BTC rises lockstep with the Nasdaq and broader markets

On Wednesday, November 30th the Chairman of the Federal Reserve Jerome Powell delivered a well-received message that sent markets flying during a session of prepared remarks and questions at the Brookings Institution. This will be his last scheduled appearance before the central bank's next meeting in two weeks. His remarks outlined Fed was anticipating "slowing down" from the fast pace of three-quarter percentage point rate rises that had prevailed since June.

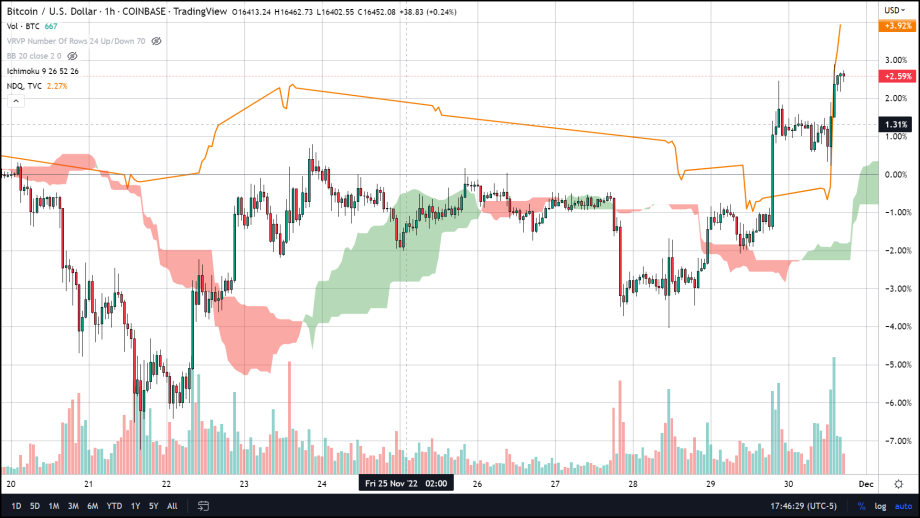

This sent Bitcoin along with the broader crypto and financial markets flying as traders finally got near definitive confirmation that the drastic monetary tightening would continue, but at a slower pace than what we have been accustomed to over the past 8 months. BTC is posting gains of 4.34% or $711 as of 6:16 PM EST. The Nasdaq mirrored gains seen in Bitcoin closing the day up nearly 5% (4.82%) or 554.90 points at 12060. The precious metals also did quite well today with both gold and silver futures adding to their weekly gains of 1.79% for gold futures and 5.25% for silver futures so far with 2 more trading days remaining this week.

Even with today's near 5% climb in Bitcoin that was accompanied by a nice spike in trading volume Bitcoin is facing an upward battle with several areas of potential resistance areas if it continues on its price ascent from the recent lows at around $16,000.

Now trading overseas Bitcoin remains in a bullish posture near the top of its current trading range of $16,000 - $17,500. The top of the range represents the first challenge BTC bulls must overcome. Above that at $17,798 is the long-term 78% retracement that formed the triple bottom that was broken through November 9th. Even further north is the 50-day SMA at roughly $18,340, all of these levels seem to fall within the Ichimoku cloud formation which is red due to pricing being below the cloud.

All these technical studies suggest that Bitcoin is not out of the woods yet. However, they do seem to suggest that there’s a decent chance Bitcoin could be bottoming as we speak, and a very high chance that whenever Bitcoin does take out the band of resistance overhead price will have smooth flying towards the standard cruising altitude of $20,000.