The Greyscale effect

BTC futures is currently posting a gain of $2300 (6.76%) as of 3:20 PM Eastern Standard Time. It is currently trading above a resistance trendline that it had moved above intraday on Friday of last week and Monday but was unable to hold and close below on both occasions. If it manages to hold near its current price of $36,255 could signal a breakout to the upside; however, we would have to see it hold current pricing up to the close.

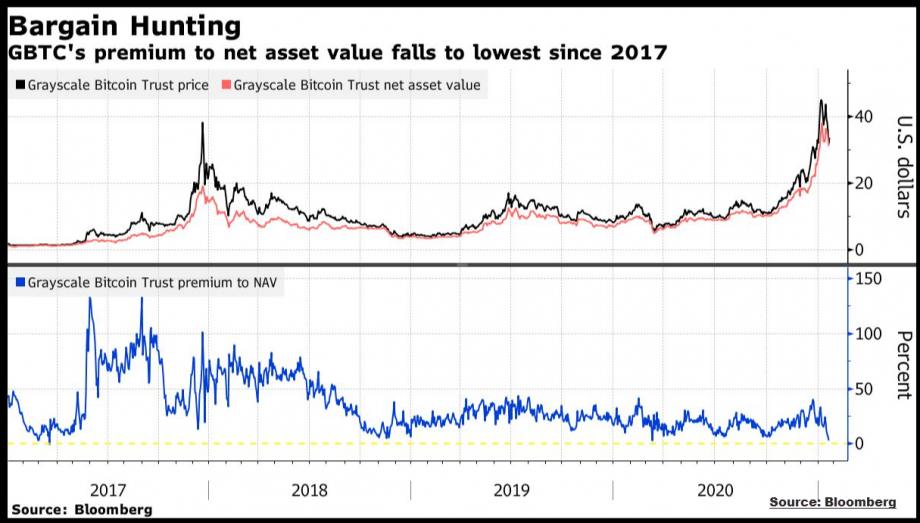

Like we had predicted in our article about the Grayscale Bitcoin Trust, GBTC is now trading with a minimal premium on its price. Shares of GBTC are currently priced at $34.22. This price puts the premium associated with GBTC at 6.4%, which is far lower than the 40% premium we witnessed in December.

While I see this erosion of premium as a bearish indicator for BTC, there is another aspect to the Grayscale Bitcoin Trust that could spark yet another rally in Bitcoin futures. An article written by Ben Lilly at Jarvis Labs that details how Grayscale's system of offering private placements to accredited investors who then must hold their shares for six months before selling them on the open market is the biggest driver of Bitcoin's price action.

"To sum it up, Grayscale is an entity of the Digital Currency Group that has cornered the market, accumulating a total of 536k BTC to date.

Their unique structure is what makes it possible. It is essentially structured to hoard Bitcoin. BTC and USD (which is then used to purchase BTC) flow in, and nothing comes out."

The article details what effect this has on the spot markets, examining time periods in which large numbers of privately issued shares are "unlocked" and can be sold on the open market. This dumping period tends to drive prices higher as investors tend to buy back into the trust or buy Bitcoin on the spot market, in either case pumping the price higher as well as GBTC's premium.

"The next major unlocking is set to happen around February 3, 2021" and as such, we should see this coincide with a move to higher pricing starting tomorrow if this phenomenon continues.