Bitcoin futures set to test all time high at $65,000

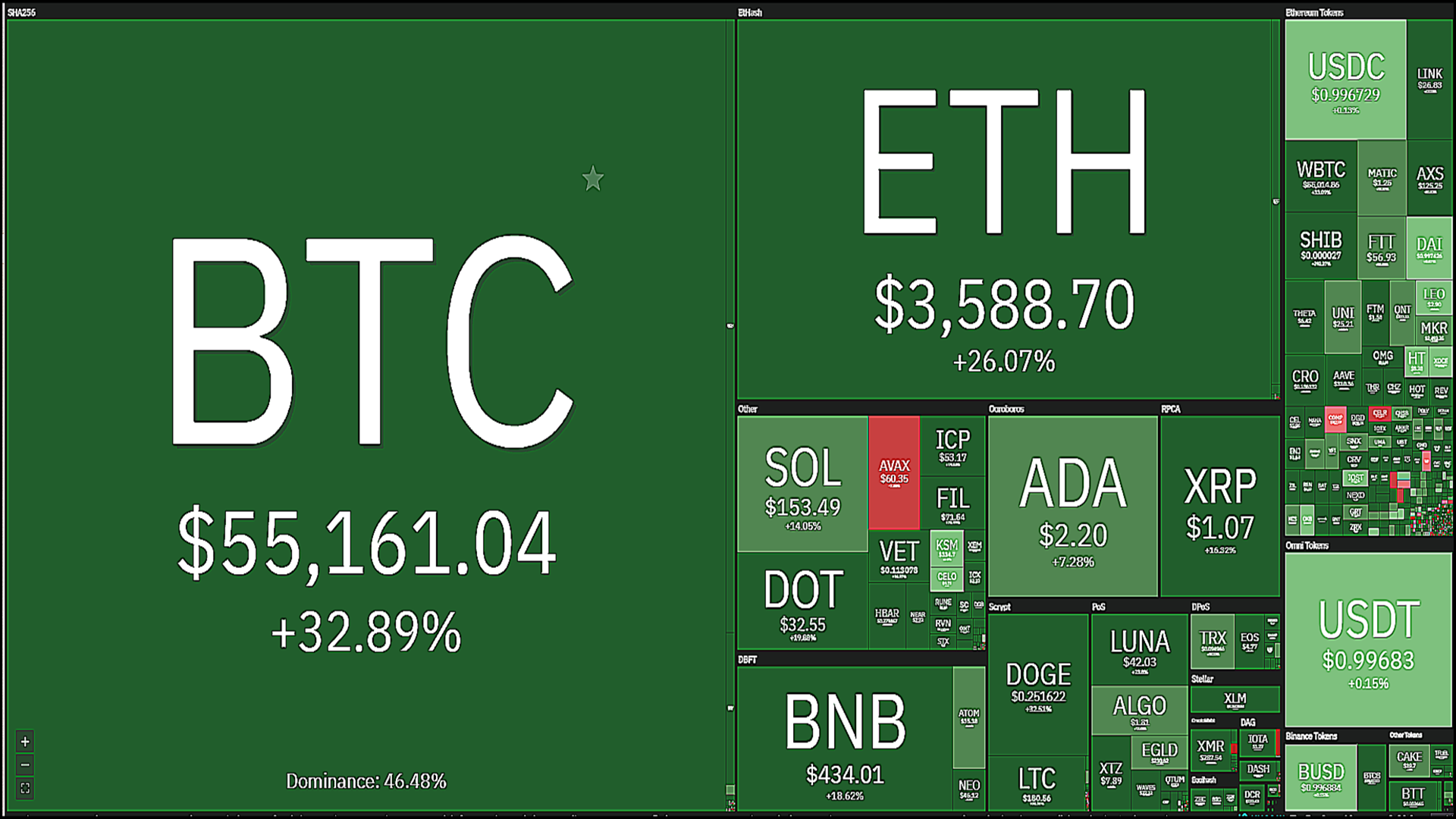

The first four days of October 2021 have been exciting times for Bitcoin bulls, starting this week at approximately $43,000 now five days later BTC is trading $12,000 dollars higher. That equates to a 32.5% increase over the last seven days beating Ethereum’s 25% gain for the same period.

This Bitcoin rally is reminiscent of October 2020 as far as fundamental events and the rush of new buyers as well as current holders (hodlers) adding to their positions.

