Silver's Volatile Rally Continues as Metal Posts 150% Gain Despite Wild Year-End Swings

Video section is only available for

PREMIUM MEMBERS

Silver futures staged a dramatic recovery Tuesday, rebounding from the previous session's sharp decline in the latest demonstration of the precious metal's exceptional volatility during what has been a breakout year for the commodity.

Silver futures climbed to $78.03 per ounce on Tuesday, representing a 10% gain at the session's peak before moderating into the close. The metal ultimately settled around $76, marking a $4.40 or 6.16% advance for the day. The pronounced price swings reflect the amplified volatility characteristic of thinly traded holiday sessions, a dynamic that market participants can expect to persist through Wednesday's shortened trading session and Thursday's market closure.

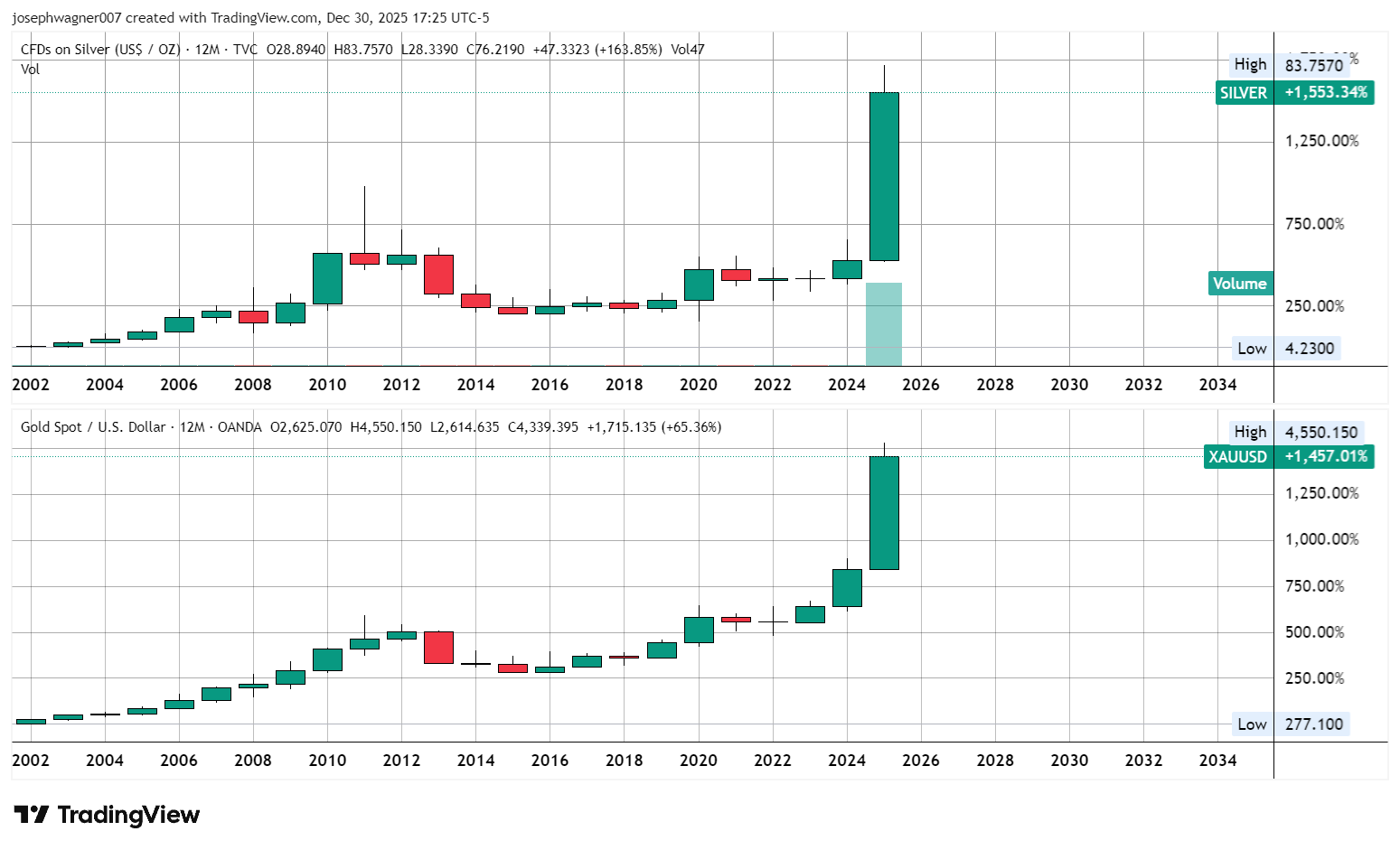

The Tuesday rebound follows an extraordinary year for silver, with prices more than doubling since January—a 150% increase that significantly outpaces gold and other precious metals. According to TradingView data, silver has surged 163.85% in 2025, reaching an intraday high of $83.7570, while gold posted a comparatively modest 65.36% gain over the same period, climbing to approximately $4,550 per ounce. This performance marks one of the most impressive rallies in recent commodity market history, drawing renewed attention to the white metal from both industrial consumers and speculative investors.

