ETFs report third largest day of inflows but still account for small percentage of volume

As of 4:00 PM ET, Bitcoin is up by just over 5% ($2,300) on the day at $47,590. The huge gains achieved today have propelled this week 11.62% higher, making it the biggest week for Bitcoin since October.

One of the drivers of this week comes from the developing money flows regarding the newly launched spot Bitcoin ETFs. On Thursday, spot ETFs had their 3rd biggest day since launching with over $405 million entering them collectively. They did this despite GBTC’s $100 million in outflows for the same day. The volume in the ETFs compared to normal spot trading on centralized exchanges is still in its infancy, according to Foresight News, the trading volume of US Bitcoin spot ETFs accounts for 10-15% of the total Bitcoin spot trading volume on global centralized exchanges. This represents only 3% of the total circulating supply of Bitcoin, or approximately 650,000 Bitcoins.

The small percentage compared to CEXs is not as profound as how much Bitcoin currently resides on spot exchanges. According to data from the on-chain analytics platform Santiment, the supply of Bitcoin on exchanges has just dipped to 5.3% of the total circulating supply for the first time since December 2017. This means that 94.7% of the supply is held in private custody.

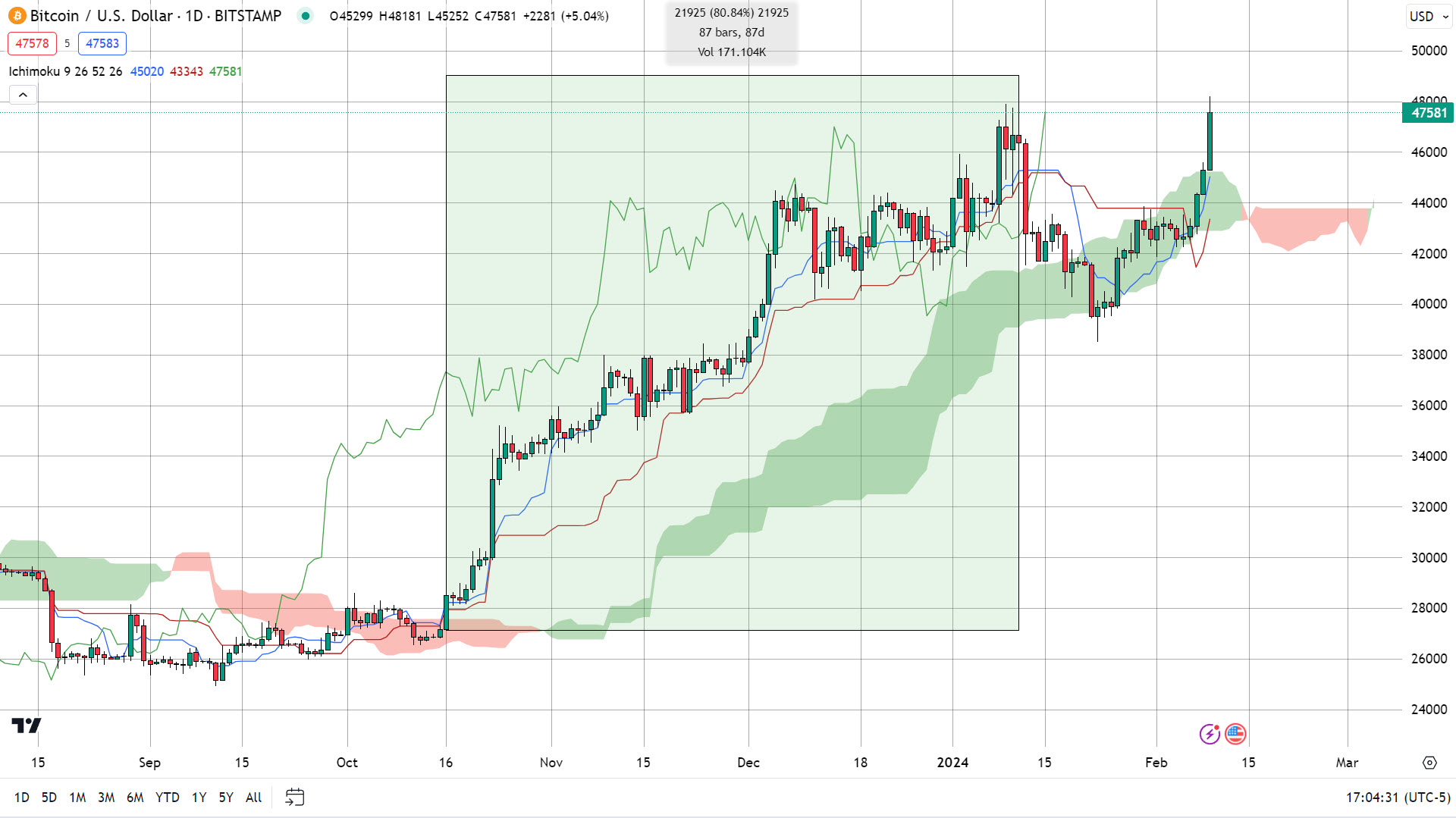

Exactly three weeks ago, Bitcoin entered the Kumo or cloud formation where it remained until today. The last time Bitcoin broke above its cloud formation was on October 16th which resulted in an 80% increase in 87 days.

The daily chart also formed a very strong bullish candlestick pattern known as “three white soldiers.” This is one of the most reliable candlestick patterns, and it predicts a continuation of bullish momentum. The pattern is one of the rarer ones, so it should not be taken lightly. These two strong technical indications have flipped my short-term sentiment to bullish. The only caveat is that today’s high just above $48,000 marks an area of strong technical resistance, so a small pullback is not out of the question. However, I feel a consolatory phase is more likely and would be another bullish indication for Bitcoin.