A strong dollar causes gold to drop and fill a gap in the continuous futures chart

Video section is only available for

PREMIUM MEMBERS

A lot has changed in how gold trades on the futures market. Gold futures used to open and close daily leaving a time when you could not place trades at the market, similar to the way stocks trade today.

Gold now trades around-the-clock 24 hours a day, five days a week. Gold futures only close one time a week. It closes on Friday at 6 o’clock in New York and reopens on Monday morning at 9 o’clock in Australia. This means that there can be a price gap or void between Friday’s close and the opening on Monday in Australia. Gaps can also occur when trading closes on a holiday.

Lastly, another way a price gap or void can be created in gold futures is in a continuous futures contract. This can occur when the most active contract month expires, and a new month becomes the most active. Many market technicians believe that typically a gap will be filled, and although this does not always occur it is something that market technicians look for when a gap appears.

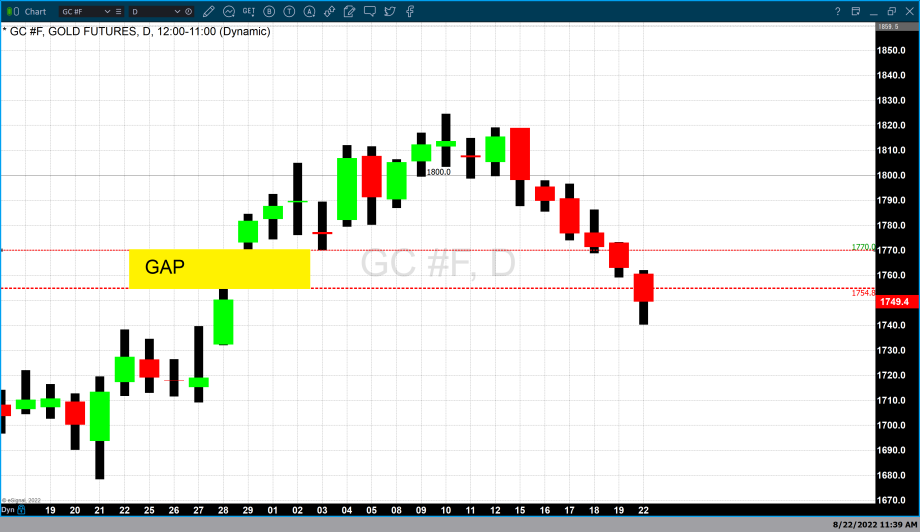

The chart above is a continuous futures contract of gold. On July 29 the most active August 2022 contract expired, and the new most active contract month became December 2022. This created a price gap as gold futures closed at $1750 on July 28 and opened at $1773 the following day.

On Friday, August 19 gold prices opened above the gap created in July and today gold closed below the gap, effectively filling the gap created last month. Market technicians believe that once a gap has formed prices will at some point back-fill the gap before returning to the primary trend direction. In the case of the gap that was created in July now that it has been filled, we may see support come into gold pricing ending this most recent strong price dissent over the last six trading days.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer