional policy firming, I.E. additional rate hikes. Removed from the statement was the following comment that was contained in prior Fed statements; “the committee will continue to assess additional information and its implications for monetary policy. In determining the extent of any additional policy firming that may be appropriate to return inflation to 2% over time, the committee will take into account the cumulative tightening of monetary policy, the legs with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Lastly, during the press conference, Chairman Powell was asked about the possibility of the first interest rate cut to begin in March. His response was, “Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that. But that’s to be seen.”

Powell confirmed that a rate cut in March is highly unlikely which seemed to send multiple financial markets into a tailspin. One the CME’s FedWatch tool predicted that there was a 73.4% probability of a rate cut in March which has now declined to a 35.5% probability that the Fed will initiate its first quarter percent rate hike at the March FOMC meeting.

The combination of the Federal Reserve’s FOMC statement and Chairman Powell’s press conference created wild price swings in gold. The chart above is ½ hour candlestick chart of gold futures (a continuous contract currently representing April gold). Gold futures were fixed at approximately $2056 during the release of the statement. In the short time of only a few hours, gold prices ran from $2056 to their daily high above $2075. What followed over the final hours of trading was a methodical price decline to the low of the day $2048.90 which occurred between 3:00 PM and 3:30 PM ET. Gold prices would recover over the remaining hours of trading. As of 5:15 PM ET gold futures are currently fixed at $2057.70 after factoring in today’s gain of $2.40.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer