Gold's Resilient Rally: Navigating a Bullish Market Landscape

Video section is only available for

PREMIUM MEMBERS

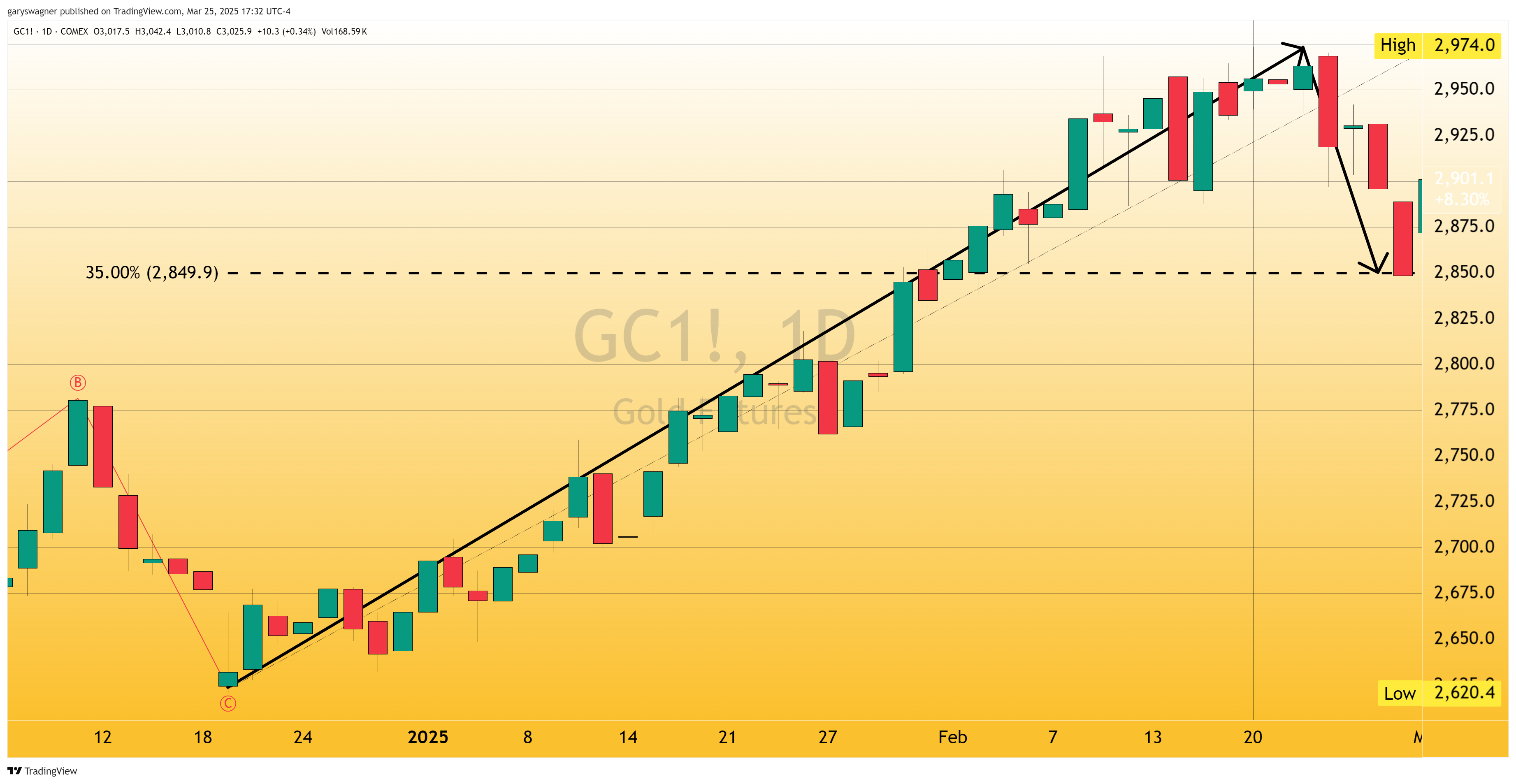

Gold has demonstrated extraordinary resilience in recent months, staging an impressive rally that has captured the attention of investors worldwide. From mid-December to February, the precious metal experienced a remarkable price advance of $343, showcasing its underlying strength and potential for further growth.

The market's recent price action reveals a nuanced and compelling narrative of strategic movements and sustained bullish momentum. The initial rally began at $2,620 in mid-December, surging impressively to $2,963.20 by late February. What sets this market performance apart are the remarkably controlled corrections that followed, characterized by their shallow depth and brief duration.

The first correction saw a 35% pullback of $122, while a subsequent Fibonacci correction dropped from $3,065 to $3,007, representing just a 23.6% retracement. These measured movements suggest an underlying market strength that continues to support gold's upward trajectory, even as technical indicators suggest an overbought condition.

David Morrison from Trade Nations provides an intriguing perspective on gold's potential, suggesting an alternative scenario where gold could continue its upward momentum. He offers a balanced view, acknowledging both the possibility of a continued rally and the potential for a further pullback or consolidation.

The upcoming Personal Consumption Expenditure (PCE) index data emerges as a critical focal point. This economic indicator could provide crucial insights into monetary policy, potentially serving as a significant catalyst for gold prices and investor sentiment.

A confluence of global economic factors is driving gold's current market position. The dollar index has experienced fractional declines, traditionally a positive indicator for gold prices. Escalating international trade tensions and geopolitical uncertainties are simultaneously increasing gold's appeal as a safe-haven asset.

Ongoing trade conflicts, including potential tariff implementations and tensions in global markets, are further enhancing gold's attractiveness as a store of value. The constant threat of economic instability continues to drive investors towards this precious metal.

The latest market data paints an encouraging picture. The April gold futures contract stands at $3,025.90, with a recent net gain of $10.30, representing a 0.34% increase. Overseas trading in Australia has seen the contract reach $3,026.10, indicating sustained global interest.

Investors are advised to maintain a close watch on several key indicators. The upcoming PCE index data, potential shifts in Federal Reserve monetary policy, ongoing geopolitical developments, and movements in the dollar index will all play crucial roles in shaping gold's future trajectory.

Wishing you, as always good trading,

Gary S. Wagner - Executive Producer