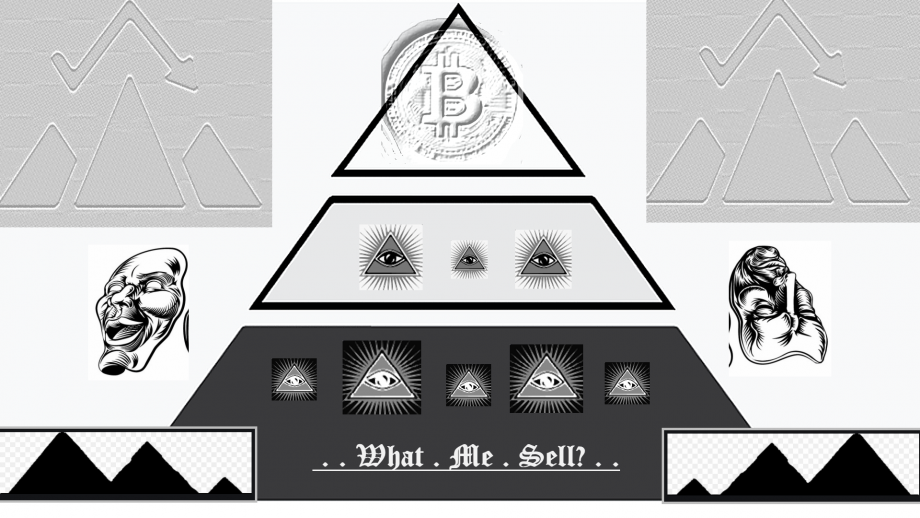

The * parabolic * pyramid * pattern

ßitcoin seems to have found at least short-term support at our first of three likely pivot points that make up the three most probable places for the current triangle pattern to find a bottom. This first area which would mark yet another extremely shallow correction occurs at the 38% retracement point coming in near $30,200 the lows that came in right at $30,000. Bitcoin futures are currently trading at the highs for the day and as of 1 PM Eastern standard Time BDC futures are fixed it $32,540 up 2.86% for the day. Today’s data compose the first technical signs of a possible pivot in the market.

Whether or not we see a recovery from $30,000 is dependent upon the focus of the general public and financial institutions returning to crypto. It’s really not if this will happen, as much as when this will happen. While I still maintain the belief that before we get another parabolic move to the upside there will likely be more downside pressure and extreme volatility that could ultimately bring us back to the $20,000 area by March of this year.

As for when the next big move past $40,000 it will certainly be at a time when there is heightened awareness surrounding crypto due to new innovations and further merging with financial markets. What I am referring to is the creation of Bitcoin ETF. This further breakthrough for Bitcoin is on the horizon especially after Pres. Biden’s pick for SEC chair gets appointed to office.

His nominee Gary Gensler is well acclimated to crypto currencies as well the role they may serve in fact he taught a class on this very subject at his alma mater of MIT. His expertise in fintech and digital currency could lead to new regulatory approvals, such as the Bitcoin Exchange Fund. Gary Gensler has been nominated as chair of the Securities and Exchange Commission, and his expertise in fintech and digital currency could lead to new regulatory approvals, such as Bitcoin.

Elsewhere across the world in Switzerland, CoinShares became the second to announce the launch of a Bitcoin exchange-traded product on the Swiss Stock Exchange this year. In Switzerland CoinShares today became the second issuer to announce the launch of a Bitcoin exchange-traded product on the Swiss Stock Exchange this year. The product allows investors to gain bitcoin exposure on a regulated European stock exchange and held in custody by Komainu, a regulated institutional-grade digital asset custodian.

The new product means there are 22 Bitcoin ETPs and structured products on the Swiss Stock Exchange from seven issuers, following the addition of ETC Group on 13 January 2021. In the list is likely to grow when that growth sparks more market mania, we will be set to take full advantage of it.