Bitcoin Hits New Low for April

On the heels of a 3% decline in the Nasdaq Composite, Bitcoin hit a new low for the month, reaching levels not seen since mid-March. As of 3:10 PM ET, Bitcoin is trading down by approximately $2,000 or around 4.8% at $38,500, according to Coinbase.

The equities markets were riddled with fears ahead of earnings for tech giants Microsoft and Alphabet. Concerns surround more than just the Hawkish Fed and the war in Ukraine. For the tech juggernauts, it is the resurgence of Covid in China that has the real potential for supply chain shortages to re-emerge from A country that is integral for producing many of their products.

According to Reuters, “The S&P index recorded no new 52-week highs and 34 new lows, while the Nasdaq recorded 18 new highs and 464 new lows.”

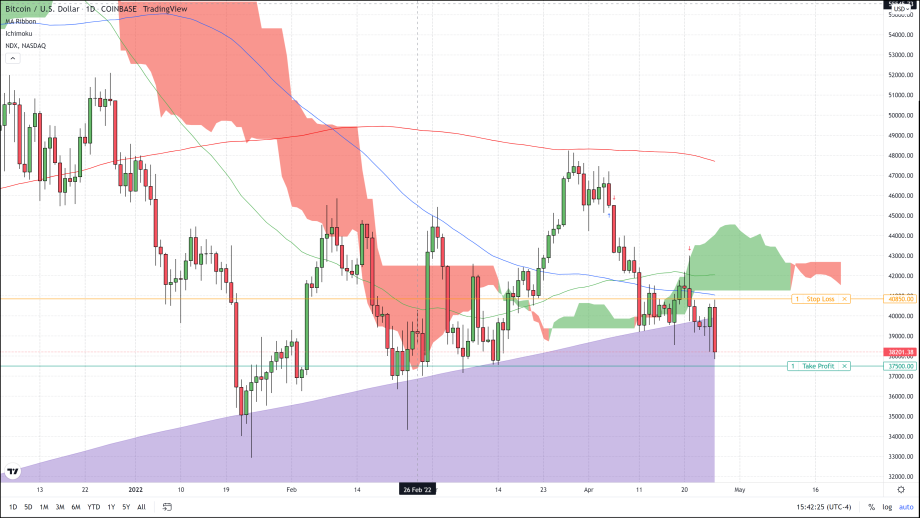

Bitcoin reacted expectedly and broke back below the 600-day moving average, which had been a level of support for the world’s first cryptocurrency several times going back to January. The break below this key support level along with the grim outlook for U.S. equities re-affirms our expectations for lower pricing in Bitcoin, and our short trade is still active.

We came extremely close to getting stopped out of the short trade we recommended on Thursday, April 21st. Our protective stop at $40,850 was narrowly avoided. If hit, traders would have been stopped out with only a $50 loss per Bitcoin after lowering protective stops last Friday to closely match our entry price. Our target for exiting the trade remains at $37,500.