Two cryptocurrencies that were dramatically affected by the launch of EDX

EDX Markets is a new centralized exchange that was launched on June 20th and is backed by some of the biggest names in Wallstreet. Citadel Securities, Fidelity Investments, Charles Schwab, Paradigm, Sequoia Capital, and Virtu Financial make up the founding investors with other huge names joining in as additional strategic investors. There is no doubt that EDX Markets will be huge, but it promises to bring much more than that to the table. EDX is making the claim that it will bring a “traditional finance” touch to the crypto sector and be the go-to platform for institutions as well as retail investors that have been waiting for a secure, efficient, and regulated cryptocurrency exchange.

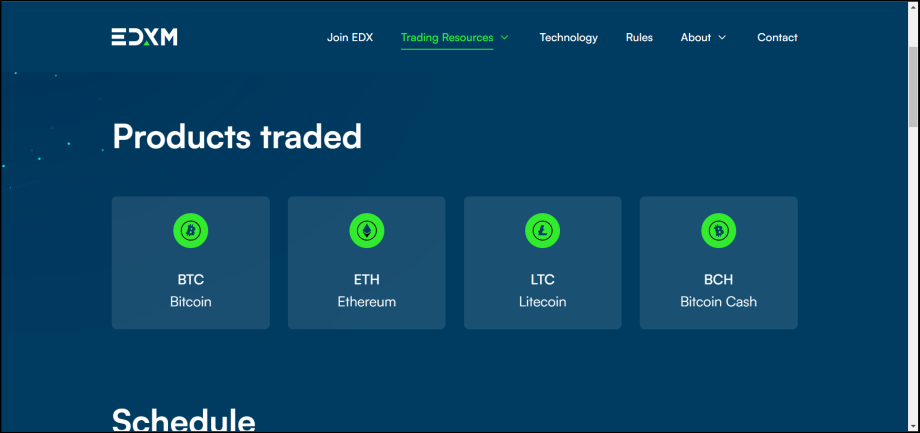

So, what coins will this exclusive exchange list? The red carpet will only be rolled out for Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). So, what is so special about these four coins?

Well first off Bitcoin was created in 2009, 2 years later in 2011 Litecoin went live, and 2 years after that Ethereum was released these three names are all legends in the space and represent some of the most successful coins of all time, and then there is Bitcoin Cash.

BCH is a coin created from a hard fork of Bitcoin back in 2017 when the Bitcoin community was split on whether to increase the block size in order to support higher transaction volume, BCH settled on blocks of 32MB compared to BTC’s 1MB at the time. It is not the first nor the last hard fork of the Bitcoin blockchain but it is the most successful.

However, in terms of market cap BCH commands only 0.3797% of the total crypto market capitalization. So why was it chosen over Cardano or Solana which have approximately 2 to 3 times the market cap of BCH? The reason is the recent labeling of those and other top cryptocurrencies as securities. Both have since appealed their security classification however, it is clear by EDX’s listings that the SEC allegations are enough to scare away big institutions and exchanges that want to participate in the digital assets sector and stay away from coins like Solana for now. On the flip side, Bitcoin Cash is experiencing a new surge of optimism as it becomes an honorary red-carpet crypto.

Solana is trading lower by roughly 16% over the last 30 days, while Bitcoin Cash has surged 110% one week after the launch of EDX Markets. Both coins do have something in common. Out of the top 20 cryptocurrencies by market capitalization, they hold the records for the deepest decline from their all-time highs. Even after all the recent gains Bitcoin Cash is still trading 95% lower than its all-time high while Solana comes in second currently off by 94% from peak prices.

Technical data

From a technical perspective Bitcoin Cash is approaching a key level at $259 if it can overcome this price point than it has a shot at reaching $390. If it reverses and starts to move back down there is not any technical support until $100.

Solana’s technical resistance recently is all about the 20-day exponential moving average (purple line). On the date of the SEC lawsuit (June 5th) naming Solana as a security it broke below the 20-day EMA and for the last 7 consecutive days that technical indicator has been the point of insurmountable resistance. Support for SOL is at roughly $14.20, should SOL somehow break above the 20-day EMA the next level of resistance is at $19.

So, the recent launch of EDX has made Bitcoin Cash an A-list coin once again and at the same time reiterated the prejudice against top coins like Solana until they clear their name.