Fed Minutes: did investors get ‘the whole truth and nothing but the truth’

Video section is only available for

PREMIUM MEMBERS

For the first time in a couple of years, Chairman Powell and other members of the Federal Reserve met in person rather than virtually at the FOMC meeting last month. Today the minutes from that meeting were released. It begins with an address to the American people from Chairman Powell;

“Inflation is much too high, and we understand the hardship it is causing, and we’re moving expeditiously to bring it back down. We have both the tools we need and the resolve that it will take to restore price stability on behalf of American families and businesses. The economy and the country have been through a lot over the past two years and have proved resilient. It is essential that we bring inflation down if we are to have a sustained period of strong labor market conditions that benefit all.”

Yes, he acknowledged the obvious, inflation is extremely hot and persistent. But he also said that the Federal Reserve has the necessary “tools” to accomplish that. Really? Many analysts including myself adamantly believe that this statement is incorrect. It lacks an acknowledgment of the limitations to impact and resolve the underlying cause of high inflation the supply chain issues and bottlenecks simply by raising rates.

Inflation will remain high and persistent as long as global supply chain issues continue. Raising rates has no impact on that problem. The supply chain bottlenecks must unravel through a natural process. Add to that now more events recently have elevated the issue.

The war in Ukraine continues to dramatically reduce grain exports from both Ukraine and Russia. There are also large regions of the United States that are experiencing droughts further exacerbating agricultural production for exports. Also, recent upticks in Covid 19 have dramatically decreased products being shipped out of China.

Until these issues resolve themselves over time no road can lead to inflation rates moving to the Federal Reserve’s target of 2% or 3%.

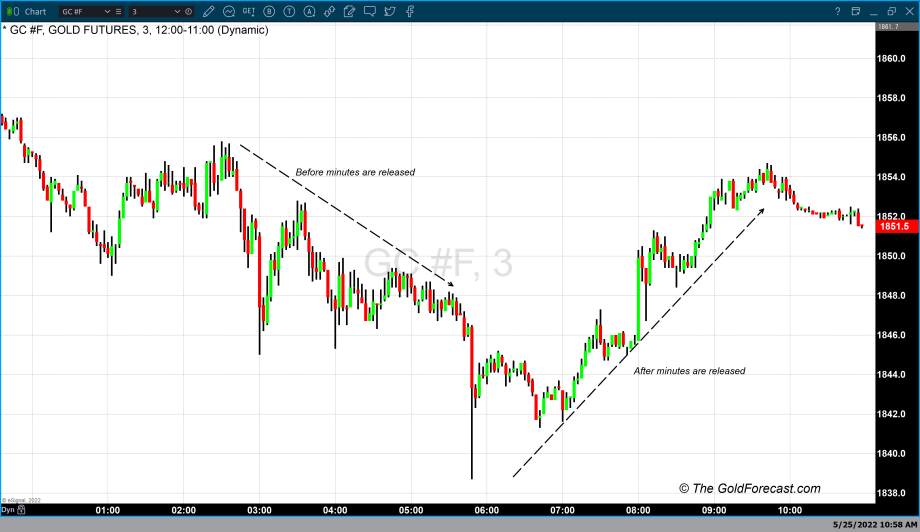

It was the minutes released today that caused gold futures to close lower; As of 4:55 PM, EDT gold futures are currently down $13.10 or 0.70% and fixed at $1852.30. The chart above is a three-minute Japanese candlestick chart of gold futures. This short 3-minute chart magnifies the quickness and dramatic price swings that occurred today.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer