Minutes reveal interest rate hikes are coming sooner and at a faster velocity

Video section is only available for

PREMIUM MEMBERS

The Federal Reserve released the November FOMC meeting minutes today. What followed was a decisive shift in market sentiment in multiple financial sectors. All three major indices had strong selloffs immediately following the release of the November minutes. Concurrently the dollar lost value and did both gold and silver.

Major indices sustain a substantial decline in value

The Dow Jones industrial average opened at 36,722.60 and traded to an intraday high of 36,952.65, a new record high before succumbing to selling pressure. By the time the dust settled the Dow had lost 1.07%, or 392.54 points, and is currently fixed at 36,407.11 points.

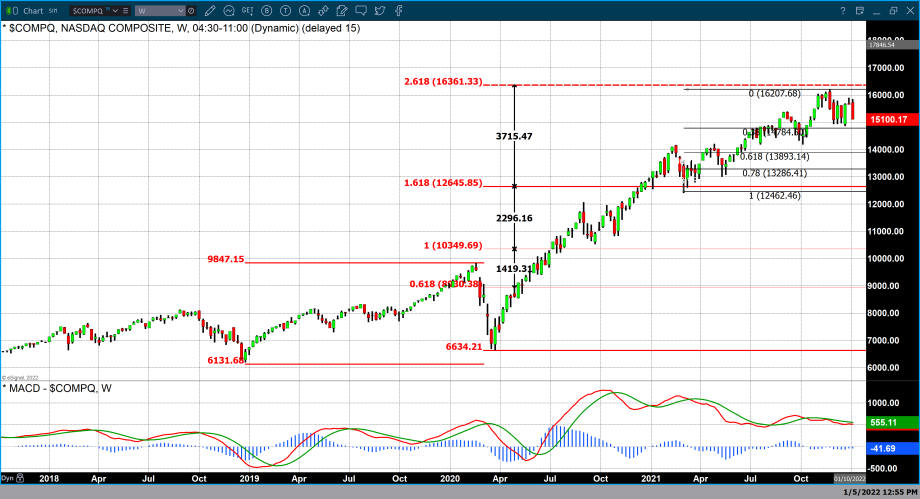

After reaching an all-time intraday high yesterday the Standard & Poor’s plummeted as the bullish market sentiment in U.S. equities quickly waned. The S&P 500 lost 1.94% today and the index is currently fixed at 4700.58. By far the greatest carnage in U.S. equities was found in the NASDAQ composite which lost 3.34% and is currently fixed at 15,100.17 points.

Precious Metals lower prices in gold and silver, and higher palladium and platinum

Gold prices had solid gains as trading began in New York this morning. After opening at $1815.20. the bullish market sentiment took gold as high as $1830 and then reversed to as participants bid the precious yellow metal lower. Any solid gains were short-lived as gold prices plummeted from $1830 to $1808.20. As of 5:42 PM EST gold futures basis, the most active February 2022 contract is down $5.10 and currently fixed at $1809.50. Silver lost 1.09% and like gold initially gained value after opening at $23.095. The precious white metal also sold off strongly immediately following the release of the November minutes. Silver is currently down 0.241 cents and fixed at $22.81.

Both platinum and palladium scored modest gains today with platinum gaining $11.60, and palladium gaining $8.30.

The price decline in multiple financial asset sectors such as stocks, gold, and silver reacted quickly as the statement revealed a more hawkish Federal Reserve. The new addendum showed a major change in their monitory policy.

In essence, said that interest rate hikes would begin quicker than anticipated, they also said that the rate hikes would be at a faster pace than they previously had expected.

In an interview with MarketWatch, Brien Lundin, editor of Gold Newsletter said that “The Fed minutes were hawkish, showing greater concerns that inflation would be persistent and generally indicating an accelerated schedule for rate hikes. Thus, they were bearish for gold, as confirmed by the immediate market reaction in the gold price.”

Recently there’s been strong support for gold pricing based upon real concerns about the surging cases of the Omicron variant of Covid-19. The spike has been so dramatic that yesterday it would be reported that approximately 1 million US individuals tested positive for the virus. However, the financial markets reacted to today’s minutes with much more intensity than their focus upon the potential economic effect due to the surging number of new infections.

On Friday market participants will once again intensely focus upon the Federal Reserve as they conclude their first policy meeting in 2022. In particular, they will attempt to glean subtleties in the change of language as well as information on the timelines giving more specifics to the Federal Reserve’s monetary policy moving forward.

