Mt. Gox repayments bring BTC into oversold territory

Bitcoin was already trending to the downside, approaching the key physiological level of $60,000 when the trustee assigned with the tax of repaying victims of the infamous 2013 hack of what was at the time the world’s largest Bitcoin exchange.

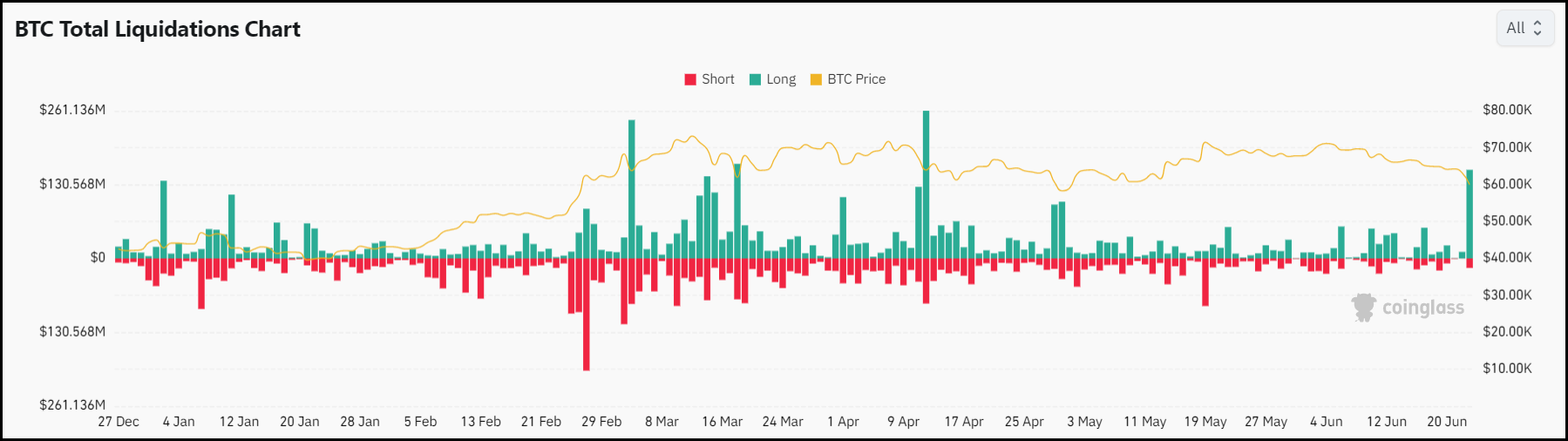

This sent Bitcoin beneath $60,000 for the first time since the start of May. The cumulative damage done today amounts to nearly $180 million in liquidations, with the vast majority ($162 million) being long positions versus much fewer ($16 million) short side liquidations. This is the largest spike in liquidations since April 12th. There were a few instances of days this year with more liquidations than today, however on those rare instances the positions that were closed out were more mixed between buyers and sellers, unlike today’s aimed mainly at the long side.

Today’s decline in pricing caused a dramatic change to Bitcoin’s relative strength index. The drop today caused the RSI to fall by nine points, bringing Bitcoin into oversold territory at approximately 25. This is the first instance of BTC with an RSI below the 30 mark (which suggest that a market may be oversold) this year. The last occurrence of this came in August 2023, at the time BTC was priced at $26,500.

Traders have moved Bitcoin off its low near $58,500 as some have speculated that the Mt. Gox repayments will not flood the market with new Bitcoin being sold as claimers have had 10 years to sell their Bitcoin to creditors who many believe were purchasing to add to their holdings instead of making a short-term profit. As this revelation came to light traders propped Bitcoin back above the key $60,000 level. This level was highlighted as a short-term target in our video released Saturday. Even with the RSI signaling, oversold Bitcoin could continue lower for the next few weeks as miner capitulation continues in the aftermath of the 4th Bitcoin halving that occurred in April.