Bitcoin on solid footing but the real news is below the surface

This week Bitcoin broke out of the descending triangle that had defined its price action since the end of May. The top of the upper resistance trendline of this formation was tested on three separate occasions on the first week of June, in mid-August, and in mid-September. In each of these attempts at testing the upper resistance, the bearish faction showed its teeth. On all three occasions, Bitcoin swiftly fell to the bottom of the triangle at around $18,000, the first rejection back in the second quarter of 2022 resulted in Bitcoin descending to its lowest price in 2 ½ years.

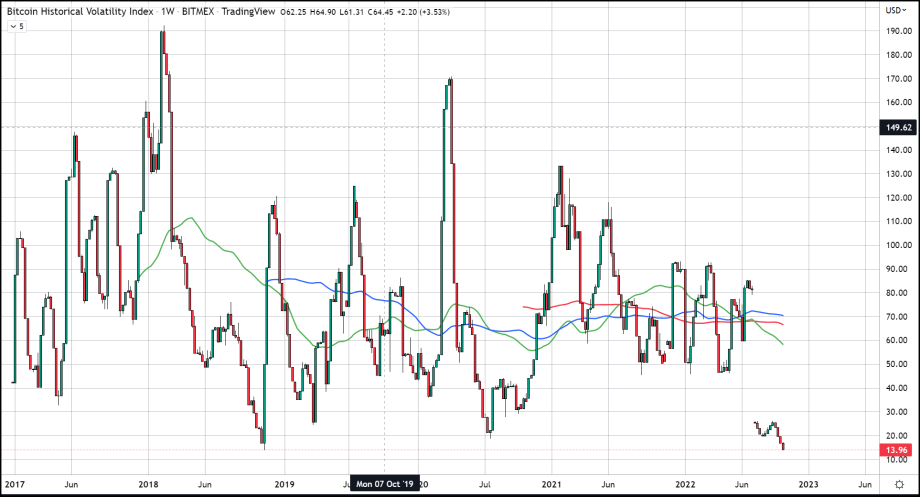

But although this bullish breakout was welcomed by BTC bulls it by no means suggests that Bitcoin is off to the races. The truth is volatility in the market has hit a record low according to the historical volatility index (Bitmex) and the descending triangle existed within a much larger descending triangle which starts at the all-time highs reached in November of 2021, this proceeds the ascending triangle which began in March 2020.

Historically speaking Bitcoin has followed the same cycle we are near the end of four times already but the cycle doesn’t complete after the parabolic rise and subsequent fall in price, rather BTC tends to have a long consolidation period after a parabolic move. It is that consolatory period that we are still deeply entrenched in, the volatility index supports this. That is why I along with other analysts believe that the next bull run in Bitcoin will not occur for some time, my timeline puts it around Spring 2023.

So, while I was very pleased with Bitcoin’s ability to break above and hold $20,000, I do not believe we are seeing the start of the next bull run in BTC. That being said, the fact that BTC has made these recent gains amidst dreary macroeconomic conditions is the real underlying aspect that makes this move so much more than just the increase in dollar value.

What makes me even more bullish for the future is the role Bitcoin took on this week that took it to higher pricing. I am referring to Bitcoins safe-haven appeal that showed itself this week during the election turmoil in Britain where many investors choose to exit their long Sterling positions fearing the volatility of England’s national currency and chose to enter into Bitcoin as a haven play. This week the trading volume in GBP/BTC reached its all-time high as the pound reached its all-time low falling to near parity with the USD or 1.03 in GBP/USD.

These traders could have gone into gold, but they didn’t. Traders have been actively selling gold throughout this entire week. Even though gold did witness slight gains the gains in price were entirely due to dollar weakness. It seems that the safe-haven claim given to Bitcoin for close to a decade had finally come to fruition. For that reason, I feel the price gains are not the most important thing that the bulls should focus on rather it is the transformation happening beneath the surface.