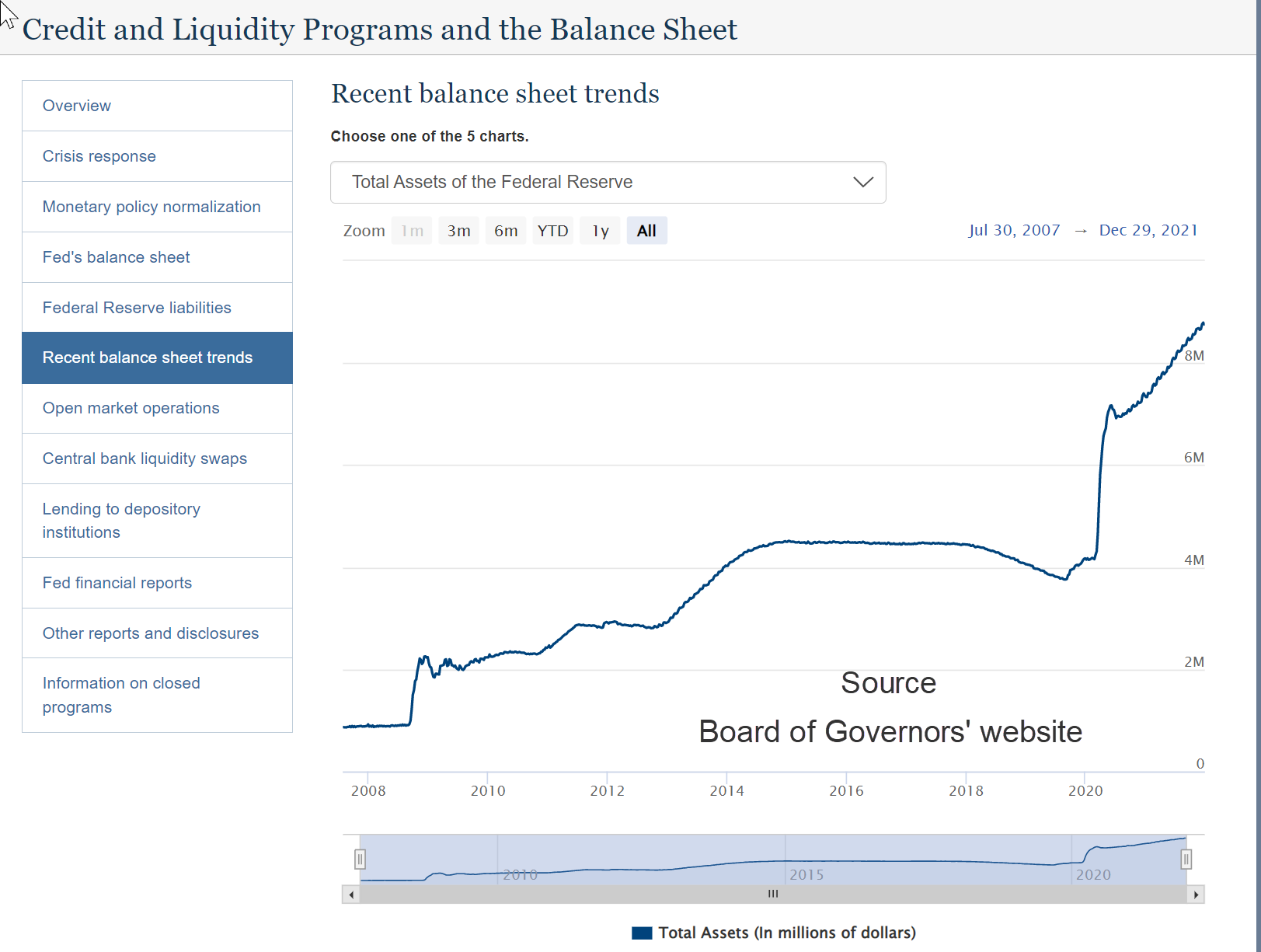

Lastly, the minutes released today address the question that gave insight into the asset balance sheet of the Federal Reserve which is now swelled above $8.5 trillion. This is roughly double the assets in the Federal Reserve balance sheet after the last round of quantitative easing in 2013.

Wishing you as always good trading and good health,

Gary S. Wagner - Executive Producer