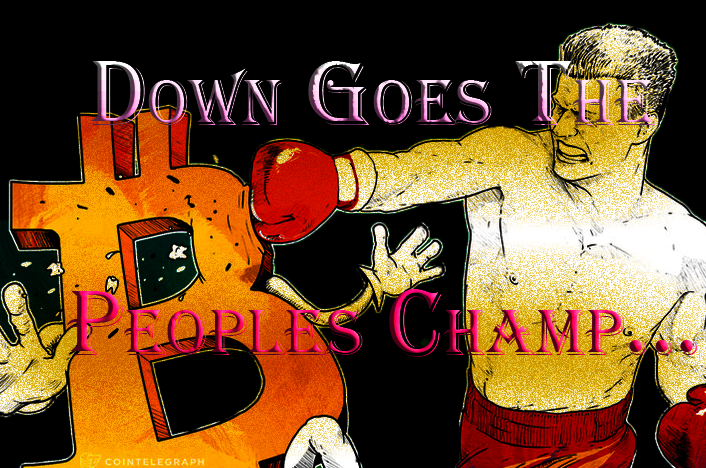

Bitcoin takes a beating

Since September 2nd BTC most active futures contract has lost approximately $2,000 in value. What is worse is the last three trading days have had extended lows along with a massive spike in (double the daily average in August) daily volume. Also, the RSI has plummeted 20 points, and the bulls have given up three major support levels in these last four brutal trading sessions. However, on the brighter side of Bitcoin, things are pointing to clearer skies ahead for the world’s dominant cryptocurrency.

Bitcoin futures saving grace may be in its historical and technical areas of what I believe to be major support and should hold up and I believe BTC will form a bottom between $8,800 – $9,500. This area holds quite a few critical points that BTC must sustain as support.

Some of these possible support levels include the 100 and 200-day moving averages. The most vital area however that must remain support occurs at the intersection of three of the most fundamental technical indicators in this market presently. Two of them are made up of Fibonacci harmonics from two data sets. The first fib. retracement stretches from the all-time high in the CME at about $20,000. The second retracement is drawn from the lows to the highs of this year. Both retracements form a harmonic at their perspective 38% retracement points, $9,589 - $9,417. Even more noteworthy is how the descending top that was finally taken out July 27th now sits in between the two harmonics.

Needless to say if BTC is to remain in the ring as the heavy weight champion of hyperspace it has to stage a come back at one of these areas. If not the recent rope a dope will result in a knock out blow to Bitcoin, and the matador will have succeeded in vanquishing the bulls and usher in the era of the bear.