One man’s fear is another man’s FOMO

Although some analysts believe that there is a distinct difference between what is fueling this rally compared to previous rallies seen in Bitcoin, I do not see this distinction as different enough to negate BTC from a pullback after such a parabolic rise that we have witnessed recently in Bitcoin and believe it is still susceptible to a correction in the near term.

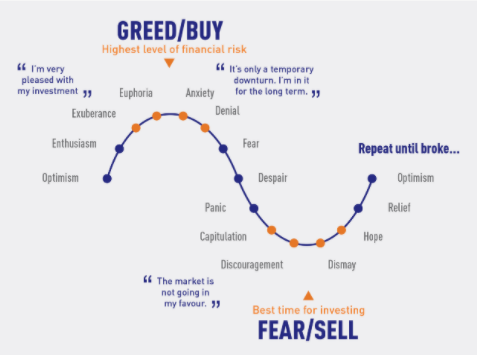

The difference between previous moves and this most recent price advance that brought Bitcoin above $16,000 for the first time since December 2017 is what fueled the move and where the fuel came from. According to Cointelegraph, “A large uptick in trading volume and consistent inflow of stablecoins into exchanges typically mean that the demand for Bitcoin is rising. As such, there is a strong possibility that the main impetus for the BTC rally above $16,000 was the high trading activity and newly emerging appetite for BTC from stablecoin inflows”. In previous rallies, the catalyst came directly from buyers of Bitcoin versus stablecoins but in all cases, it was largely due to “FOMO” in the market. The main difference I find noteworthy is now the “fear of missing out” is coming from small scale and institutional investors instead of just smaller scale holders of Bitcoin.

Regardless of the buyers, the “FOMO” that is driving it is destined to be its undoing as it means investors are less likely to hold onto their Bitcoin during a fall out causing an increase in the downside pressure when it does move in that direction. The RSI and other indexes that depicts a market’s strength suggest that Bitcoin is at its highest level (83.04) other than Spring 2019 when it hit a high of 89 three times during the 2019 rally. This is painting a picture of an overbought and overheated market and whether or not BTC corrects at this price or not it certainly will have an exaggerated and harsh downward move where we could easily see 5-10% declines in a single day when it does correct.

One analyst site a CME gap going back to 2017 as a hint BTC may jump to $18,000 and bring Bitcoin prices higher when it does. I would rebut this argument by pointing out there are two gaps in the CME more recent and more likely to be filled much sooner. These gaps appear at $11,000 and $9,600.

We have yet to see any technical data pointing to a continuation of the current rally. Instead, recent moves primarily yesterday and today point to the fact that there is strong resistance at $16,309 the 78% retracement. With all things taken into account, it is much more likely that a pullback from recent highs in the market is the next move than a continued rally. Should this pullback indeed take place we can assume that BTC will find support at $11,600 or $9,600.