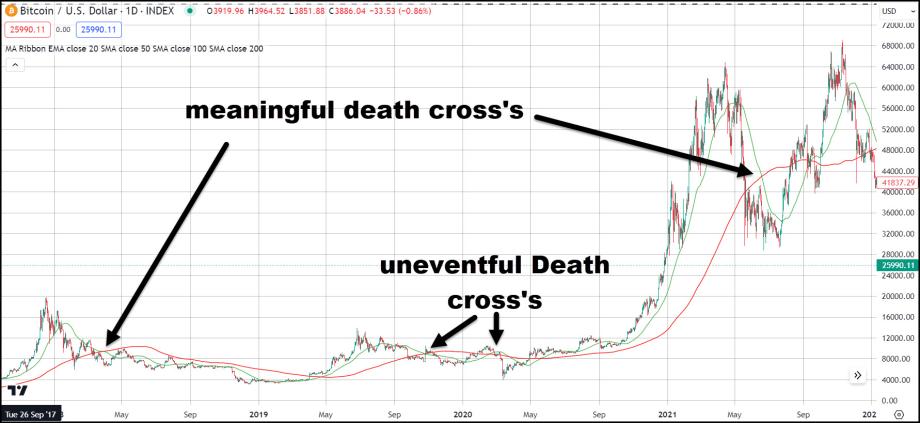

Death Cross in Bitcoin, Prelude to Further Decline?

Today we had a crossing of two major moving averages in Bitcoin with the shorter-term 50-day crossing below the longer-term 200-day simple moving average. This type of cross between a longer and shorter-term moving average is known as a bearish cross or a death cross.

Bitcoin has historically played into the idea and definition of this bearish technical indicator. The last time BTC had this sort of crossing of moving averages took place mid-January 2022, at the time Bitcoin was trading at roughly $42,000 and after would continue its bearish fall for the following year ultimately making a low of around $15,500. A little more than a year after making a bearish cross the moving averages would cross again in February 2023, with the price at right around $22,000.

Out of the last five occurrences of a death cross Bitcoin has traded dramatically lower on three of them. Usually when the cross occurs after hitting an apex, most notably in Jan. 2022 and March 2018. Since this occurrence of a death cross comes in during a time of sideways trading it may be a false signal like the two instances in Oct. 2019 and Feb. 2020.