Delayed reaction to Friday’s “Jobs Report” moves gold lower

Video section is only available for

PREMIUM MEMBERS

On Friday the U.S. Bureau of Labor Statistics released the jobs report for March. However, because the release occurred as many markets were either closed or shortened due to the Easter holiday weekend beginning with “Good Friday” the financial markets did not react to the numbers until trading resumed Monday morning in Australia.

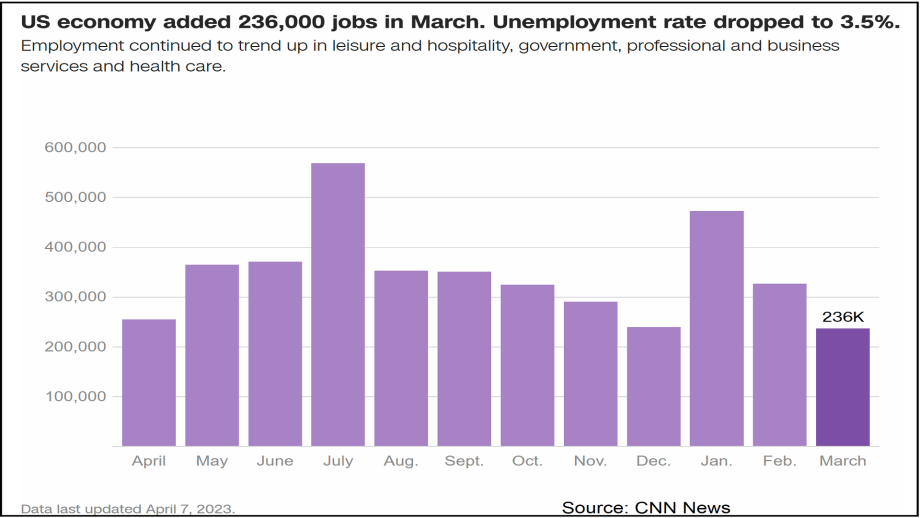

According to the BLS, “Total nonfarm payroll employment rose by 236,000 in March, and the unemployment rate changed little at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in leisure and hospitality, government, professional and business services, and health care.”

Friday’s jobs report indicated that the labor market is contracting. Economists polled before the release of Friday's jobs report estimated that there would be 239,000 jobs added in March, just above the actual numbers. Economists also believed that the unemployment rate would hold steady at 3.6%, the actual numbers revealed that the unemployment rate dropped to 3.5%.

The number of new jobs added has been on a steady decline since January when 517,000 new jobs were added. Year to date the labor market has had a net gain of 4.1 million jobs which is an average of 345,417 jobs added per month. New jobs added in March was the smallest monthly gain since December 2020.

The reduction of new jobs added last month shows that the aggressive rate hikes by the Federal Reserve are contracting the economy and slowly reducing inflationary pressures. According to the CME’s FedWatch tool, there is a 69.7% probability that the Federal Reserve will raise rates by ¼%, and a 30.3% probability that the Fed will pause raising rates at the next FOMC meeting in 22 days.

Gold Futures were closed for trading in observance of Good Friday causing a delayed reaction to the jobs report released last week. Gold opened lower in Australia and traded to a low in New York of $1996.50. As of 5:20 PM EST, the most active June 2023 contract is currently trading at $19.80 or 0.98% lower and fixed at $2006.60. This was partially due to dollar strength which gained 0.50% taking the dollar index to 102.235.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer