“The Rock Bottom”

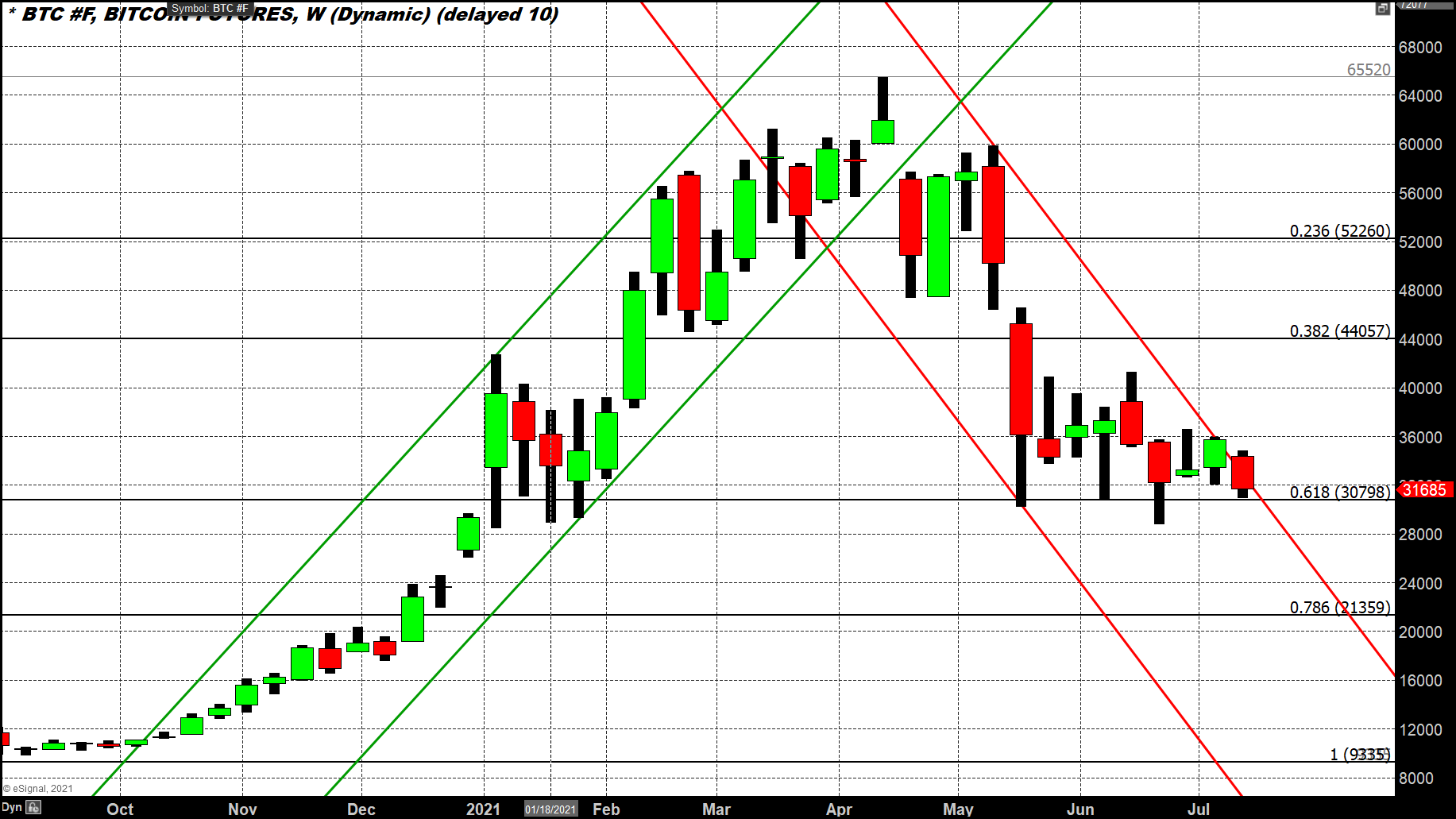

Bitcoin has once again shown how strong support is at the $30,000 level. Once again, this level is technically significant as it represents a 61.8% retracement from where we mark the beginning of the rally that took us to all-time highs. This is important to note because this would be a logical level for a deep retracement to find support and pivot from. With so many bearish fundamentals in the form of a regulatory crackdown, and negative media/social media, it is easy for one to lose hope for a quick return back to rally mode. However, this Holy Grail of technical integers (1.618) having foretold the most likely pivot point, and that pivot point has held astonishingly. So, on a purely technical basis, things don’t look so bleak, and I have found that BTC moves follow technical order more so than most markets.

The negative social media I am referring to is, of course, is the tweetstorm released by Dogecoin’s co-creator Jackson Palmer. He basically laid out a 10-part tweet on why he chose to leave the crypto industry; here are some keywords,

“After years of studying it, I believe that cryptocurrency is an inherently right-wing, hyper-capitalistic technology built primarily to amplify the wealth of its proponents…

…Despite claims of “decentralization,” the cryptocurrency industry is controlled by a powerful cartel of wealthy figures who, with time, have evolved to incorporate many of the same institutions tied to the existing centralized financial system they supposedly set out to replace.”

This had an effect on the markets, although mostly to Dogecoin itself, which suffered the biggest drawdown (5.49%) as of 6:30 PM Eastern Daylight Time. All of the other major crypto’s besides Binance Coin (BNB) continued on their current trajectory with small but steady declines across the board.

Bitcoin on spot exchanges at 6:30 PM EDT is trading down roughly $1150 on the day, equivalent to a 3.5% drop. In the same timeframe Ethereum has fallen roughly the same amount down 3.9% on the day, the other two autistic twins Cardano and Ripple were down slightly less at approximately a 3% decline for the other two coins I put (at least with Ripple) in the same category as a doge.

I want to apologize as I was not specifically clear with my last article as I stated that there were two scenarios that were both the most likely one. What I meant to say was that these two scenarios were together the most likely scenario meaning one of these two would probably be the outcome. We can definitely deduce that the slow and stable range-bound scenario appears to describe the current action in the markets. However, another mistake I made drawing my wedge in my last article was putting the flat bottom above where support is. When we do this, we see that we are still inside of a flat bottom descending top that has yet to reach its apex.

With all this considered, my forecast is that we will remain somewhat stable until we reach the apex, which could be next week. And when we do reach that apex, a breakout will occur, but it is not written in stone which direction that will take as of yet. So, with all the doubters coming out recently against crypto amidst widespread regulatory crackdown as a technical trader and a Bitcoin bull, I can’t forgo that there is a strong possibility that the breakout will take us to higher pricing as we have completed the checklist for a strong correction already.

BTC weekly chart shows we have fallen back into the symmetrical pattern and channel.