Bitcoin Remains Unfazed by Recent Developments

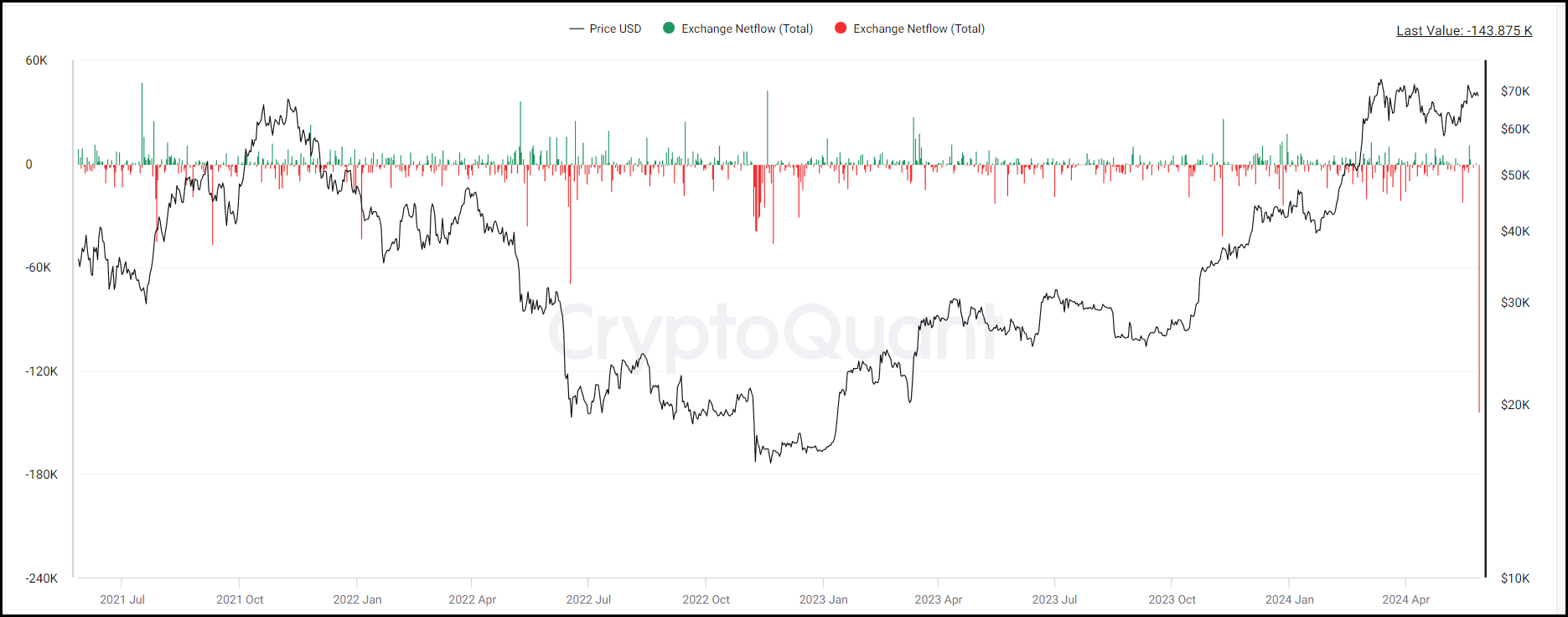

Bitcoin's resilience was on display as its price witnessed only a tepid decline of around 1.3% or approximately $900 as of 6:15 PM EST. Surprisingly, Bitcoin remained relatively steady despite experiencing the largest single-day decline in spot exchange balance in recent history. On May 27th, spot exchanges experienced a staggering net outflow totaling 143,000 BTC. Contrary to typical expectations, such a drastic decline in spot balance is often viewed as a bullish indicator for BTC, signaling that Bitcoin is being taken off exchanges and placed in cold wallets for long-term holding.

