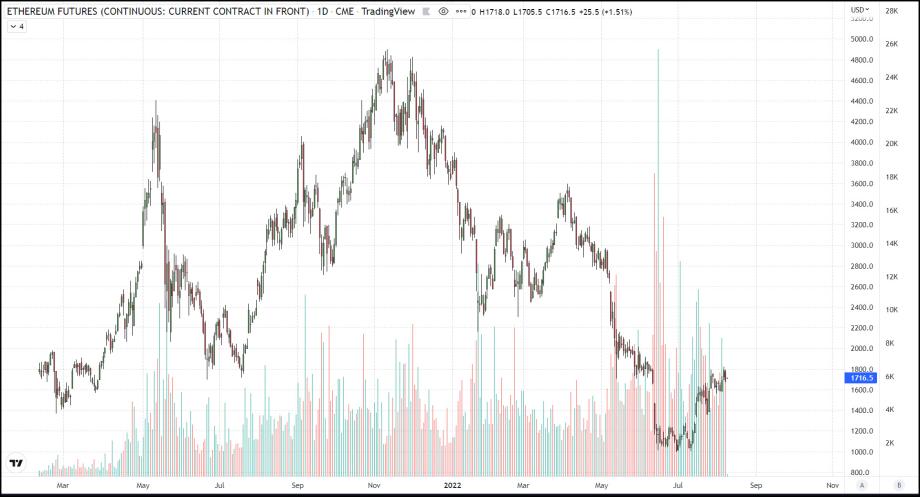

Ethereum futures volume at an all-time high

Both Bitcoin and Ethereum or down on the day ahead of tomorrow’s release of the U.S. consumer price index for July. Bitcoin had effectively a false breakout yesterday from a compression triangle that dates back to mid-June. Bitcoin today re-entered this wedge pattern after posting a loss of $600 or 2.57% (3.8% in futures) as of 5:25 ET and will likely re-test support at $22,400 before moving higher once again towards $24,800 where the first level of resistance is plotted. Bitcoin remains just a hair above the 200-week SMA currently at $22,400.

Ethereum is experiencing a bout of backwardation, a time in which the futures price is below that of the spot price. Usually, this is a bearish indication as it symbolizes that traders are expecting prices to be lower in the future. However, that is likely not the case in this instance as sentiment around Ethereum is solidly bullish surrounding the upcoming merge to PoS. This lower futures price can be explained by investors more interested in holding Ethereum itself rather than an ETH futures contract because once the merge does commence it will work in such a way that for every Ethereum token one has pre-merge, call it Eth PoW (for Ethereum on its proof-of-work blockchain) an Eth PoS token will be airdropped into their wallet and essentially a person will now have both an Eth PoW and an Eth PoS token in their possession. Although the old Eth PoW token will likely be worthless after the merge some speculate otherwise. It will work in the same way the Bitcoin cash and Ethereum classic hard forks did.

Despite the increased appeal of holding actual Ethereum vs. an Ethereum futures contract trading volume on ETH futures over the last 90-days is at an all-time high. Although ETH futures open interest has been on a downward slope since peaking out on June 15th at over 25,000 contracts traded on that day. Currently, the volume of ETH futures remains elevated at over 6,000 contracts traded per day.