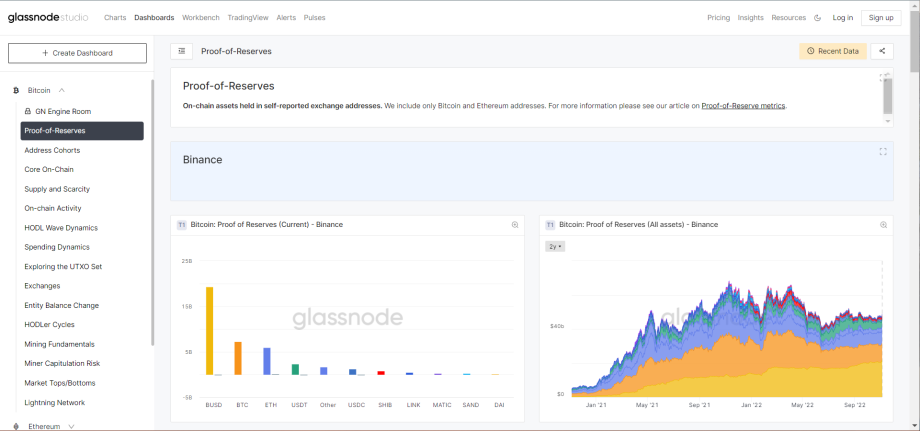

Glassnode offering new “Proof-of-Reserves” feature to all users

Starting today Glassnode, one of the top sources for chainmetrics added an awesome new metric that in light of the recent FTX fiasco will become instrumental in order for crypto exchanges to regain any sort of public confidence.

“In a bid for enhanced transparency, and in an attempt to counter practices of fractional reserves, many exchanges have started a process of self-reporting their crypto reserves. The industry commonly refers to this practice as “Proof-of-Reserves”, which involves the verifiable disclosure of both reserves held (on-chain), and matched liabilities (both on, and off-chain).”

-Glassnode Studios

Simply by clicking on the Proof-of-Reserves dashboard available at Glassnode.com anybody can see a real time composition of 9 of the biggest exchanges visible holdings. For now, the wallets shown consist of an exchanges balance that has been confirmed on their Bitcoin and Ethereum wallets, (Other layer 1 holdings not shown such as Solana) as well as what they hold in stablecoins including their own native stablecoins.

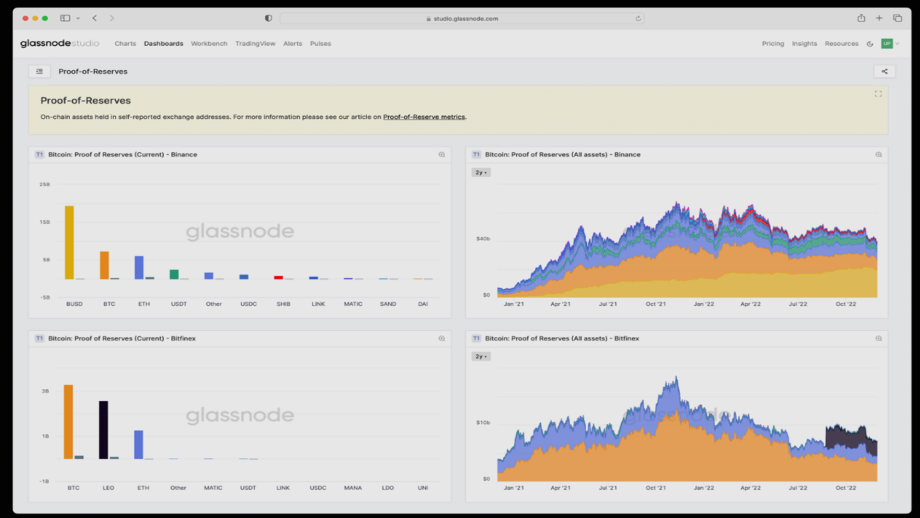

One interesting insight this can give us is the ability for anyone to see what coins make up their reserves. What is noteworthy by comparing exchanges reserves over time is that for all exchanges except Bitfinix and Bitmex (the 2nd and 3rd largest exchanges listed) all hold the greatest percent of reserves in stable coins, either USDT (Tether) or USDC. The largest exchange shown Binance holds nearly $20 billion in its own stable coin BUSD, and has steadily built up its holdings of BUSD over the past year.

Since ERC-20 coins are shown as well we can see certain altcoins that exchanges might have a vested interest in. For instance, Bitfinix holds over $2.5 trillion in Leo tokens and Crypto.com holds almost as much Shiba Inu $500 million (Shib) as it does Ethereum (ETH) $655 million.

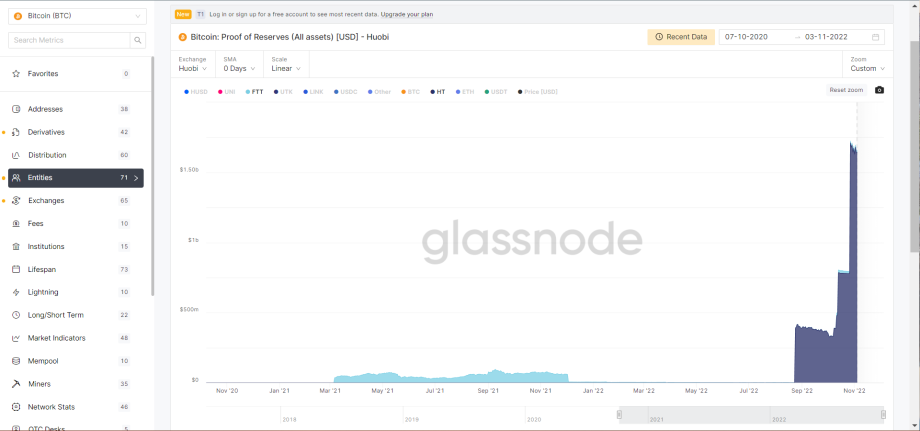

One worrisome revelation comes out of Huobi where they seem to have purchased a lot of their own native token HT. The decentralized exchange has more than doubled its holdings of HT at the end of October now holding over $1.7 billion in its own native token.

This is troubling because an overabundance of FTT (FTX’s native token) led to FTX’s downfall.