Bearish candlestick pattern confirmed in Bitcoin

Yesterday after declining from just under resistance at the long-term 78% retracement ($17,779) losing around $450, Bitcoin completed one of the most accurate of candlestick patterns, the “three river evening star”.

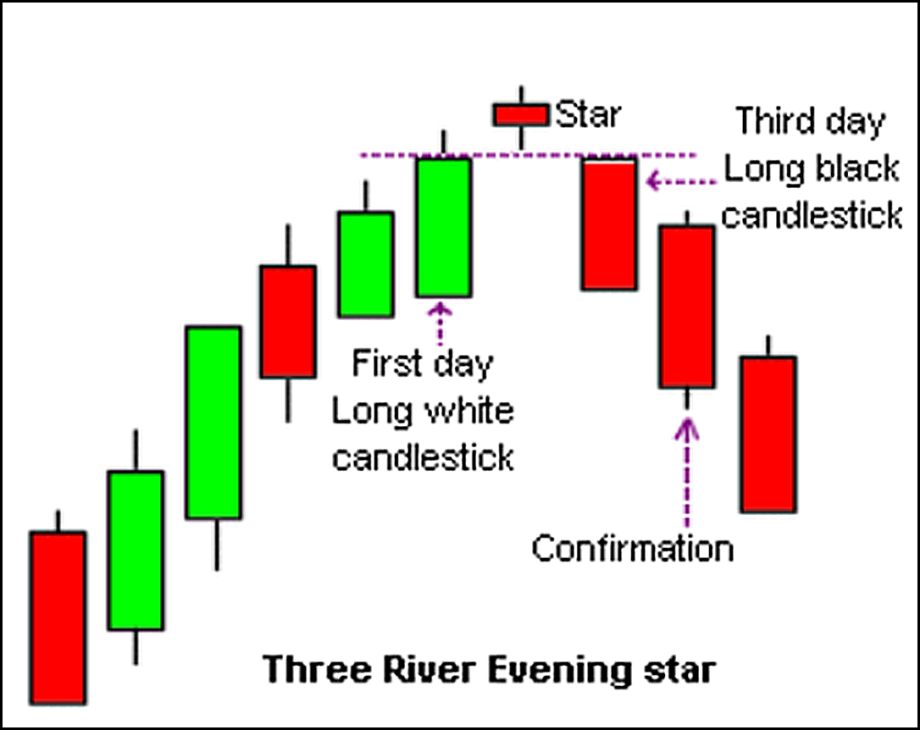

This three-day candlestick pattern consists of an up day (green candle), a star (small bodied candle) above or wicking above other two candles, and a final down day (red candle).

After the three days the market should be near the same price where the pattern began at and can be acted upon once we get a final red candle with a lower low and a lower high. Proper action would generally consist of shorting the market from here with protective stops above today’s opening price.

Another thing to look at in a three rive evening star is the RSI or relative strength index. We want to see a peak in the RSI that coincides with the peak in pricing or during the star candle. An RSI peaking above 70 is what we would want to see in this pattern, we are not quite there in BTC but we did have a spike on the star candle just below 60.