Home on the range

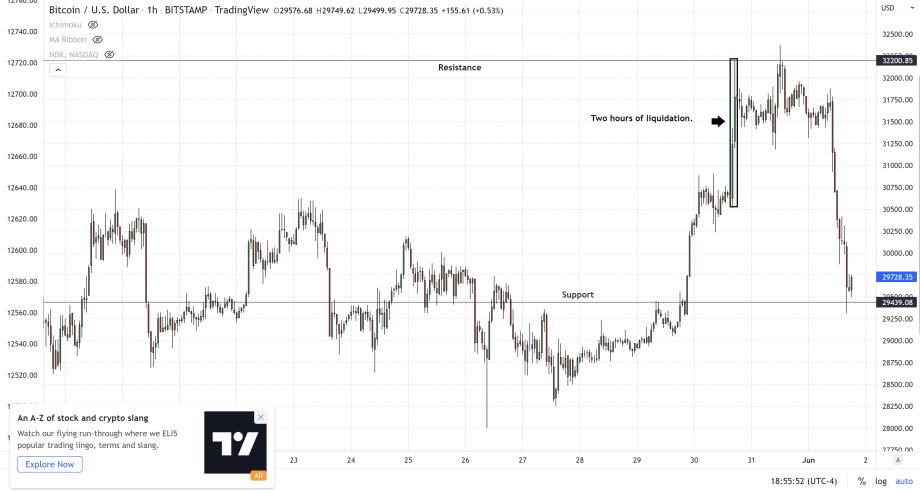

Bitcoin re-affirms range

According to on-chain data from CoinGlass, $71.13 million shorts were liquidated over one hour as Bitcoin broke through $31,000 during early Asian hours on Tuesday. Traders that take my recommendations were among those as it did stop us out of our current position. However, we made a nice profit of nearly $7,000 per Bitcoin ($6,900) by trailing our stops several times since entering from the short side from $36,000 on May 5th.

The reasoning behind trailing stops so tight instead of attempting to buy (exiting the trade) near the bottom of the trading range (roughly $28,000 - $31,000) was based on BTC’s ability to avoid the fact that Bitcoin was able to essentially remain above $28,75 only marking two daily candles with closes no more than $100 lower.

$28,750 represents the 61.8% Fibonacci retracement from the Covid crash of March 2020 ($3,800) up to the ATH reached in November of 2021 ($69,000). We have highlighted the importance of this support level several times as it also acted as a bottom now for the third time.

An effective hold of the 61.8% retracement either as support or resistance is one of the most consistent tools a technical trader has at their disposal as. Even with all the current fear in the crypto markets, Bitcoin’s ability to remain above this crucial support level is a welcoming beacon of hope for BTC bulls to rally behind.

This level represents a huge amount of stored kinetic energy, like a compressed spring that could shoot off in either direction once uncoiled. For this reason, we choose not to try and bottom pick our exit. So that we could be in the market to profit from such a move if we saw a break below this floor in pricing.

The most likely explanation for Tuesday’s bounce was Bitcoin simply playing catch up to the Nasdaq composite and the S&P 500, which had sizable moves to the upside late last week. We have not come close to a pivot in U.S. equities in the shorter to mid-term time frames. Expect Bitcoin to continue sideways between $28,000 - $32,000; above that, strong resistance is at $37,500.