Buy the rumor sell the fact, false ETF approval causes Bitcoin to surge

Crypto traders have been feverishly waiting for approval of any Bitcoin spot ETF up for review by the SEC. There are several high profile/net worth investment houses that have submitted their applications in hopes of becoming the first to offer retail investors a convenient way to include Bitcoin in their portfolios, with the largest most influential of these firms being BlackRock with $10 trillion in assets under management.

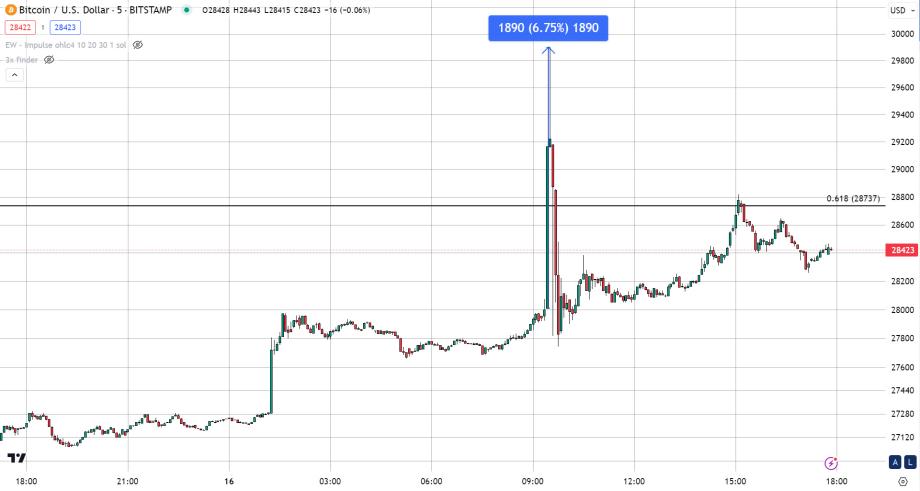

Early in trading today (around 9:25 AM EST) Cointelegraph posted a comment claiming that BlackRock’s request for a spot Bitcoin ETF had been accepted by the SEC. This sent Bitcoin flying higher by $1,890 (6.75%) in a span of ten minutes. The sudden surge liquidated eager investors buying the rumor. According to data from Glassnode, the aftermath of the surge traders observed an increase in liquidations. The tweet was taken down 30 minutes later after being disproven by a Fox news reporter who spoke directly with a BlackRock executive.

This caused an immediate and swift knee-jerk reaction as the market sold off just a quickly as it rose causing prices to dip even lower than what they had been at upon the New York markets opening, within 15 minutes there was price range of nearly $2,000 because of the false news, $113.75 million in long positions and $78.87 million in short positions were liquidated within 4 hours.

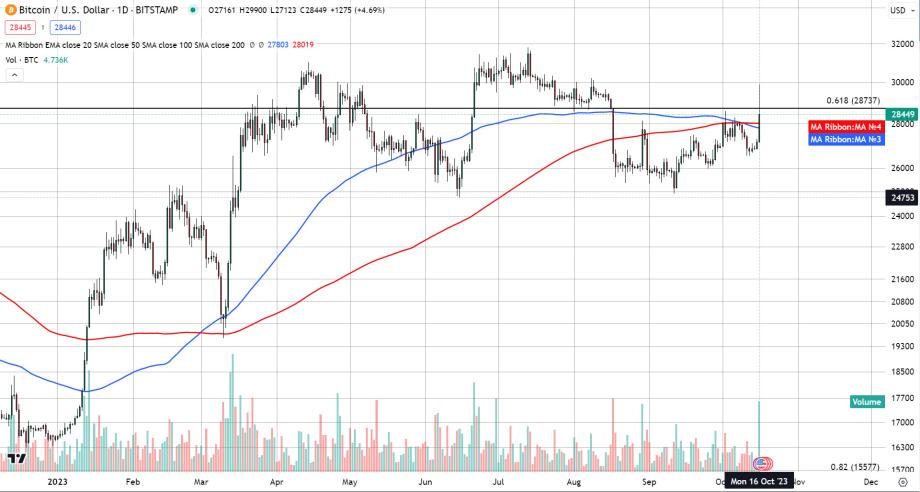

However, a more controlled ascent resumed following the dramatic whipsaw in price and as of 6:20 PM EST, is trading up by 4.67% or $1,270 on the day. Today’s uptick moved the price over both the 100 and 200-day simple moving averages which had acted as resistance for nearly 2 months and had formed a bearish cross just last week.

The absolute level of key resistance, however, remains intact, the level is at $28,737 and marks the long-term 61.8% Fibonacci retracement from the 2020 low to the 2021 all-time high. This level has served as support and resistance in several of the most important price moves over the past several years such as the triple bottoms formed between the two all-time highs in 2021 and opened the floodgates towards $15,000 Bitcoin’s local bottom formed 1-year after hitting the ATH in November 2022. Although pricing has once again found unsurmountable resistance at this level the fact that it was taken out on the ETF rumor is solid evidence that it will undoubtedly not remain as the ceiling in price once an ETF approval is formally announced.

XBTO Global CEO Philippe Bekhazi had this to say, “When this approval happens, it will open up new possibilities for a number of sovereign, pension funds, IRAs and 401k as well as other institutions who, before this point, may not have had access to digital asset investment opportunities…From there, it's likely we’ll see a number of other applications get approved in 2024, which will be a positive step forward for the institutional adoption of crypto.”