The sudden exodus from exchanges can be tied to the anticipated repayment from Mt. Gox to parties that had lost their holdings during the largest Bitcoin heist in history. A series of hacks between 2011 and 2014 bankrupted the once-leading Bitcoin exchange, resulting in losses totaling 850,000 BTC, of which 740,000 belonged to customers and 100,000 to the exchange itself. Alarmingly, the stolen BTC equated to 7% of Bitcoin's total supply at the time.

In November 2021, a plan to reimburse creditors was approved, outlining that the repayments to those affected would be finalized by October 2023. However, in September of last year, this deadline was pushed back to October 2024. With the new deadline less than six months away, a trustee of Mt. Gox, holding over 140,000 BTC, has recently moved those Bitcoin set to be distributed to a cold wallet, presumably the first step in a decades-long process for partial recovery of the stolen coins.

Traders have been closely watching the coins tied to this case because such a large amount of BTC being returned to those who had their Bitcoin stolen from exchanges opens the possibility of a substantial portion being sold on the open market, which could negatively impact the asset's price. While the exact ratio of Bitcoins that will be sold versus held remains unknown, it is logical to assume that a significant amount would be immediately liquidated, considering the average price of Bitcoin at the time of their loss was around $100.

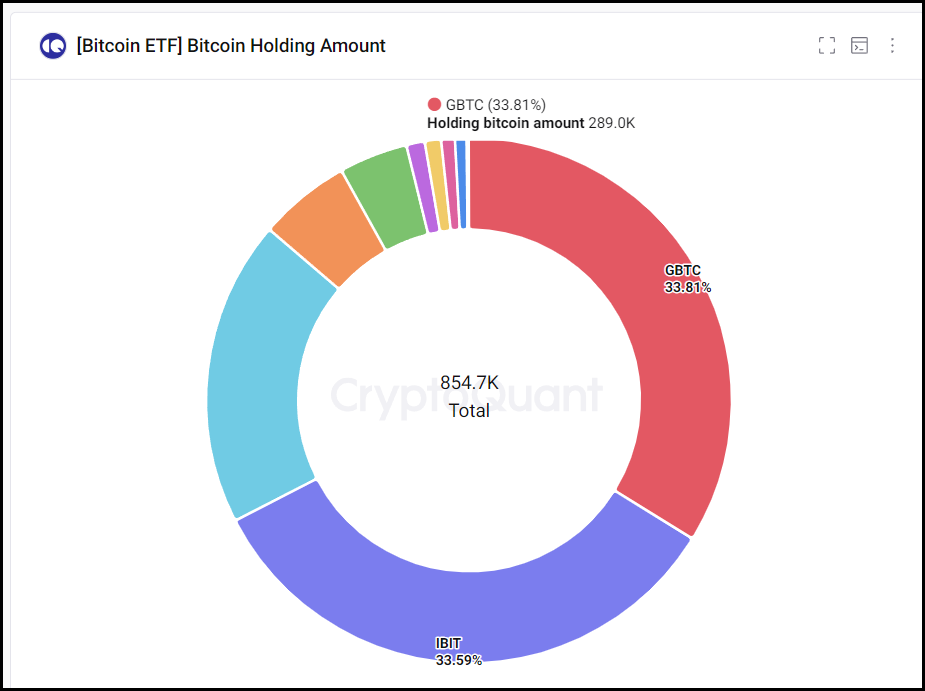

Meanwhile, spot ETFs are gaining traction in the U.S. market, with GBTC outflows becoming less pronounced and inflows into its cheaper-priced competitors on the rise. Notably, BlackRock's IBIT has hit a milestone, now holding approximately as much Bitcoin (around 290,000) as the once-dominant holder GBTC. Both IBIT and GBTC now hold about one-third of all U.S. spot ETFs, totaling above 850,000 BTC.

Bitcoin continues to trade within a narrow range, as opposing bearish and bullish forces have formed a relative equilibrium in traders' confidence. This is confirmed by the RSI for BTC futures hovering around 55. Technical resistance remains near the all-time high of $72,000, with support levels at $65,000 and $62,000.