End of the wedge and CPI disconnect

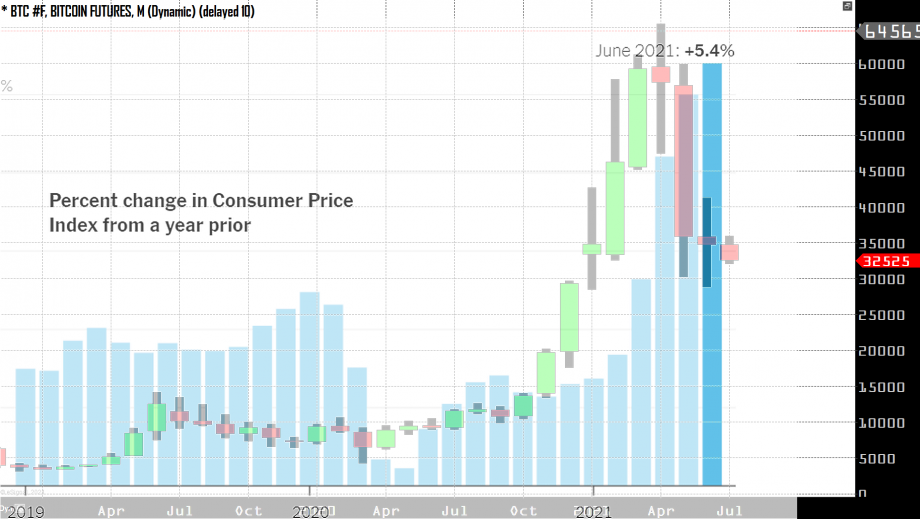

BTC failed to react to the stark CPI report released today for the month of June. The report indicated that inflation continues to rise at an accelerated pace, with inflation rising for consumers by 5.4% over last year. Something has changed over the past few months, whereas Bitcoin and other assets typically seen as a hedge against inflation have had a disconnect with recent data.

A few months back, on April 13, when the March 2021 CPI was released showing a spike up to 2.6%. That data helped to bring BTC to its highest ever price the following day, April 14, when intraday it reached above $65,000. At the same time, the data also helped traditional safe-haven assets such as gold continue to rally, breaking above its 50-day moving average two days later and above all its major moving averages over the next month. The following report released on June 10 did little to move the price of BTC or gold as both assets closed unchanged on that day.

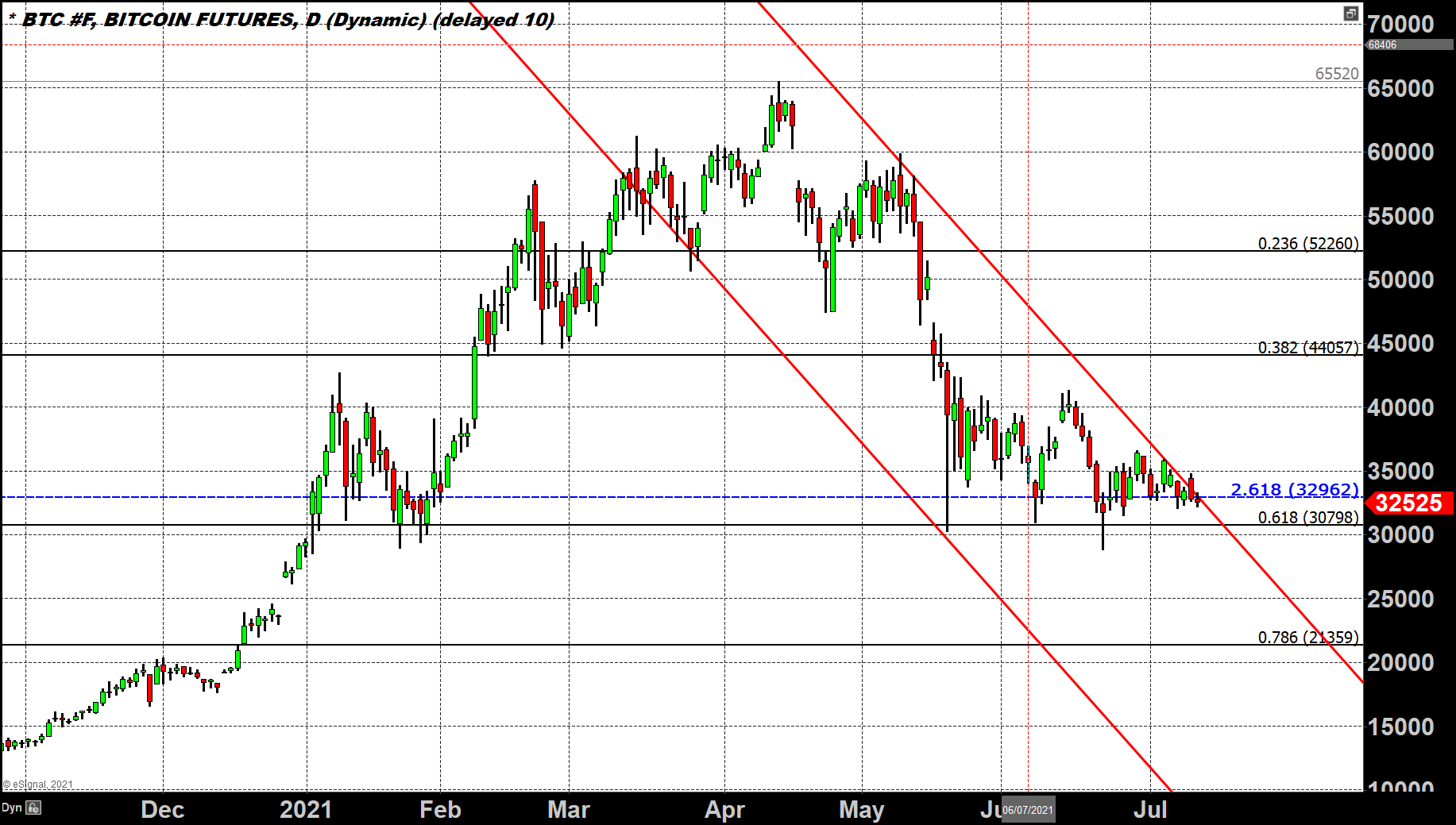

Today’s CPI report had the same effect with gold and BTC, both closing with only fractional changes in price. However, the slight move in BTC futures took pricing below one of its support levels at approximately $33,000. This level coincides with a 2.618% extension of 2019’s rally starting from the beginning of the 2020 – 2021 rally. Since hitting an apex above $65,000, BTC has only closed below this price point a total of three times, including today.

As long as we remain above major support at approximately $30,000, the most likely scenario is relatively stable pricing similar to action witnessed in June and July of last year (2020), where pricing remained inside of a $1000 range ($9000 – $10,000) before a breakout occurred. However, we have just about reached the end of the flat bottom, descending top pattern that has defined pricing over the last few weeks. And what that suggests is that we will likely get a breakout before the end of this week; that breakout will likely continue in the prevalent trend direction, which is to the downside.