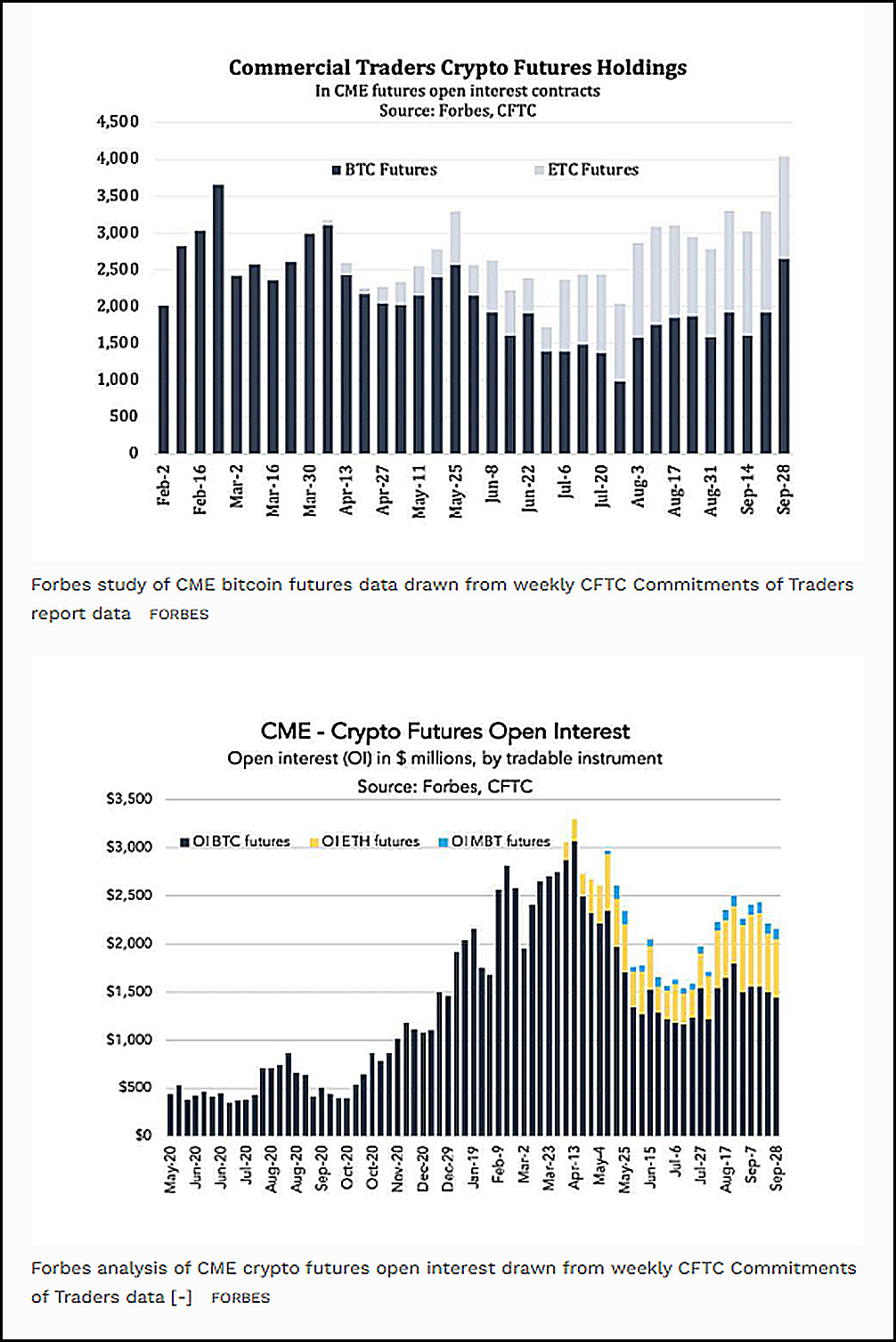

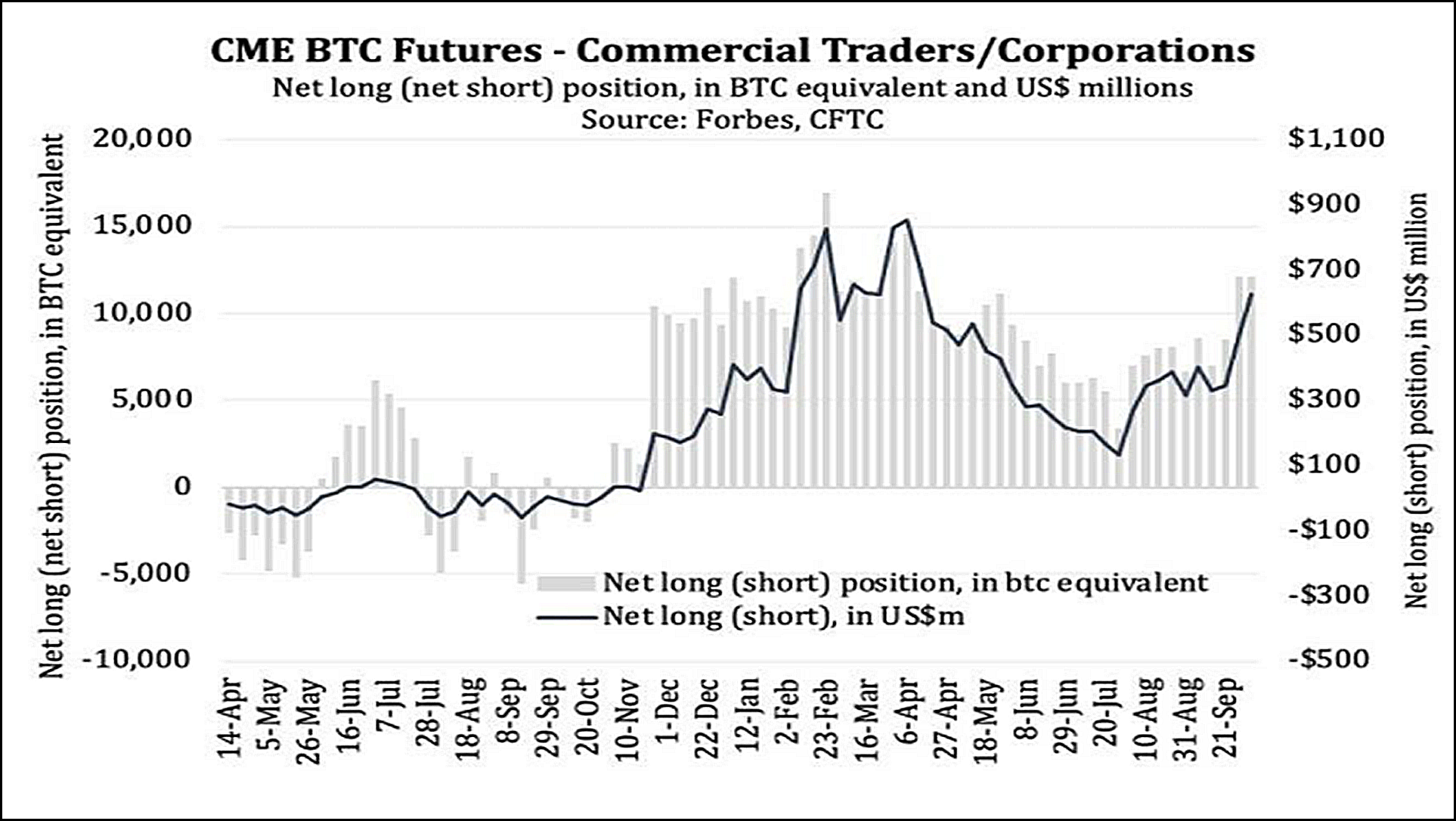

These CFTC charts are telling, don’t be misled by the short hedge fund positions as they often corelate to hedging against long positions in the spot market. Both retail investors as well as corporate entities have stepped up their amount of BTC exposure in recent months.

Flash back to October 2020, when Bitcoin Futures were holding above $10,000 for the longest period ever at the time (two and a half months) and news was just getting out about PayPal’s plan to begin to allow users to hold/exchange and eventually buy Bitcoin and a few other crypto’s atop their payment platform. Exactly one year ago Bitcoin was at a pinnacle moment in its evolution and this October seems to be stacking up for another historic Halloween season with BTC bulls knocking on your door saying “trick or treat.”

Excerpts from an article published in Money Wire on Oct. 12th, 2020:

- Square recently purchased $50 million worth of bitcoin. But that’s just part of a larger investment in cryptocurrencies.

- Other mobile payment companies are also hot on the trail. According to reports, PayPal (NASDAQ:PYPL) and Venmo plan to allow users to buy and sell cryptos directly from both websites.

- Blockchain is on its way to affecting everything.

From a technical perspective, we have already broken above two key resistance levels this week. The first occurred on Monday when BTC futures traded above the recently important level of $44,000. This key area had been both an area of support and resistance since pricing fell from $60,000 five months ago in May. When BTC traded above this level it also corresponded with many other technical indicators taken out as well on Monday. At the start of the week BTC took out numerous possible obstacles by moving above the 38% Fibonacci retracement level (encompassing the entire move over the past 12 months), as well as the 200, 50 and 21-day Moving averages.

Today BTC took out just as significant of a level when it traded above $52,260. This price point served as support for BTC after breaking above it for the second time on March 9th. This served as the jumping point from which BTC would reach $60,000 on three occasions and $65,000 on one occasion (ATH).

This October is setting up to be another month BTC traders will always remember. Interestingly the crypto fear and greed index is at the same levels it was at the end of October 2020. I firmly believe we will see $60,000 by next week, By the end of the month we could easily see a new all-time high for the world’s first and largest digital currency.