Gold Rally, Another day another Milestone as gold Futures Test $5100

Video section is only available for

PREMIUM MEMBERS

Everyone has probably heard the Phrase, “give an inch, take a mile” usually in reference to a person taking advantage of a situation or deal to extract the highest amount of profit possible, often at the counter party’s expense. As you are reading this you might notice that this is beginning to sound like the setup a good trader is trained to seek out. Usually, the counterparty in a strong uptrend such as the one gold has recently experienced would be the short seller. In terms of the current explosive appreciation in the precious metals, the US dollar (or any Fiat currency) is the one who gave an inch and gold in this case took a whole lot more.

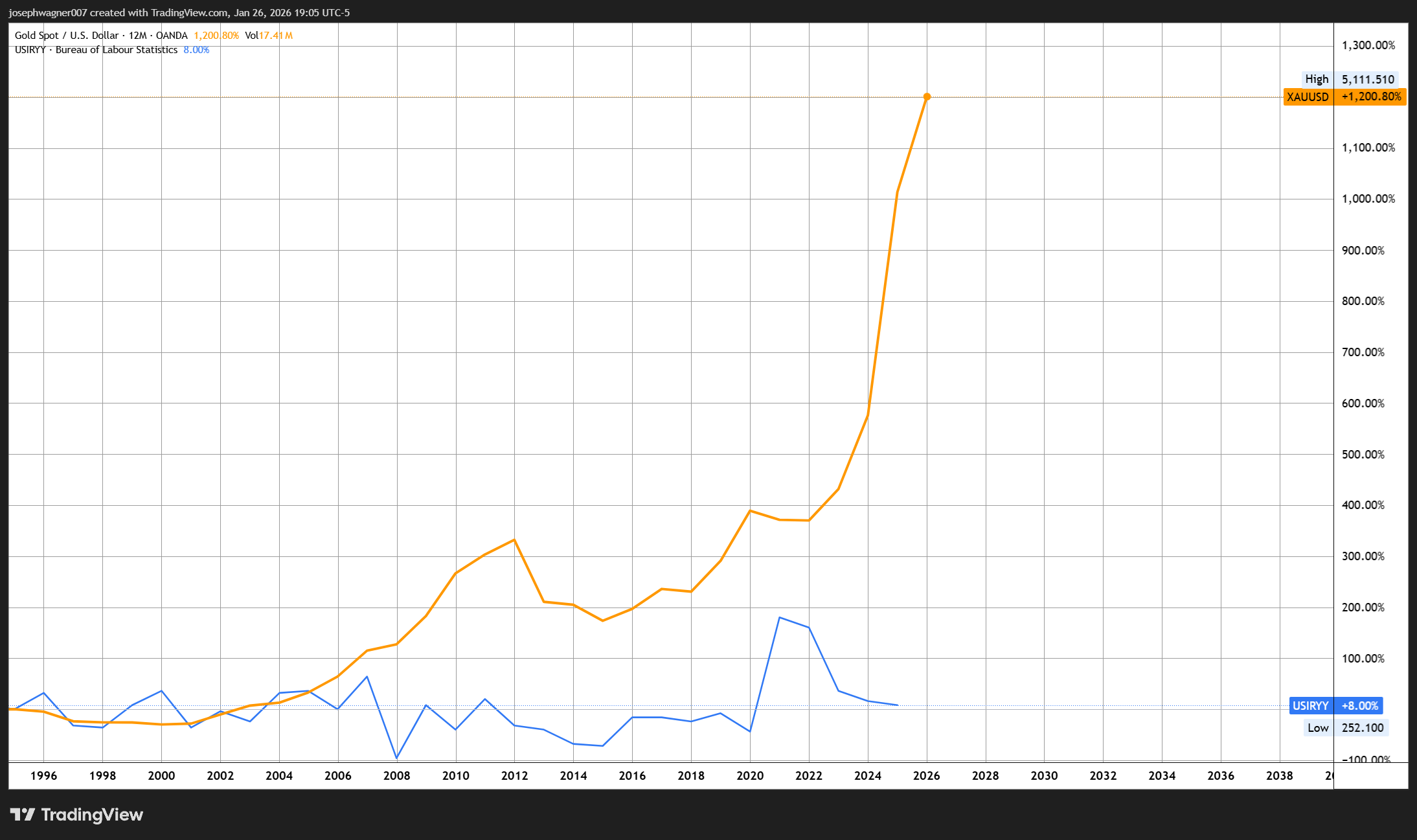

To illustrate this idea, we have put a 12-month candlestick chart of spot gold above a US dollar index chart of the same duration. We can see that during the prior year of 2025 The US dollar gave up over 9%, while gold gained almost 65%. This math tells us that gold gained value, over six times more value than the dollar lost. To make a more accurate viewpoint of how gold, not the dollar is in the wheelhouse steering the future of the global economy and reserve system that it is based off spot gold VS US inflation rate YoY or USIURYY.

The picture is almost identical when looking at the last few months and gets bleaker the farther out in time we go. One thing is for sure the direction of the two corner stones of our modern monetary system are opposite each other. Through a ultra long-term view only one thing can be certain, Fiat currencies are speeding towards a zero absolute value, while gold races to the sky.

That too must be noted with the major caveat that gold’s buying power over time has ultimately remained relatively stable while the dollar has been on a downward spiral at points beating out other forms of fiat currency also on its accelerated path to its intrinsic value, that of a scrap of paper.

Wishing you as always, good trading,

Gary S. Wagner - Executive Producer