Greyscale wins appeal against the SEC sending Bitcoin higher

If there was any doubt that a spot Bitcoin ETF would move the market higher, that was surely removed today. After being denied approval to convert their Bitcoin trust into a physically backed spot Bitcoin ETF, Greyscale had a victory in overturning that ruling. The U.S. District of Columbia Court of Appeals has ruled in favor of Grayscale, overturning the SEC’s lawsuit, and putting the company one step closer to achieving Bitcoin Spot exchange-traded fund status.

While this does not mean that Greyscale’s spot ETF will automatically be greenlighted the means under which they won the appeal gives all the spot ETFs still waiting to be determined upon a much higher likelihood that they will be granted approval. The reason that the SEC has been citing for their numerous denials of an exchange-traded fund that was directly tied to the spot markets has been their concern of “market manipulation.” However, U.S. Court of Appeals Circuit Judge Neomi Rao found the rejection “arbitrary and capricious,”

“The Securities and Exchange Commission recently approved trading two bitcoin futures funds on national exchanges but denied approval of Grayscale’s bitcoin fund. Petitioning for review of the Commission’s denial order, Grayscale maintains its proposed bitcoin exchange-traded product is materially similar to the bitcoin futures exchange-traded products and should have been approved to trade on NYSE Arca.”

After approving Greyscale’s Bitcoin Trust based on the futures price of Bitcoin, the Judge did not see why a spot-based ETF would be any different. This puts the SEC’s go-to claim for denial “market manipulation” as no longer holding water. This gives the several high-profile spot-based ETFs still waiting to be decided upon much better odds of approval after Greyscale’s victory today over the SEC.

Market rallies on the heels of the ruling

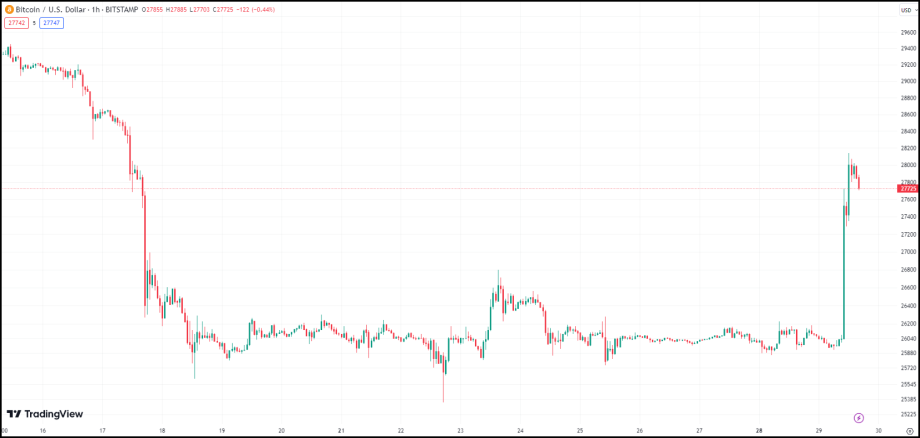

For any traders who still harbored any uncertainty as to how a physically backed ETF would affect the market that was all wiped away after today. For the 11 days preceding Greyscale’s victory, Bitcoin traded in a defined narrow range between $25,800 - $26,800. As you can see on the 1-hour candlestick chart below, the hour after the ruling took BTC sharply higher making a big leap in erasing the losses from the flash crash on August 17th.

This puts the current price of Bitcoin at $27,860 up 6.7% (as of 4:14 PM EST) on the day firmly above the 200-day and 200-week simple moving averages.

Better indicator for price bottoms?

In the past, the 200-week SMA has served as a reliable indicator for price bottoms. Recently, Bitcoin has moved below and above this indicator a total of four times since June 2022. For that reason, I went searching and found a more reliable indicator of Bitcoin’s price bottoms in the SMMA or the simple smoothed moving average of 200 weeks. This indicator currently lies at roughly $19,000.