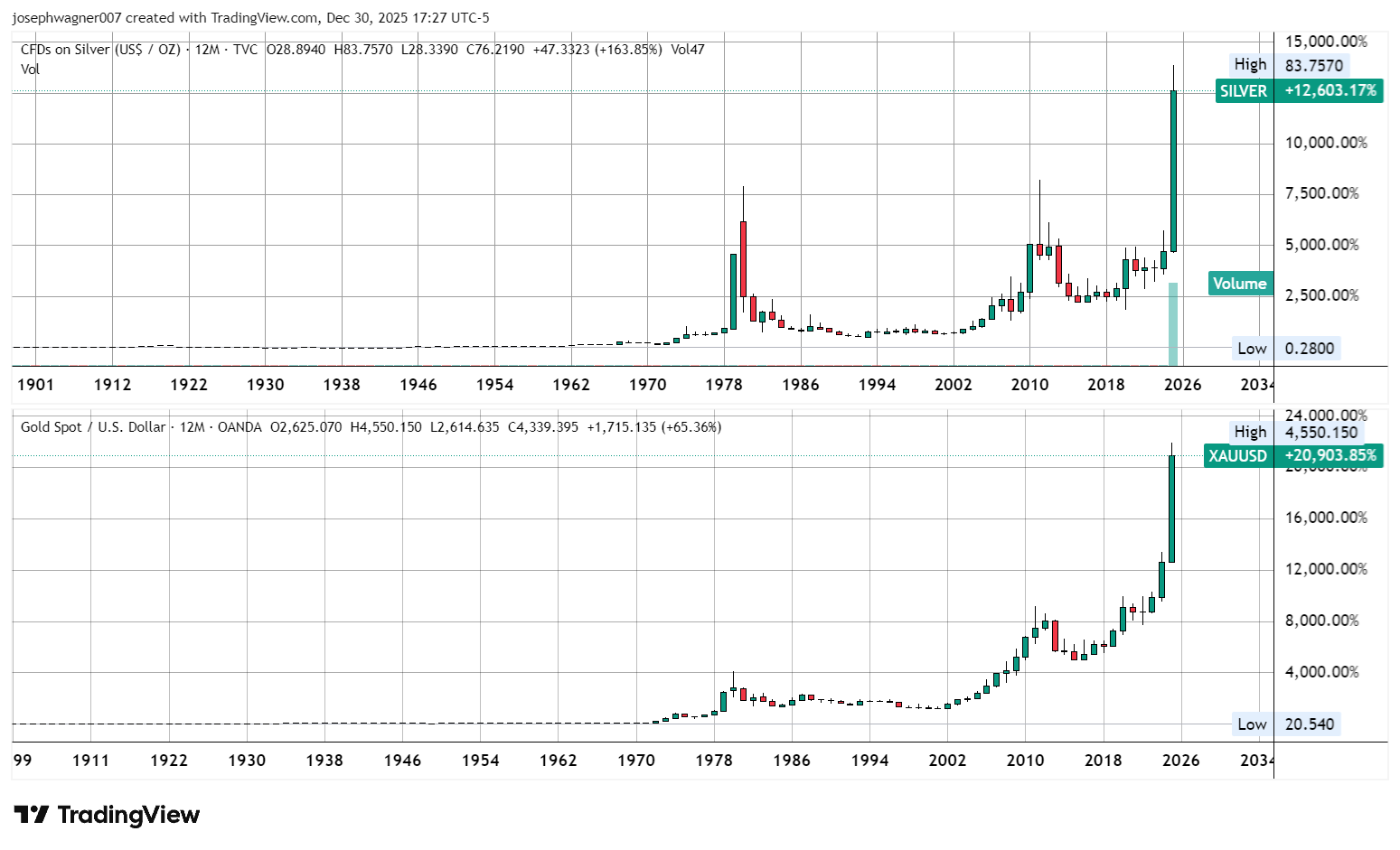

Long-term historical data reveals the magnitude of 2025's precious metals rally in broader context. Silver has appreciated an extraordinary 12,603% from its century-low of $0.28 per ounce, while gold has gained 20,904% from its historical low of $20.54. However, the recent 2025 surge represents something more significant than gradual long-term appreciation—it marks a decisive breakout from a multi-decade consolidation pattern. Both metals spent roughly four decades trading below their inflation-adjusted 1980 peaks, a period of frustration for precious metals investors that appears to have definitively ended with this year's explosive moves.

The magnitude of silver's 2025 breakout becomes even more striking when viewed against this historical backdrop. For much of the period from 1985 through 2020, silver traded in a relatively constrained range, predominantly between $5 and $30 per ounce following its 1980 peak near $50. The explosive move above $80 represents a fundamental repricing of the metal, driven by a confluence of factors including robust industrial demand, particularly from the solar energy sector, alongside traditional safe-haven buying amid broader economic uncertainty. While gold's simultaneous rally to record territory reinforces the broader precious metals strength, silver's outperformance by a factor of nearly 2.5 times this year highlights its unique supply-demand dynamics and higher beta characteristics relative to its monetary metal counterpart.

The magnitude of recent price movements underscores the dual nature of thin holiday trading conditions. While reduced market participation can create opportunities for outsized gains, it simultaneously exposes positions to heightened risk during sudden reversals. Tuesday's session exemplified this dynamic, with the metal's initial 10% surge partially eroding as profit-taking emerged later in the day. Traders navigating these conditions must remain cognizant of how compressed liquidity can amplify both upside momentum and downside corrections, particularly in a market that has already demonstrated extraordinary volatility throughout 2025.

