Bitcoin ends a period of low volatility putting $21,000 on the horizon

Yesterday, after spending 8 weeks with extremely low levels of volatility, Bitcoin broke from its dormancy with a sharp break to the downside.

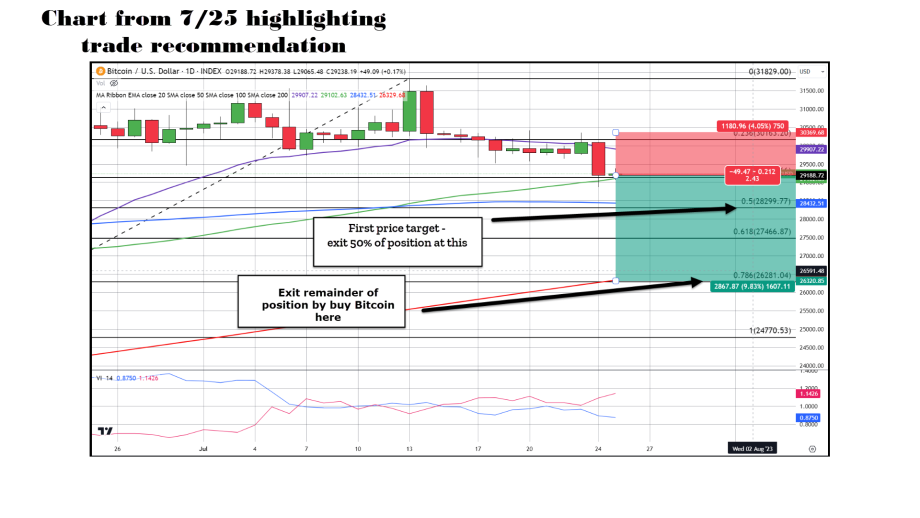

The direction of the break was widely anticipated by market analysts, including any traders who follow along with our trade recommendations. Followers taking our advice entered a short position on July 25th at $29,150. With our target of $26,800 reached yesterday traders should now effectively be flat after bagging a 10% profit on their initial investment.

Bitcoin had an inside trading day after hitting technical support yesterday at $25,500 represented by numerous tops and bottoms reached over the last 14 months, most notably the flash crash that occurred on May 12th, 2022. Yesterday’s low occurred within $100 of the low on May 12th, 2022 which was a signal that hinted at the lower prices ahead. Yesterday’s harsh selling pressure is telling us the same thing, that lower prices are highly probable in the short term. The next area of technical support occurs around $21,500 and I do not foresee a pivot to the upside diverting us from that target.

Historical harmonics surrounding halving events

The recent price action matches that of 2019, which was a year prior to the 2020 halving just like today with BTC’s next halving event set for next year, putting 2019 and 2023 in the same part of their respective 4-year cycles.

In both cases, the bottom was hit after reaching all-time highs one year previously.

In the case of 2018 the lows reached occurred at an 85% retracement of the run-up preceding it, in the current cycle the lows came in at an 82% retracement. In the previous cycle, Bitcoin had bounced off the lows of $3,000 to rally 300% in 200 days only to fall back down to $3,800 two months before the 2020 halving and the accompanying parabolic rise above $60k.

In the current cycle Bitcoin has so far made its cycle lows (likely) and hit a top roughly 200 days after the bottom was reached rallying over 100% to $32k. If it continues to follow the four-year cycle to a tee, we can expect to see a further decline possibly nearing the recent bottom at $15,500 before starting the next parabolic run up to new highs following the 2024 halving event.