Profit Taking takes Gold Lower after breaking $2900, a Key Psychological Level

Video section is only available for

PREMIUM MEMBERS

Gold prices made history yesterday, when for a brief moment the most active April futures contract traded above the key psychological level of $2900 per troy ounce. As we saw in yesterday’s price action, gold at that price was unsustainable in that it attracted some traders and investors to quickly pull profits.

In fact, after April gold broke above $2900, it only took 10 minutes for gold to reach the all-time record high of $2906, and a total of 20 minutes before gold traded back below $2900.

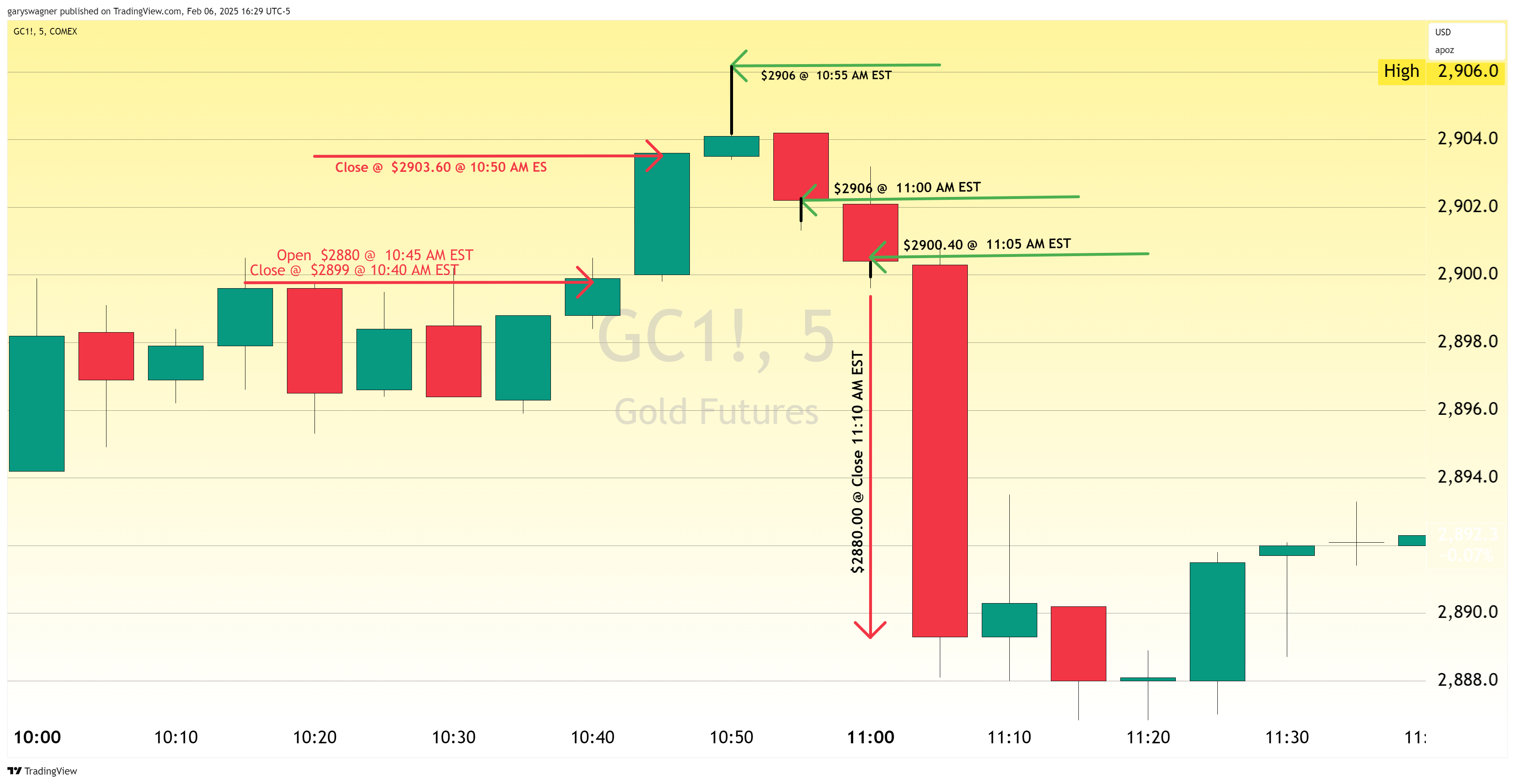

The chart above is a five-minute standard candlestick chart of April gold futures.

At 10:45 AM EST gold opened at $2900 and closed at $2903.60 by the close of the five-minute candlestick. At 10:50 AM EST gold opened at $2903.50 and closed at the all-time record high of $2906 by the close. Over the next 10 minutes gold would trade to a low of $2899.60, and close $2900.40. Gold remained above $2900 for a total of 20 minutes in trading yesterday, because at 11:05 AM EST gold closed at $2889.30, after dropping $11 in five minutes.

The US dollar had some influence on gold yesterday, the dollar index declined 0.34% taking the index to 107.62. This illustrates that dollar weakness aided gold in trading to the new all-time record high. Whereas golds decline from the new record high was the completely net result of traders actively selling and taking profits.

April gold is currently fixed at $2880.80 after factoring in a net decline of -$.4.00, or 0.14%. Gold traded to a low of $2855 and recovered. This indicates that the tariffs imposed on China are still in focus by market participants and investors as investors bought the dip this morning.

That being said, gold has risen over 10.63% since the gold traded to $2620 on December 19. From the low of December 19 to yesterday’s high goldens gained $279 which is the largest rally that occurred last year with one exception. That exception took gold $433 from the middle of February, concluding in the middle of April.

Therefore, it seems likely that investors and traders will look for strategic points in which to take profits. This means that gold could experience a correction and continued to have bullish market sentiment. There is a decent probability that gold will experience a shallow correction.

Wishing you, as always good trading,

Gary S. Wagner - Executive Producer