Despite these substantial gains, silver remains well below its inflation-adjusted historical peak. The metal's 1980 record, clearly visible in the long-term chart data, would equate to approximately $200 per ounce when adjusted for current purchasing power. This disparity suggests considerable room for potential appreciation, even if gold's own rally shows signs of exhaustion. The comparison underscores silver's position as potentially undervalued relative to its historical extremes, though such projections remain subject to numerous market variables including industrial demand trends, monetary policy shifts, and evolving investment sentiment. The fact that silver has now surpassed its nominal 1980 high while remaining far below the inflation-adjusted figure presents a compelling case for further upside potential.

The final trading days of 2025 have proven particularly tumultuous for silver futures, with Friday's 10% surge followed by Monday's equivalent decline and Tuesday's volatile recovery. This three-day sequence of extreme movements has tested both bullish and bearish positioning while highlighting the challenges of maintaining exposure during year-end sessions. As holiday trading continues, market participants should anticipate sustained volatility in this already dynamic market environment, with liquidity unlikely to normalize until the new year brings a full complement of market participants back to trading desks. For a market that has delivered triple-digit percentage gains in a single calendar year while breaking out of a four-decade consolidation pattern, heightened volatility appears likely to remain a defining characteristic well into 2026.

Wishing you as always good trading and A Happy New Year!

Gary S. Wagner - Executive Producer