Is Greyscale (GBTC) a good investment vehicle for Bitcoin exposure?

With many traders flocking to the world's larger than life cryptocurrency many investors of small scale have turned to the Greyscale Bitcoin Trust, to fulfill their demands. Greyscale otherwise known as GBTC its ticker symbol has become a popular tool for both small-scale and institutional level entry into the growing Bitcoin market.

With no official ETF (electronically traded fund) for Bitcoin, the closest thing for eager traders to get into is the Greyscale Bitcoin Trust. As written on Cyrptocurrencyfacts.com “A trust (an investment trust) is a company that owns a fixed amount of a given asset (like gold or bitcoin). Investors pool money and buy shares of the trust, owning contracts that represent ownership of the asset held by the trust. In a gold trust, 1 share might be worth 1/10th an ounce of gold. With the Bitcoin trust, 1 share is worth about 1/1000th a Bitcoin (it was about 1/10th). The trust is managed by a company who charges a fee, in the case of GBTC that company is Grayscale.”

My readers are likely well versed and accustomed to the SPDR Gold Trust (GLD), essentially each share of GLD is equivalent to owning a tenth of an ounce of gold. With one notable exception being the fees associated with GBTC which include a 2% annual fee. Simply put every year the trust will sell some of its holding in Bitcoin to pay this fee making each share worth slightly less Bitcoin year after year. For example, in February 2018 each share was worth 0.00100721 Bitcoin, approximately 1,000 shares equaled 1 Bitcoin, at the time of this article’s publication (Dec. 9th, 2020) each share now represents 0.00095137 of a Bitcoin. Also, there is a premium associated with GBTC compared to Bitcoin’s spot price on most exchanges. This premium fluctuates with time concerning overall market sentiment and demand. As such in times when Bitcoin is rallying and market sentiment is extremely bullish the difference in price per Bitcoin and the cost of GBTC shares equaling one Bitcoin is very high.

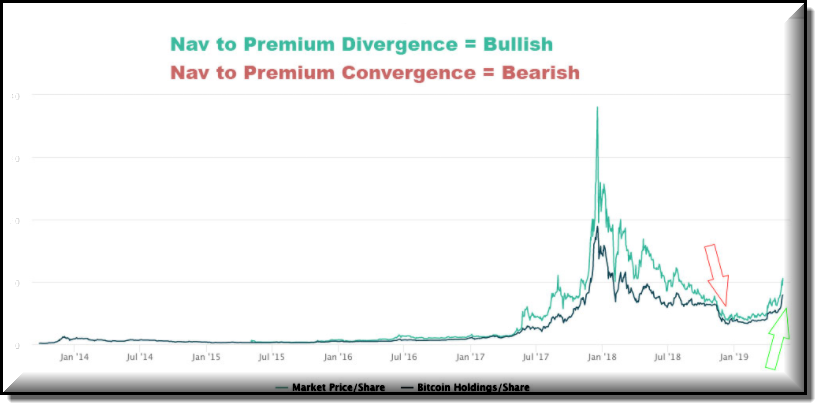

The premium between buying a single Bitcoin on one of the many exchanges versus the price of purchasing enough Greyscale shares equaling one coin can sometimes hint at the overall market sentiment. NAV is another thing traders take into consideration when determining if they should invest in a trust or mutual fund, of December 9th the mark up on GBTC is 30% above its net asset value. Some analysts have called for GBTC value in relation to its NAV to reverse and believe that there will soon come a time when GBTC actually trades at a discount which since 2017 has never been the case although it does fluctuate between 15% - 40%. While I do not believe a discount is likely to come soon compared to the trusts NAV with BTC enveloped in a pullback the premium compared top flat out owning BTC is likely to erode. This erosion of premium is likely to continue and eventually dwindle to less than 10% when some of the many large institutions are awaiting approval for their own Bitcoin ETF.

Greyscale does take responsibility for custodial responsibilities which for many less technically savvy investors is a huge selling point. On top of that GBTC does contain the ability to avoid paying high taxes by being part of a pension fund or personal 401K. This is also relevant to any investor outside the U.S. as there are ways to avoid being taxed altogether by purchasing their shares with Bitcoin.

In conclusion, GBTC may be the easiest way to obtain Bitcoin exposure safely and does offer some advantages as far as taxation and storage are concerned. However, with many new Bitcoin stocks and ETFs available to people outside the U.S. and many more soon to come in 2021 to U.S. citizens, some traders serious about riding the Bitcoin wave into the future that is unable to afford the larger CME five-coin contracts (BTC) may want to hold off until the premium dwindles a little more which I see likely in the coming months or wait until a better option is offered altogether.