A strong 4th quarter GDP is the driving force that took gold sharply lower today

Video section is only available for

PREMIUM MEMBERS

A report released today by the government indicated tremendous growth in GDP Q4, coupled with the change of market sentiment for gold from yesterday’s release of the Fed's updated monetary policy resulted in gold trading sharply lower.

As of 3:43 PM EST gold futures basis the February 2022 Comex contract is trading $36 lower or -1.97% and fixed at $1793.70. The April Comex contract which will soon become the most active contract month lost $36.50 and is currently fixed at $1795.50.

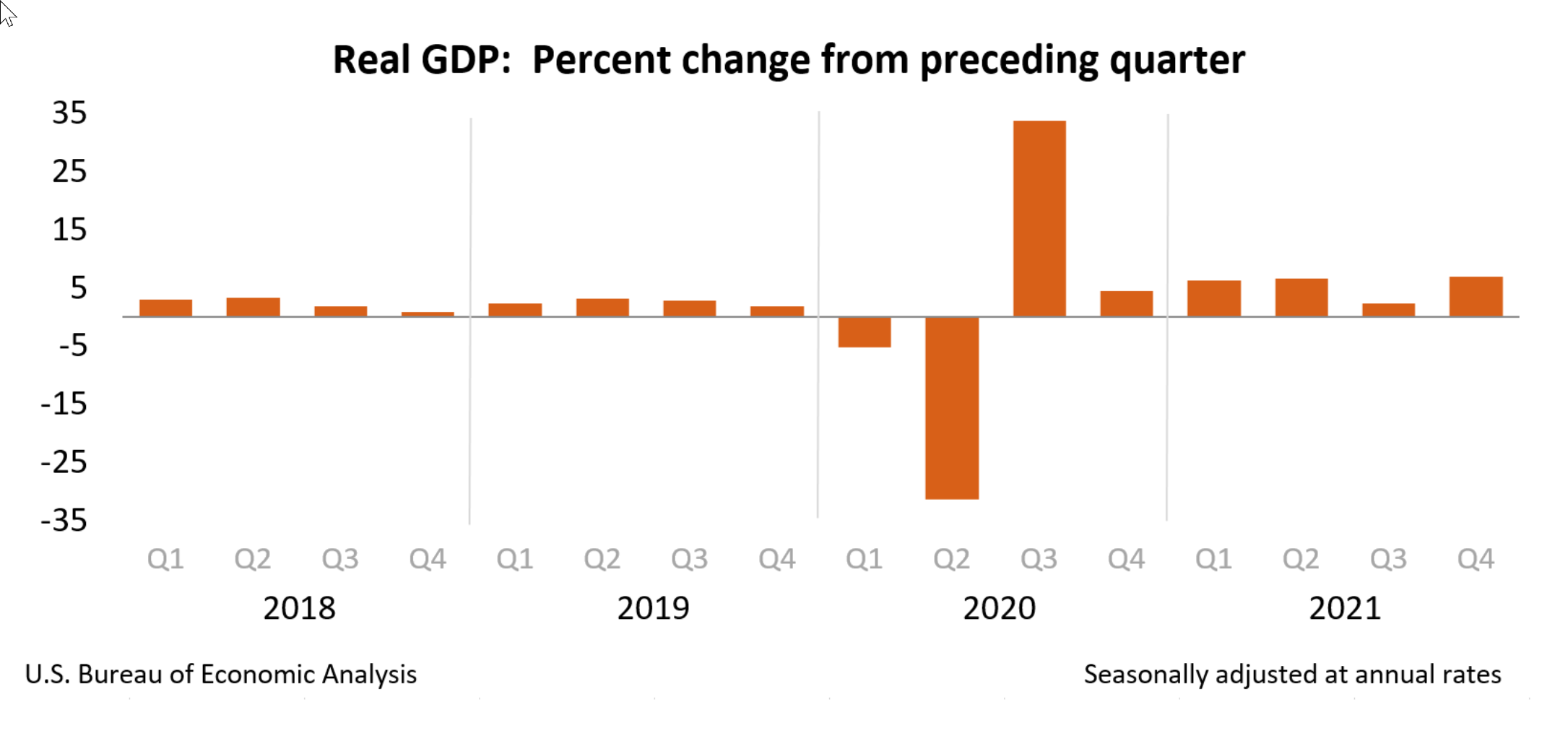

Today the Bureau of Economic Analysis part of the US Department of Commerce released its advance estimate of the Gross Domestic Product for the fourth quarter of 2021. It revealed extremely strong growth during the last quarter of 2021.

According to the BEA, “Real gross domestic product (GDP) increased at an annual rate of 6.9 percent in the fourth quarter of 2021, following an increase of 2.3 percent in the third quarter. The acceleration in the fourth quarter was led by an upturn in exports as well as accelerations in inventory investment and consumer spending. In the fourth quarter, COVID-19 cases resulted in continued restrictions and disruptions in the operations of establishments in some parts of the country. Government assistance payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households all decreased as provisions of several federal programs expired or tapered off.”

This is an advance estimate with the final numbers to be released on February 24, 2022. This is a huge leap from the third quarter GDP which came in at a tepid 2.3%.

The current GDP in terms of dollars increased by 14.3% at an annual rate of $790 billion, taking the fourth-quarter GDP to a level of 23.99 trillion. The GDP in the third quarter increased by 8.4% or 461 billion.

Concurrently the report indicated that personal income had increased $106 billion in the fourth quarter compared with an increase of $127 billion in the third quarter. Collectively in 2021 real GDP increased by 5.7%. Real GDP in 2020 indicated a decrease of 3.4%. An exceedingly strong indication of the strong economic recovery currently at play in the United States.

When added to yesterday’s Federal Reserve monetary policy statement and chairman Powell’s press conference in which the Federal Reserve for the first time since the onset of the recession in early 2020 signaled the date when interest rate normalization or liftoff would begin. Chairman Powell first said “soon, but clarified the statement indicating that the first-rate hike would occur in March. He also said that the process of tapering their monthly asset purchases of 120 billion to zero would be completed in March.

The only caveat is concerning reducing inflation quickly. The Fed’s intention to begin to hike interest rates to reduce inflation in the next year will be difficult and improbable at best. The Consumer Price Index for December 2020 came in at 7%, a level not seen since 1982. He also mentioned that they anticipated that the inflationary numbers vis-à-vis the CPI will most likely increase when January’s numbers are released creating a dire scenario in terms of reducing inflationary pressures.

Simply put, a rate hike of 1% or even 1 ½% this year will most certainly not curtail current inflation rate. The reduction of inflation above 6% is a multiyear process and many analysts including myself believe that it will take a minimum of 2 to 4 years to effectively reduce inflation to the Fed’s preferred target level of 2%.

Wishing you as always good trading and good health,

Gary S. Wagner - Executive Producer